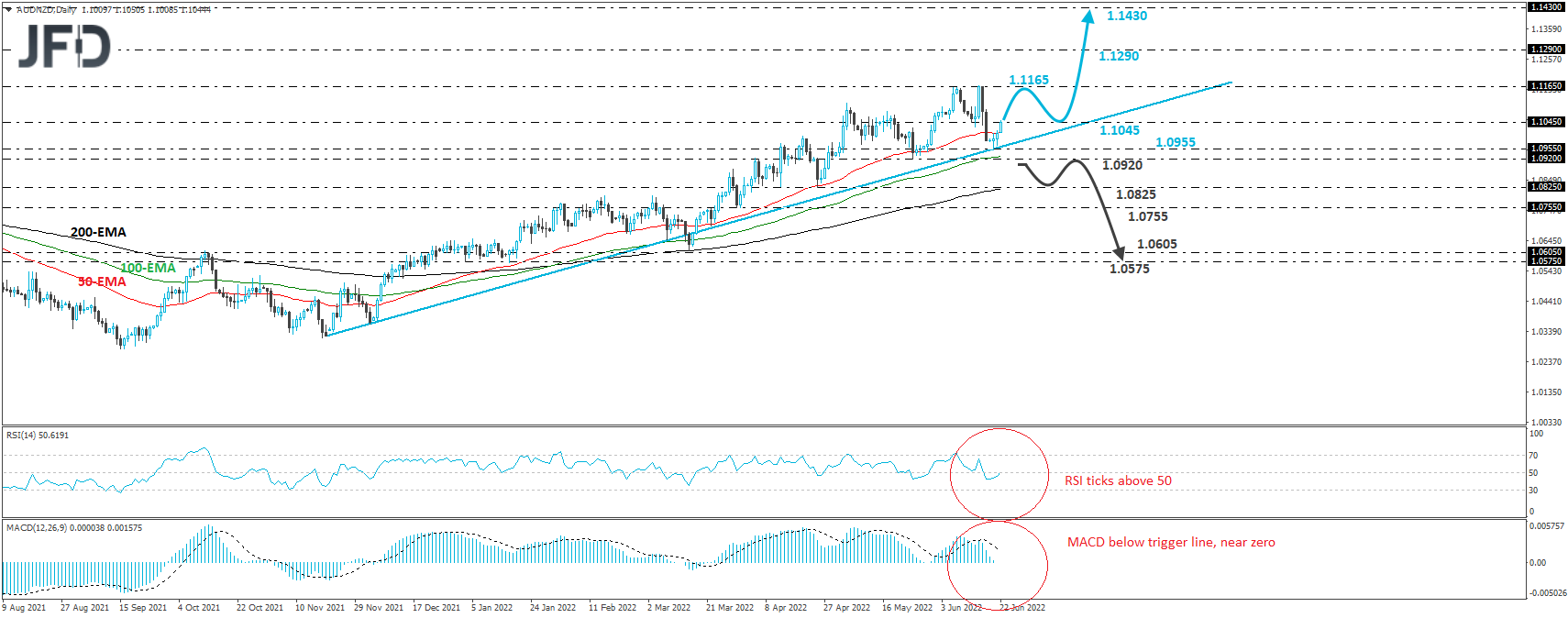

AUD/NZD traded higher recently after hitting support near 1.0955 on Monday. At that moment, that barrier coincided with the upside support line drawn from the low of Nov. 18. So, considering that the rate remains above that upside line, we will consider the medium-term picture to be positive.

At the time of writing, the rate is testing the 1.1045 zone, where a break could aim for the key resistance of 1.1165, marked by the highs of June 7th and 15th. If the bulls are not willing to stop there, then a break higher will confirm a forthcoming higher high and may pave the way towards 1.1290, a resistance marked by the high of October 2017. Another break above 1.1290 could carry extensions towards the 1.1430 zone, marked by the high of July 2015.

Shifting attention to our daily oscillators, we see that the RSI turned up and appears ready to move back above its 50 line, while the MACD lies below its trigger line, slightly above zero. It could start bottoming as well soon. The RSI suggests that the rate may gather upside speed soon, while the MACD has yet to do so.

That’s another reason we prefer to wait for a break above 1.1045 before getting confident on further advances. On the downside, we would like to see a clear break below 1.0920, marked by the low of May 25, before we start examining the case of a bearish reversal.

This could confirm the break below the aforementioned upside line and may initially target the 1.0825 level or the 1.0755 barrier, marked by the lows of Apr. 25 and the low of March 3t0h, respectively. If neither territory can invite enough bulls, then a break lower may encourage the bears to push towards the low of Mar. 15, at 1.0605, or the low of Jan. 17, at around 1.0575.