The past several months have seen the US dollar index rally again, pushing King Dollar up to a retest of multi-year highs.

At the same time, the euro has been sputtering and is nearing multi-year lows.

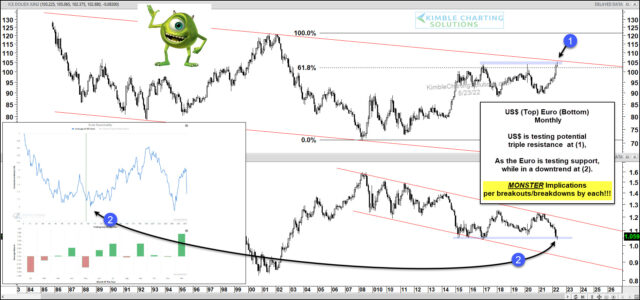

In today’s long-term monthly chart 2-pack, we look at both currencies… and highlight how both are facing monster tests.

As you can see, the dollar is testing triple resistance comprised of its overhead 25-year falling channel, the 61.8 Fibonacci retrace, and its prior highs at (1). A breakout would be a major development for the global financial markets.

Meanwhile, the Euro is testing critical support within its falling channel. And a breakdown here would be equally important. But note that it is nearing a seasonal period where it often makes a low.

The entire financial complex of stocks, commodities, bonds, and cryptos will be affected if the US dollar breaks out and the Euro breaks down. On the other, perhaps these areas hold firm, and the currencies remain confined within their trading channels.

Commodity bulls most likely would LOVE the Euro to find support at (2) and rally!