If you’ve gotten accustomed to seeing strong growth in US jobs every single month, as the rest of the world has, you may be in for a rude surprise this month.

According to the White House Press Secretary Jen Psaki, a full 9M people called in sick due to Omicron infections in the week the NFP survey was conducted. Psaki went on to warn that the jobs report may even show outright job losses for the first time since December 2020.

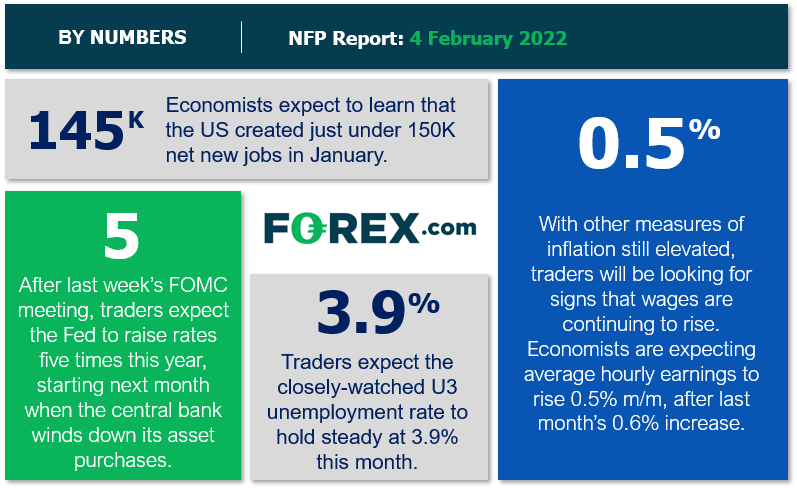

Thankfully, economists aren’t quite that pessimistic, anticipating 145K net new jobs and wages to rise 0.5% m/m, it’s still critical to recalibrate our expectations a (hopefully one-off) soft reading:

Source: StoneX

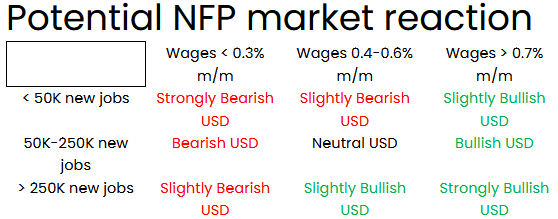

When it comes to the Federal Reserve, policymakers are likely to look through any short-term distortions, but Jerome Powell and company remain very conscious of the optics of their policy decisions, so a particularly poor report could tilt the Fed away from the “double” 50bps interest rate hike that some more aggressive traders have penciled in for March.

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component printed at 54.5, up slightly from last month’s 53.9 reading.

- The ISM Non-manufacturing PMI Employment component printed at 52.3, down from last month’s 54.9 level.

- The ADP Employment report -301K net new jobs, well below last month’s downwardly revised 776K print and the first negative reading since January 2021.

- Finally, the 4-week moving average of initial unemployment claims rose to 255K, up sharply from last month’s 205K reading.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to a slightly below-expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 25K-125K range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.6% m/m in December, will likely be just as important as the headline figure itself.

The US dollar index had a busy January, falling nearly 200 pips in the first half of the month before surging 300 pips to 18-month highs, and now that we’ve entered February, dropping a quick 200 pips to the mid-95.00s. All of this volatility leaves the world’s reserve currency in the middle of its January range, with no obvious technical bias heading into the jobs report.

As for potential trade setups, readers may want to consider EUR/USD sell opportunities if the jobs report is strong. As we go to press, the pair is testing a bearish trend line off its late-May highs in the 1.1400 area after an impressive rally so far this week. A solid US jobs report could present an opportunity for EUR/USD bulls to book profits and take the pair back below 1.1300.

On the other hand, a soft jobs report could present a sell opportunity in USD/JPY, which has been showing signs of losing upward momentum for the last couple of months. A disappointing reading on the US labor market could see USD/JPY continue to roll over and break back below 114.00 or even its year-to-date-lows in the 113.50 area.