Elliott Wave analysis can be fascinating. The fractal nature of price trends means you can recognize Elliott Wave patterns on charts of practically all time-frames. The pattern you spot on an hourly chart carries the same meaning as if you’ve found it on a weekly or a monthly chart.

The only difference is in the size of the pattern and the move it suggests is about to unfold. This means you can sometimes make accurate prediction months and even years in advance. We’ve already demonstrated this with airline indices and cybersecurity stocks, among others. Today, we’ll show you how we did it with USD/JPY in the Forex market.

Over a year ago, USD/JPY was barely holding above the 100.00 mark. After having fallen to 101.18 during the coronavirus panic of March, 2020, the pair dropped to 102.59 in January, 2021. The general mood felt as if plunging below the psychological 100.00 was only a matter of time. And indeed, the bears only needed one last push to break that support level.

USD/JPY Elliott Wave Details

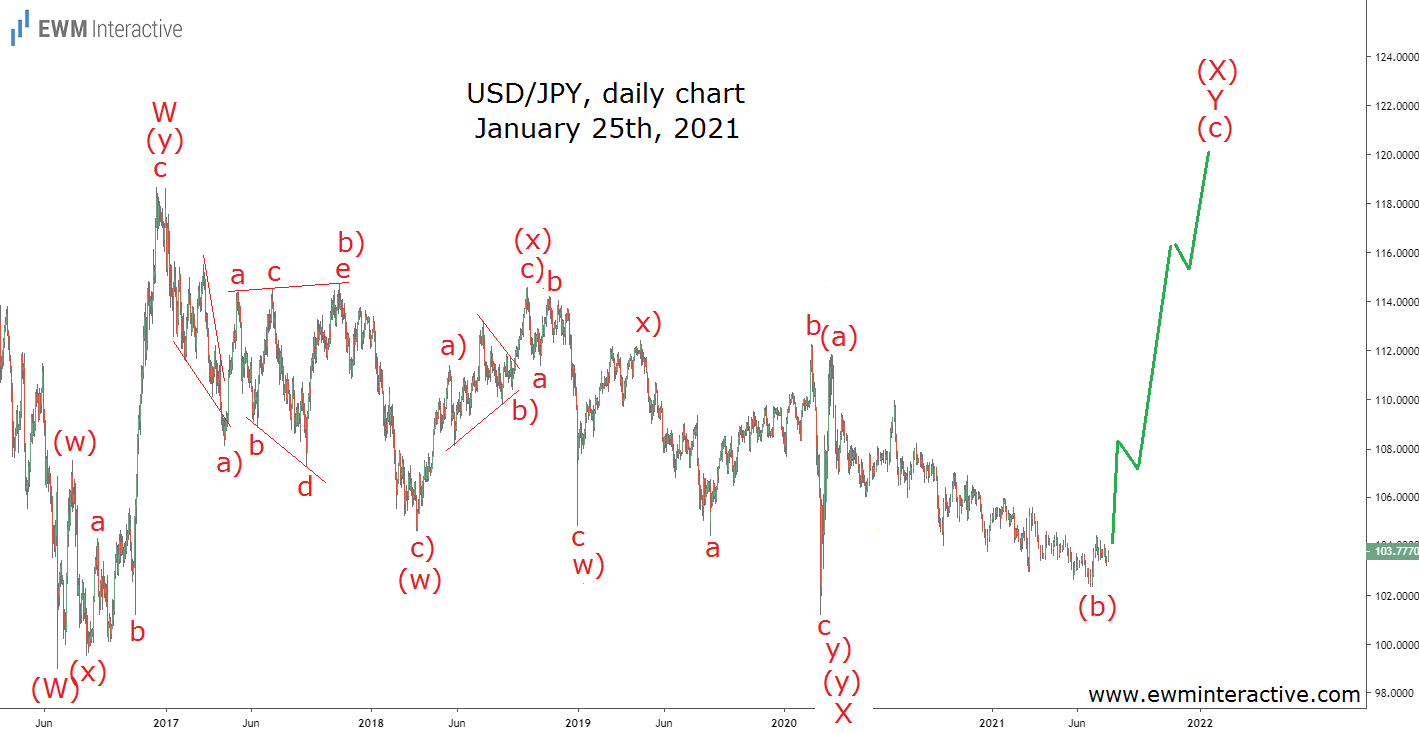

Elliott Wave analysis, however, suggested that a large move in the opposite direction was more likely to occur. The daily chart below of Jan. 25, 2021, explains.

The daily chart of the dollar against the yen revealed one big mess of corrective structures. The initial rally to 118.66 could not be seen as an impulse pattern. It was a double zigzag correction, labeled (w)-(y)-(x).

The following decline to 101.18 was even more complicated, but still obviously corrective in nature. So it made sense to believe that a bigger W-X-Y double zigzag was still in the making. Waves W and X were in place already. If this was the right count, wave Y had to exceed the top of wave W. Hence, a significant surge in wave (c) of Y was eventually supposed to lift USD/JPY towards 120.00.

However, using daily charts for trading purposes is somewhat difficult and imprecise. The minor swings along the way actually don’t matter, but can still ruin everything. So, our analysis included a 4-hour chart, as well.

USD/JPY ‘s 4-hour chart focused on the structure of the decline from 111.72 to 102.59. It wasn’t hard to tell that it was corrective. We labeled it as a w)-x)-y)-x)-z) triple zigzag in wave (b), where wave 'c' of z) was an ending diagonal.

Once a correction is over, the preceding trend resumes. Here, the direction of the preceding trend was shown by the sharp surge from 101.18 to 111.72, marked as wave (a). So, it made sense to expect more strength in wave (c).

Ahead Of The News, Events And Inflation

In other words, the 4-hour chart confirmed what the daily chart had already told us—that USD/JPY was likely to head north soon. Furthermore, it helped us identify a specific place for a stop-loss order—at 102.59. As long as it held, it made sense to stick with the bulls.

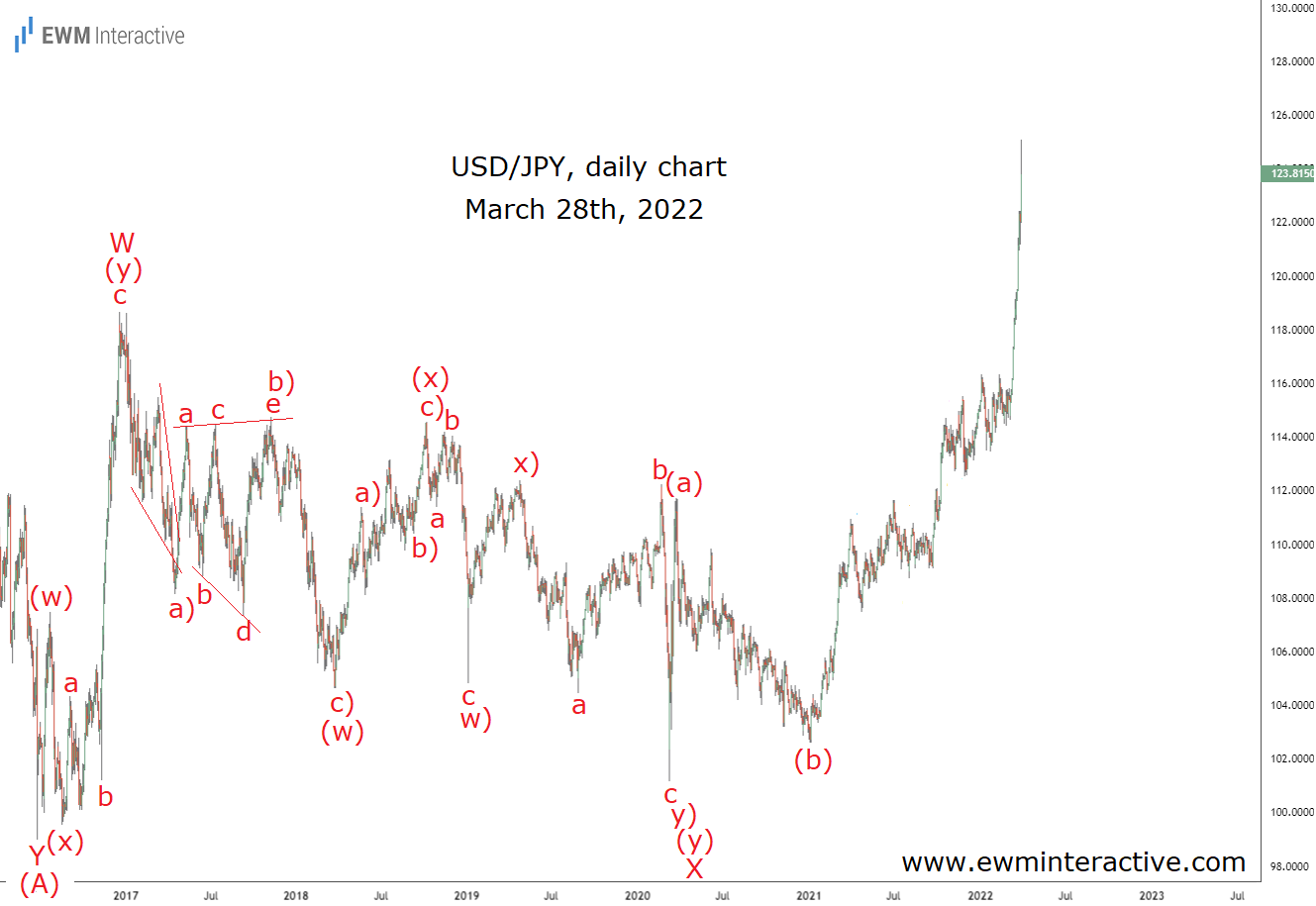

That’s what we thought 14 months ago, in late-January, 2021. The updated chart below shows how things went.

102.59 was never threatened. The bulls took charge almost immediately and began their long journey to the north. It wasn’t a smooth ride, though, as it included more than a few pullbacks along the way. That is quite normal, though, since trends rarely move in a straight line, if ever.

Nevertheless, the Elliott Wave principle had identified 120.00 as our target and there was no reason to give up on it.

Yesterday, USD/JPY climbed to 125.11, up over 2100 pips from the level it traded on in January, 2021. Our initial bullish target was reached and exceeded.

There was plenty of news over those 14 months we couldn’t possibly know anything about. The direction of the pandemic was anyone’s guess and so was the rate of inflation. Even Jerome Powell himself initially expected that inflation would be "transitory." Not to mention the "black swan" event that was Russia’s invasion of Ukraine. Yet, as the market absorbed the news, Elliott Wave analysis had somehow managed to anticipate it all.

That is not always the case, of course. Sometimes the market changes its intentions in mid-air. Sometimes our analysis simply turns out to be wrong. Oftentimes, though, it is nothing short of incredible.