Why Traders Choose Promax Trading

We’re a renowned financial services provider with a global presence and history that spans a decade.

Our mission is simple: to serve our traders both ethically & responsibly.

Long-Standing

History

Promax Trading has been serving traders responsibly since 2018, winning several awards.

Competitive

Trading Conditions

Trade with tight spreads starting from 0.0 pips on the internationally acclaimed MetaTrader 5 platform.

Ultra-Fast

Execution

Experience an NDD trading environment that employs the latest technology to execute trading orders in under 0.03 seconds.

Fast Deposits

& Withdrawals

Fund your account, transfer and withdraw instantly using a host of online payment options via the secure Promax Trading Wallet.

Top Tier

Security

Trade responsibly with negative balance protection, secure data encryption, and free VPS. Client funds are protected by the ICF and segregated from proprietary company funds.

Award-Winning

Research

Benefit from daily actionable analytics and market research from the renowned in-house Promax Trading investment research team as well as the exclusive Promax Trading Trading Central package.

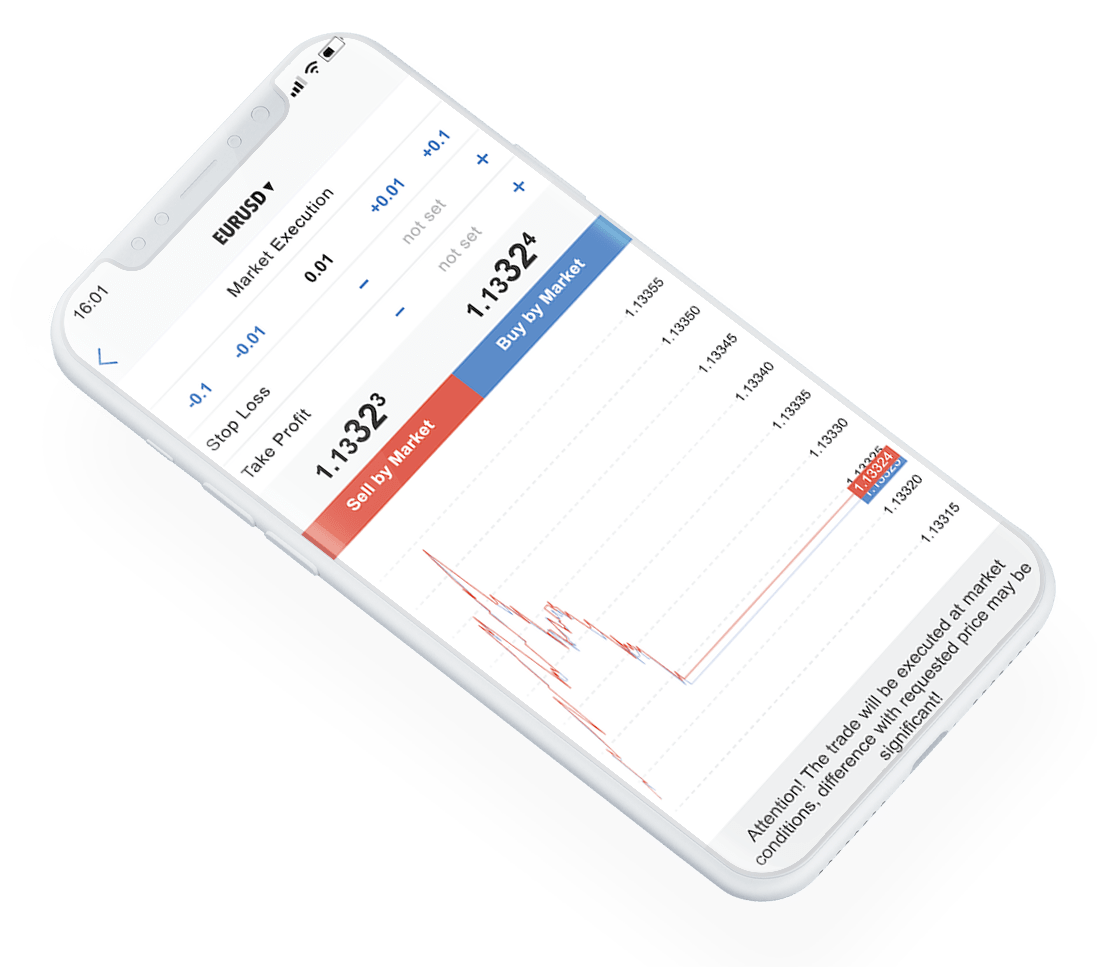

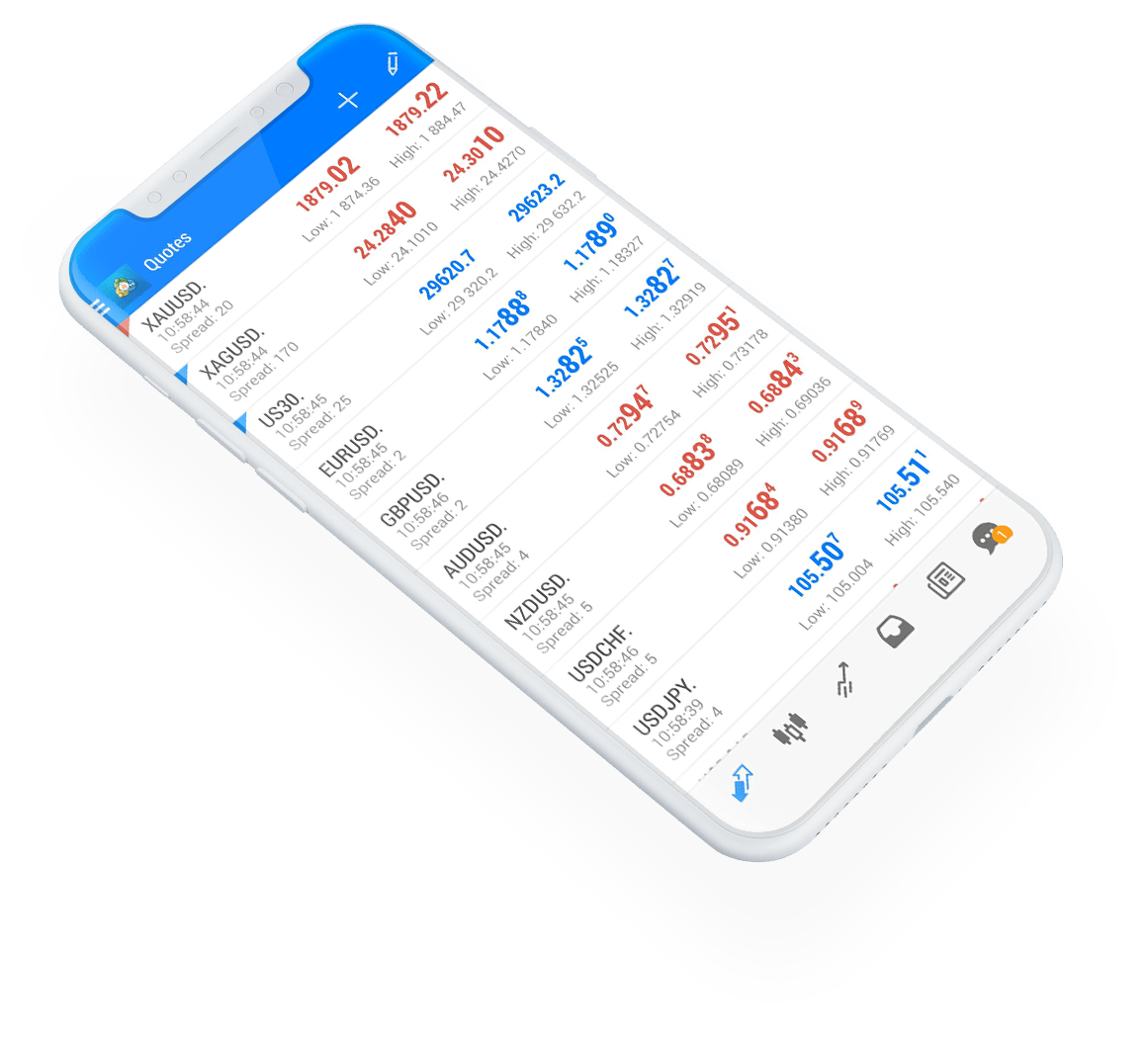

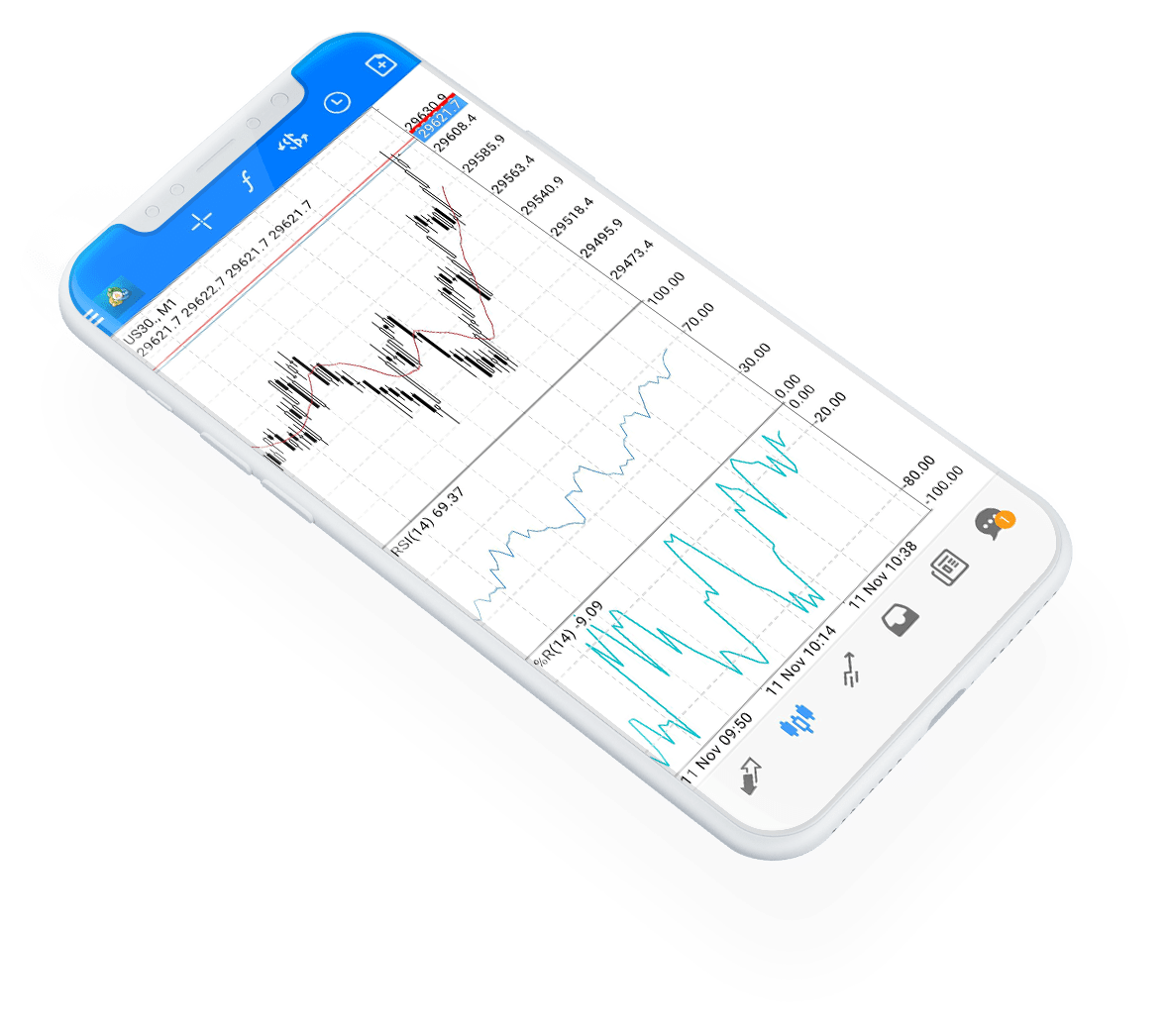

Trading Platforms

Trade with the award-winning MT5 platform anywhere, any time and on any device.

Multi award-winning

With over 15 years in the market, the seasoned MT5 platform has won multiple awards and become the go-to online trading platform for traders around the globe.

User-friendly

Fast and efficient, MT5 is accessible to traders of a range of experience levels, providing fast execution for CFD traders across a wide range of assets.

Convenient

The Promax Trading MT5 platform allows you to trade on the go whether you are on Android or iOS. Desktop traders can also access the platform on both Windows and Mac OS.

Sign up now and start trading with Promax Trading

Spreads from 0.0 pips

Trading Tools

The Perfect Trading Environment for All Investment Styles

Our trading conditions and account types are curated to meet the needs of all trading styles. Whether you're a scalper, swing trader or hedger, you can find a home at Promax Trading.

Market Research & Education

Versatile, seasoned, and passionate, the Promax Trading research team is made up of market analysts, macro-economists, experienced traders and Elliott Wave specialists. Daily publications cover fundamental and technical analysis, daily trading signals, quarterly market projections and educational content.

Local Presence & Global Reach

300+

Trading Instruments

50+ Million

Traded Volume per Month

600+ Billion

Trades executed per year

Open your account in 3 easy steps

To begin your investment journey in the Forex markets, follow these simple steps:

1. Sign up

Create an account in minutes & upload your documents.

2. Fund your account

Make instant deposits to your Promax Trading Wallet via debit card, wire transfer or your preferred online payment method.

3. Start trading

Download your favorite trading platform on your device of choice & begin trading.

Zero Fees on Deposits

Negative balance protection

Fast withdrawals

Open your account in 3 easy steps

To begin your investment journey in the Forex markets, follow these simple steps:

Zero Fees on Deposits

Negative balance protection

Fast withdrawals

1. Sign up

Create an account & upload your documents.

2. Fund your account

Make instant deposits to your Promax Trading Wallet via debit card, wire transfer or online payment method.

3. Start trading

Check your email for the go-ahead from our team & begin investing!

Fund your account via your choice of a wide range of payment options, where your funds will be held in renowned tier-1 banks. The secure Promax Trading wallet ensures instant transfers, deposits and withdrawals in a safe online trading environment.

Want to Become a Partner?

Join one of the industry's most lucrative partnership programs today.