The general contours of the business and investment climate are being shaped by three forces. First, Russia's invasion of Ukraine and the sanctions boosting price pressures and slow growth. It was a supply shock. Even before the war, countries had begun stepping back from the powerful monetary and fiscal support provided during the pandemic.

Second, China's response to its COVID outbreak is slowing the world's second-largest economy. It threatens supply chains but also a demand shock. The knock-on effect has seen a reversal of fortunes for previously favored "commodity currencies."

Third, the market understands that the Federal Reserve has made a hawkish pivot. It now sees the year-end Fed funds target at 2.85%, up from around 0.80% at the end of last year and 2.40% at the end of March. In addition, a relatively aggressive reduction of the Fed's balance sheet, in the current context, is also tantamount to some more tightening, even if economists differ on how much. This has helped send the US dollar broadly higher.

While the fog of war and the impact of China's COVID policies reduce visibility and boost uncertainty, they have spurred an acceleration of rate hikes. Among the high-income countries, the Reserve Bank of New Zealand and the Bank of Canada hiked rates by 50 bp. The Federal Reserve is expected to match them in May.

At the same time, several central banks, including the Reserve Bank of Australia, the Reserve Bank of New Zealand, the Bank of England, Sweden's Riksbank, and the Bank of Canada, have begun allowing their balance sheets to shrink by refraining from reinvesting the full amount of the maturing proceeds. At the May 4 meeting, the Federal Reserve will announce its starting date. After a short rolling start, the Fed is seen allowing the balance sheet to shrink by $95 bln a month ($60 bln of Treasuries and $35 bln MBS). This is almost twice the Fed's pace in the 2017-2019 period.

The aggressive reduction of the Fed's balance sheet spurred an abrupt steepening of the US 2-10-year yield curve in the first half of April. The inversion that provoked so much discussion was erased, and the 40 bp difference that it reached was the steepest slope since late February. The curve finished the April near 20 bp. We suspect the curve will become inverted again. The swaps market shows that the terminal rate for the Fed funds will be around 3.25%-3.50% in this cycle, suggesting that there may be value at the long end of the curve when yields are near 3%. However, the two-year note yield may need to climb closer to the anticipated peak in Fed funds.

Our concern is that something "breaks" before the Fed can lift rates to those levels. The combination of aggressively tighter monetary policy (including the balance sheet), a dramatic decline in fiscal support (the deficit may be halved this year from 10.8% of GDP in 2021 to around 5.3%), and the higher food and energy prices that sap the purchasing power of consumers will slow the economy. This quarter will likely see better growth than Q1, but starting in H2, a more sustained slowdown may become evident. Interest-rate sensitive sectors, like housing, may already be seeing some evidence.

The unexpected decline contraction in Q1 US GDP was bit of a statistical fluke. The yawning trade deficit and slower inventory accumulation shaved four percentage points off GDP. Final sales to domestic purchasers, which excludes trade and inventories, rose 3.7% in Q1, which is more than the previous two quarters combined (Q3 21 1.3% and Q4 21 1.7%). The decline in Q1 GDP is not a prelude to a recession and most economists look for a strong rebound in Q2.

Yet don't be mistaken. Growth forecasts are being cut. The World Bank and IMF have cut their global forecasts. This year's forecast for the US was cut to 3.7% from 4.0%, which is still higher than the private sector projection (Bloomberg survey median is 3.2%). Next year, the IMF has the US growing by 2.3% (0.3% less than its estimate in January). This is also a little optimistic compared with private-sector forecasts.

Several European countries, including Germany, France, and Italy cut their 2022 growth outlooks. China's Q1 GDP surprised on the upside, but the details were poor and the full impact of the lockdown in Shanghai (~25 mln people) has yet to be reflected in the data. Indeed, the pandemic in China threats domestic growth and further disruption in global supply chains. The IMF trimmed its forecast for China's 2022 GDP to 4.4% (from 4.8%), while China has targeted growth at 5.5%.

There were four main developments in the foreign exchange market to note. First, the dollar was broadly stronger, boosted by a dramatic adjustment to the Federal Reserve's now recognized as a hawkish pivot. Second, the divergence of monetary policy drove the yen to 20-year lows against the dollar. The BOJ shows no sign of ending its Yield-Curve Control policy that caps that 10-year yield at 0.25%. Third, the tightening of monetary policy reduced risk appetites, which weighed on the dollar-bloc currencies and Latam currencies. Fourth, the Chinese yuan came under strong selling pressure. The 10-year premium of 100 bp it offered in early March turned into a small discount. Portfolio capital outflows and boosting currency hedge ratios were drags on the currency.

Rising rates and weaker growth are challenging equity investors. Among the G10, only the internationally-heavy FTSE 100 is higher on the year through the end of April. In Europe, Luxembourg (~2.9%), Norway All-Share Index (~6.5), and Portugal All-Share Index (~4.6%) have shined. Between the squeeze on the property and tech sectors and the zero-COVID policy, Chinese equities are among the worst performers through the first third of the year. The CSI 300 (top 300 companies list in either Shanghai or Shenzhen) is off nearly 19% year-to-date.

A couple of markets in emerging economies are proving resilient in the Asia-Pacific region. The Strait Times of Singapore is up 7.5%, and the Jakarta Composite has risen almost 10%. Most central European equities markets have been sold, but Turkey's BIST 100 Index is up nearly 32% is notable. The lira is off a little more than 10% this year after a 44% decline last year. In 2021, Turkey's shares rallied by about 30%. However, regionally, Latam stands out. Equities in the region have generally rallied amid rising commodities. The nearly 3.5% decline in Mexico's Bolsa is a notable exception. South America and Mexico have accounted for five of the top six emerging market currencies in Q1 22, but in April, as we have noted, there were hit by an aggressive bout of profit-taking. The Mexican peso's's 2.7% decline was the best performer in the region. The Chilean peso lost about 7.26%. The Brazilian real's 4.5% drop trimmed this year's advance to around 12.2%.

UK Prime Minister Johnson's approval suffered before Russia invaded Ukraine, and the war eased the political pressure. However, the issue returned last month as the Prime Minister and Chancellor of the Exchequer were fined by the London police for violating COVID restrictions last year. Chancellor Sunak also ran afoul of poor press as his wife filed taxes as a non-domicile, which means she did not have to pay UK taxes. Sunak had been regarded as a likely candidate to succeed Johnson, but his spring budget statement was poorly received, and the fine for being at a party he denied attending sapped his support. In addition, the Tory showing in the local elections on May 5 (Wales, UK, and Northern Ireland's Assembly) may intensify the pressure on Johnson. Still, there may not be a compelling alternative that could lead the party to victory in 2024.

Germany holds two state elections in May. They may draw interest as a bit of a referendum on the federal government, which has taken at least three measures Merkel did not. First, the controversial Nord Stream 2 pipeline has been formally terminated. Second, After growing increasingly dependent on Russian energy even after the war in Georgia (2008) and the annexation of Crimea (2014), the new German government has set about reversing direction. Third, the SPD-led government committed to boosting military spending after years of under-spending (relative to the commitment to NATO). Schleswig-Holstein's election is on May 8. The state is currently led by a CDU-Green-FDP coalition. North Rhine-Westphalia has a CDU-FDP government, and it goes to the polls on May 15.

Australia's general election is on May 21. It is a close contest. The Liberal-National coalition seeks a fourth term, but voters seem to want a change. However, Labor has run an uninspired campaign. Neither may secure 76 seats in Parliament for a majority. The market anticipates the beginning of what may be an aggressive tightening cycle. An acceleration of Q1 CPI (to 5.1% from 3.5% in Q4 21) with a 4% unemployment rate, spurred speculation of the first move coming at the May 4 central bank meeting, rather than waiting until after the election. The cash rate futures market is discounts about 240 bp of tightening before year-end.

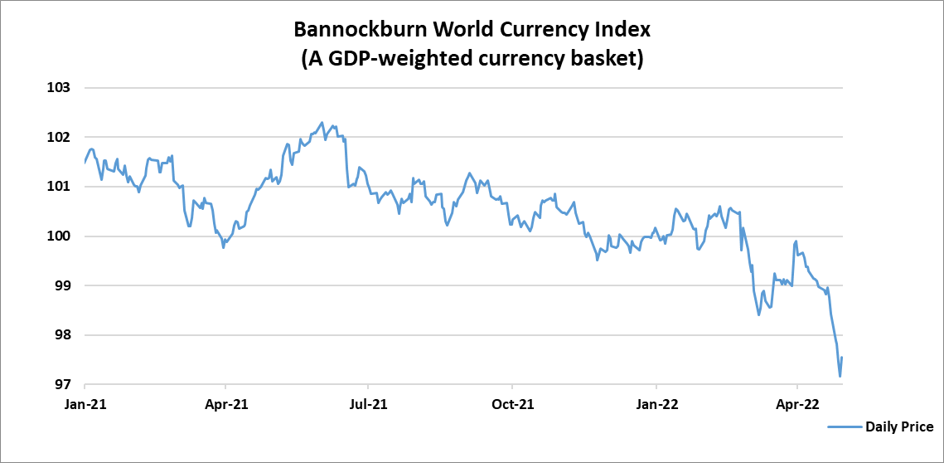

The Bannockburn World Currency Index is a GDP-weighted index of the top 12 economies (recognizing the eurozone as one economy). Half of the constituents are from high-income countries and the other half are from emerging market economies. The index fell almost 2.5% in April, reflecting the decline of the constituent currencies against the US dollar. It was the largest fall since May 2012 and the first monthly decline of more than 2% since January 2015. The

BWCI hit a low in March 2020 around 93.60 and peaked last June near 102.25. It finished April near 97.55

None of the currencies in the index gained against the greenback. The Indian rupee, with a a little less than a 1% decline, was the most resilient, followed by the Canadian dollar and Mexican peso (-2.7%). The yen was the weakest, falling around 6.2%. Several of the currencies in the index fell by more than 4%, including the euro, sterling, the Australian dollar, and the Brazilian real. The Chinese yuan's 4% decline in April appears is the largest monthly depreciation since at least 2005, when the peg formally ended.

Dollar: The Federal Reserve has communicated its intent to bring the Fed funds rate to a neutral setting and maybe higher in recognition of the persistence of unacceptably high inflation. The market has gone a long way toward pricing in 50 bp rate hikes at the next four FOMC meetings through Q3. The message from the Fed's leadership is that the policy adjustment will be front-loaded. The market accepts this and sees Fed funds peaking next year around 3.25%-3.50%. In addition, the May 5 FOMC meeting is expected to announce an aggressive unwinding of the Fed's balance sheet. After a short ramp-up period, $95 bln a month of maturing bonds will not be re-invested. Some economists estimate that the balance sheet reduction in H2 could be the equivalent of another 50 bp hike. The dollar's strength is consistent with the tighter financial conditions, and exports are at a record (even if imports have grown faster). There seems to be scope for additional dollar gains but the leg higher looks nearly complete. The pendulum of market fear of inflation may peak around the same time as the core rate. Corrective and consolidative forces are likely in the weeks ahead.

Euro: The European Central Bank will continue to buy bonds through June. The swaps market discounts a tightening cycle that begins in July and is anticipating more than 80 bp of hikes in the second half. This seems to be pricing in perfection. We note that only the hawkish members of the ECB are talking about a hike in July. President Lagarde has been more circumspect. It is still vulnerable wider cuts in Russian gas shipments. Moreover, the sanctions will begin covering parts of Russia's energy exports, which may also come at new costs for Europe. Disputes within Europe have been overshadowed by the war in Ukraine. However, the fissures cannot be held at bay much longer. The EC appears to be doing a good job separating Poland and Hungarian issues, and electoral result in Slovakia will see tensions ease, leaving Hungary with one less ally. Hungary may be the test case for the EC's new power to deny funds to members for contravening EU rules. The euro fell to five-year lows in late April near $1.0470. On a near-term view of momentum, it is stretched, but also in terms of the OECD's measure of purchasing power parity. The euro has not been this undervalued since 2001 (~-37%).

(April 29 indicative closing prices, previous in parentheses)

- Spot: $1.0545 ($1.1065)

- Median Bloomberg One-month Forecast $1.0730 ($1.1045)

- One-month forward $1.0560 ($1.1075)

- One-month implied vol 9.4% (7.8%)

Japanese Yen: Surveys suggest that Japanese businesses are more concerned about the yen falling to 20-year lows than officials who seem more focused about the pace of the adjustment. After years of adopting to a strong yen, Japanese businesses suddenly find themselves having to compete in a weak yen environment. The yen's slide of 6.2% in April brings the year-to-date decline to 11.25%. Moreover, the yen has morphed from a low volatility exchange rate to a higher one, forcing an adjustment by asset managers and hedge funds. One-month implied volatility reached almost 13% in late April, almost twice the average over the past 200-day. Japanese households appear more unsettled by the rise in price pressures, which the Bank of Japan says will not be sustainable and maintains its asset purchases and 0.25% cap on the 10-year yield. Core inflation is expected to jump starting with the April reports as the cut in the mobile phone charges drop out of the 12-month comparison. On the other hand, according to some estimates, the government's fiscal support will result in around 0.5% decline in CPI. The IMF's regional head indicated that the yen's weakness is fundamentally driven and that the dollar is strong broadly, making actual material intervention only a remote possibility. The dollar broke above the JPY130 area in late April after the BOJ strengthened its determination to cap the 10-year yield. Yet, if we are right about value emerging at the long end of the US curve, some of the downside pressure on the yen may ease and a new trading range may emerge. Tentatively, we suspect the lower end maybe inthe JPY125.00-JPY126.00 area.

- Spot: JPY129.70 (JPY121.65)

- Median Bloomberg One-month Forecast JPY126.70 (JPY120.40)

- One-month forward JPY129.60 (JPY115.50)

- One-month implied vol 11.9% (9.2%)

British Pound: Sterling fell for the fourth consecutive month in April, and its 4.3% decline was the largest since October 2016. The cost-of-living squeeze is weakening the economy and the Bank of England will be unable to raise rates as aggressively as the US and Canada, for example. The UK economy is particularly sensitive to the rising interest rates and energy prices. Excluding gasoline, UK retail sales have fallen for nine of the past 11 months through March. The BOE is tightening policy gradually. Its balance sheet has begun shrinking. With the anticipated 25 bp hike on May 5, the base rate will be at 1%, allowing the central bank to sell its holdings, not just passively wait for holdings to mature. However, the BOE has signaled this is unlikely. At the end of last year, the UK and US 2-year yields were around parity. Now the US offers about 110 bp on top of the UK, the most since before COVID. The UK holds local elections on the same day as the BOE meeting. The polls point to the likelihood of a poor showing for the Tories, which could intensify the cloud of uncertainty that hangs over Prime Minister Johnson. The political challenge is starker, too, now that the favorite to replace Johnson, Chancellor of the Exchequer Sunak, has taken a drubbing in the polls. At the same time, Sein Fein looks to take a majority in Northern Ireland's Assembly for the first time. Sterling's accelerated decline in late April leaves it stretched from a technical perspective. It punched through the $1.25 area, and there may be scope for another couple of cents, but the move looks stretched. On the upside, the $1.27-$1.28 area may offer a cap now.

- Spot: $1.2575 ($1.3140)

- Median Bloomberg One-month Forecast $1.2800 ($1.3200)

- One-month forward $1.2570 ($1.3135)

- One-month implied vol 9.7% (7.6%)

Canadian Dollar: The underlying fundamentals are constructive. Monetary policy is tightening through the interest rate channel and the balance sheet. Fiscal policy is less restrictive than anticipated. This did not prevent the Canadian dollar from of succumbing to the strong US dollar. Instead, it helped minimize the loss. The Canadian dollar declined about 2.70% in April, the least of the major currencies. Yet it was still was sufficient to reverse the Q1 gain and leave it off about 1.6% year-to-date. The Canadian dollar remains sensitive to the general risk appetite as reflected in the equity markets. The CAD1.24 area offers important support for the US dollar, while the CAD1.29-CAD1.30 area marks the ceiling. The Bank of Canada does not meet in May but when it meets on June 1, it will likely hike by another 50 bp as it did in April. The swaps market has discounted 50 bp moves in July and September as well.

- Spot: CAD1.2850 (CAD 1.2505)

- Median Bloomberg One-month Forecast CAD1.2665 (CAD1.2520)

- One-month forward CAD1.2850 (CAD1.2510)

- One-month implied vol 8.2% (7.2%)

Australian Dollar: The Australian dollar was pummeled in April. Its 5.6% decline gave the Q1 gains, and the Aussie is now about 2.8% lower on the year. The COVID-related lockdowns in China sparked concerns about the demand for commodities. The risk-off environment also undermined its attractiveness. The peak on April 5 near $0.7660 marked the culmination of a rally that began in late January slightly below $0.6970. What might have been a typical correction turned into rout in the last part of April, when China's knock-on impact was most intensely felt. In three sessions (April 21-22 and 25th), it tumbled by 4.3%. It tested support near $0.7050 at the end of last month, the only thing standing in the way of a return to the January low. Notably, the speculative (non-commercial) position in the futures market has not been net long the Aussie since last May. Around 2/3 of the net short position seen when the January low was recorded has been covered. The central bank is moving closer to raising rates, and after the sharp acceleration of Q1 CPI (5.1% year-over-year from 3.5%) the market moved to discount a 15 bp hike at May 3 central bank meeting. Given the strong labor market and the currency weakness, it seems reasonable. The market has the Reserve Bank of Australia launching an aggressive tightening cycle that will lead to a 245 bp of hikes before the end of the year. That seems exaggerated.

- Spot: $0.7060 ($0.7480)

- Median Bloomberg One-Month Forecast $0.7240 ($0.7455)

- One-month forward $0.7065 ($0.7485)

- One-month implied vol 10.0% (10.0%)

Mexican Peso: The commodity story and high-interest rates that saw Latam currencies outperform in Q1 22 reversed last month. Questions about Chinese demand weighed on metals and energy prices. Perceptions of the aggressive pivot by the Fed may have weakened the interest rate leg. Leaving aside Argentina, the Mexican peso was the weakest in the region in the January-March period, with a 3.3% gain. Its 3.4% loss last month was the least in the region. The combination of stronger than expected inflation and the expected trajectory of US monetary policy could spur Mexico's central bank into bolder action. Banxico hiked rates by 50 bp at each of the last three meetings after beginning the cycle with three 25 bp increases starting last June. The continued acceleration of inflation and the core rate rising above 7% boosts the risk of a 75 bp move at the May 12 meeting to 7.25%. President AMLO is expected to announce an agreement with some producers to limit price increases on as many as two dozen common products in early May, with the hope of restraining inflation. The dollar pulled back after reaching almost MXN21.47 in early March. It bottomed in early April around MXN19.73 and retested it mid-month. The low held, and the dollar rose a little through MXN20.60, the middle of the this year's range. The next important chart ares is MXN20.75-MXN20.80.

- Spot: MXN20.4280 (MXN19.87)

- Median Bloomberg One-Month Forecast MXN20.3610 (MXN20.10)

- One-month forward MXN20.55 (MXN19.98)

- One-month implied vol 12.3% (9.95%)

Chinese Yuan: After seemingly defying gravity, the yuan buckled in the second half of April. A big gap between the central bank's reference rate and market expectation was understood as a signal of official approval or acquiescence. The divergence of the Chinese and American business cycle has undermined a key attraction of Chinese bonds, the interest rate premium. It was slightly more than 100 bp in early March and now stands at a small discount. The economic weakness and Beijing's policies may have encouraged foreign investors to reduce equity exposure. It appears that foreign investors sold around $36 bln of Chinese stocks and bonds in February and March. In April, the sales continued, and anecdotal reports suggest currency hedge ratios were raised. Chinese exporters may ease the pressure on customers to pay in yuan, whose market share of SWIFT, the message system, remains less than 3%. Chinese officials have been reluctant to take bold measures to provide support for the economy, which still is at the mercy of COVID and the lockdowns. We are concerned that developments will get worse in the period ahead. It would mean a greater risk of supply chain disruptions and slower growth impulses from the world's second-largest economy and the largest exporter. This could translate into a weaker yuan and higher volatility. The PBOC cut the required reserve on foreign currency deposits by 1% in April ostensibly to boost the supply of dollars (and other currencies) to steady or slow the yuan's descent. This was understood as a mild move given that it hiked it in two percentage point increments twice last year. A move above CNY6.65 may encourage run toward CNY6.75.

- Spot: CNY6.6085 (CNY6.3400)

- Median Bloomberg One-month Forecast CNY6.5015 (CNY6.3540)

- One-month forward CNY6.6380 (CNY6.3590)

- One-month implied vol 7.0% (3.2%)