- Dollar recovers after Fed selloff, turns to PCE inflation

- Yen falls despite rate increase, testing three-decade lows

- Quarter-end flows could disturb the waters in a quiet week

Dollar stages recovery after Fed

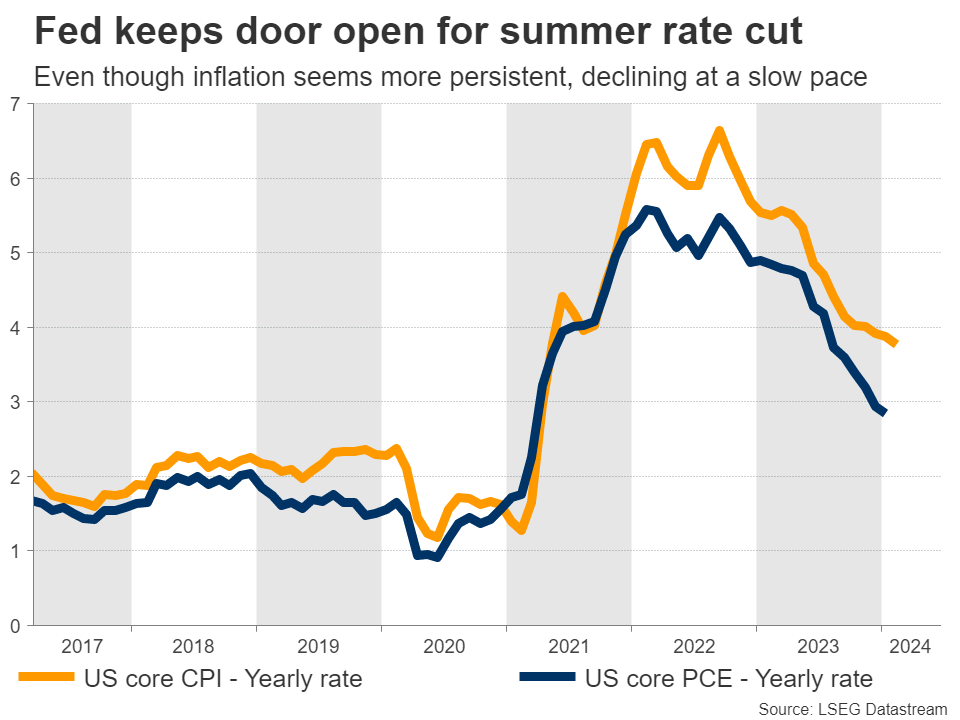

It was an action-packed week for FX traders, with five central bank meetings injecting volatility into the market. In a surprising move, the Federal Reserve continued to signal three rate cuts for this year, even though its new economic forecasts pointed to slightly hotter inflation and faster growth.

The overarching message was that the Fed will probably start cutting rates this summer, despite recent signs that inflation might be more persistent. In other words, the Fed seems willing to let inflation run hot for a while longer, to minimize the risk of a recession.

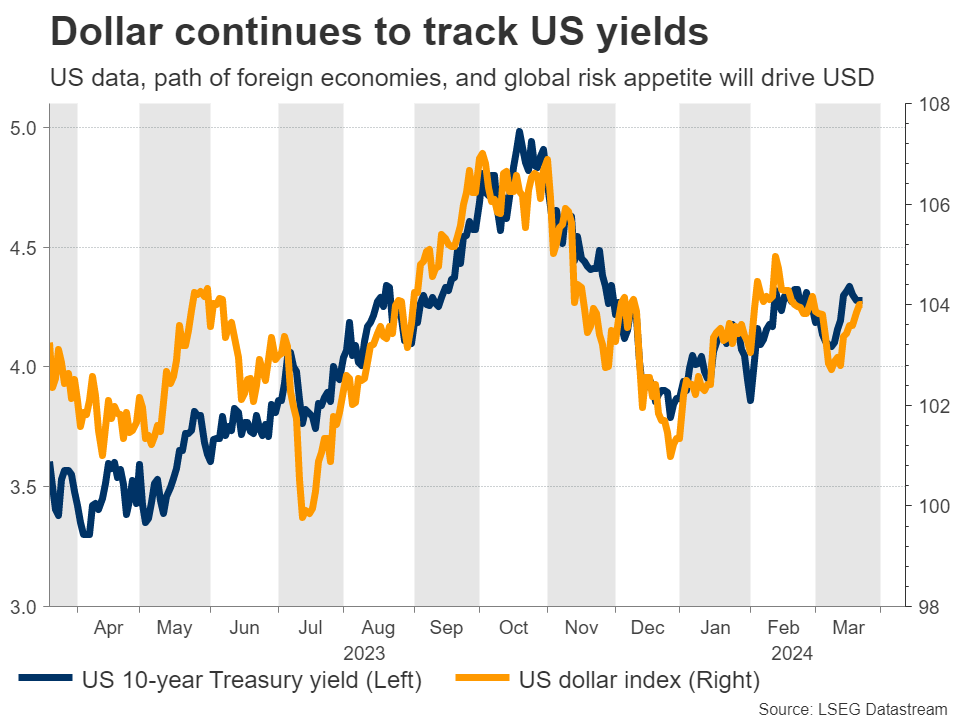

Investors reacted by selling the dollar, but the greenback managed to recover those losses to close the week higher overall, as other major currencies encountered their own problems and fell even harder. The euro was hammered by disappointing business surveys, while the pound slumped after the Bank of England softly opened the door for a summer rate cut.

Next week, the ball will get rolling with US durable goods orders and consumer confidence on Tuesday. Of course, the main event will come on Friday, when the core PCE price index is released. Forecasts suggest the core PCE rate held steady at 2.8% in February, which would reaffirm that progress on the inflation front has stalled.

Beyond economic data, the performance of other major currencies and the evolution of global risk sentiment will also be crucial for the safe-haven dollar. In this sense, a persistent rally in the greenback might require a pullback in stock markets that fuels demand for haven assets, alongside more signs of weakness in foreign economies.

Note that Friday will be a public holiday in most major economies, so stock and bond markets will remain shut. The FX market will be open for business, but liquidity will probably be in thin supply, especially since it will also be the end of the quarter. In such an environment, sharp FX moves can happen without much news behind them.

Yen gets smashed despite BoJ hike

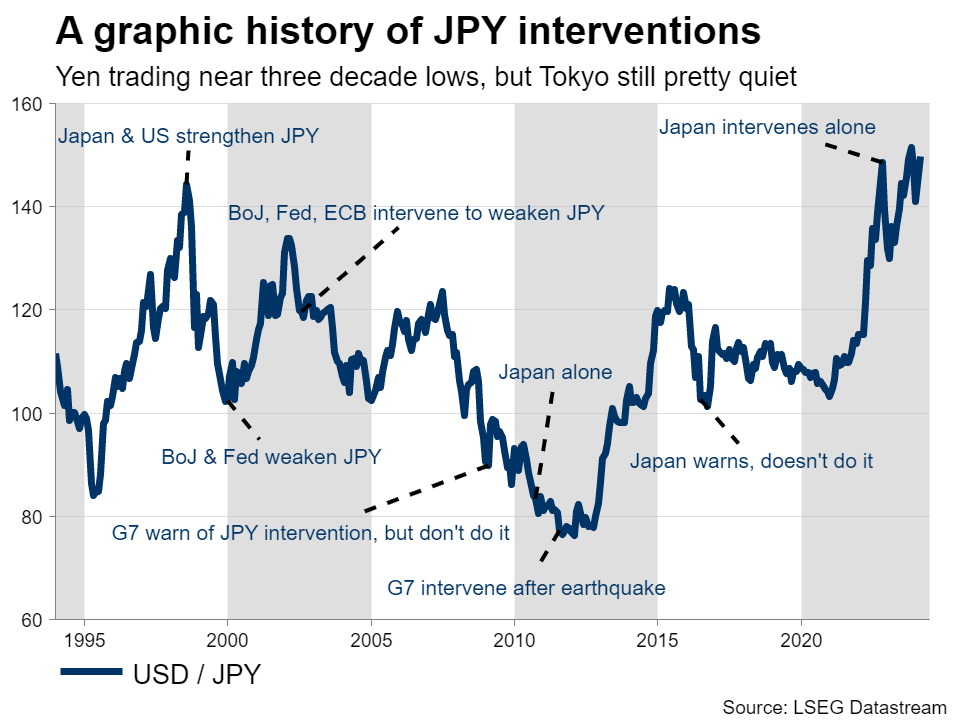

Over in Japan, the yen collapsed towards its lowest levels in three decades, even after the Bank of Japan raised interest rates out of negative territory.

It seems the market was disappointed because the BoJ did not provide any clear signals about future rate increases. Investors are concerned this might have been a one-and-done move, especially since most other central banks are preparing to cut rates.

The summary of opinions from that meeting will be released on Thursday and will provide more color around the decision to raise rates, while on Friday, the latest CPI data from Tokyo will reveal what’s next for inflation nationwide.

As for the yen, it is trading very close to the 151.90 region against the dollar, which is a 34-year low. This area has been tested multiple times over the last two years, and Japanese authorities even intervened in the FX market to defend it, so it holds tremendous importance.

How the market behaves around this region will be telling. If it holds strong once again, that would leave some scope for a yen recovery in the spring, whereas a break would signal a resumption of the longer term downtrend. That said, a break would probably draw more FX intervention warnings from Tokyo, which could slow the pace of any selloff.

Australian inflation and Canadian growth

Crossing into Australia, inflation data for February will hit the markets on Wednesday and will provide clues on how soon the Reserve Bank might cut rates, which the markets are currently pricing for September.

Meanwhile in Canada, monthly GDP stats for January are due on Thursday. With the quarter almost over, this release is a little outdated, but could still attract some market attention. That said, the path of oil prices might be even more important for the oil-exporting Canadian dollar.