- China’s CPI declines by 0.3%

- Fed’s Mester pushes back against March rate cut expectations

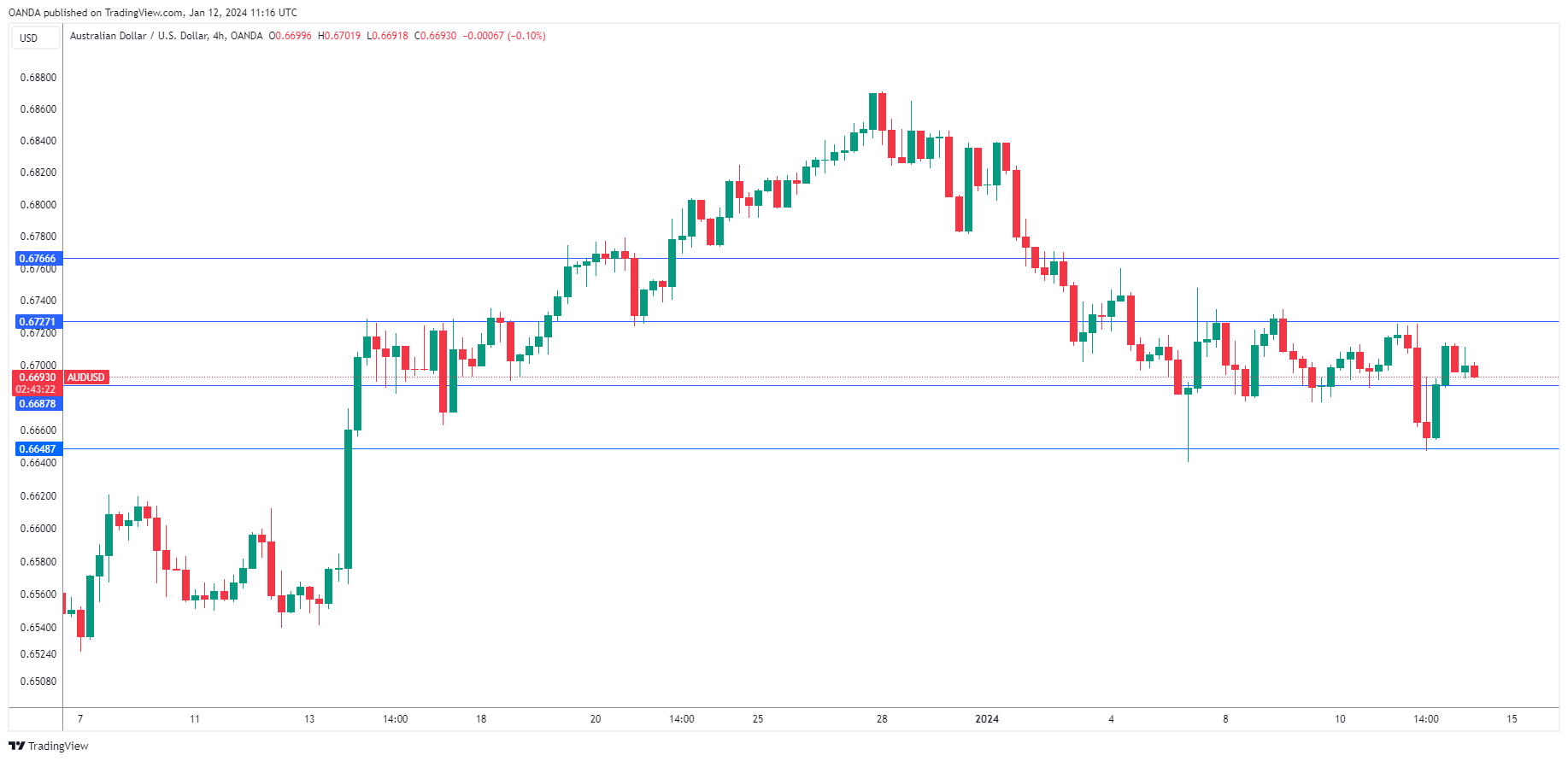

The Australian dollar has edged higher on Friday. In the European session, AUD/USD is trading at 0.6693, up 0.09%.

Policymakers at Australia’s central bank are keeping a close eye on this week’s inflation data out of Australia and China. Australia’s CPI eased to 4.3% y/y in November, down from 4.9% in October and below the market estimate of 4.4%. This marked the lowest inflation rate since January 2022, as food and energy prices decelerated in November compared to a month earlier.

China, the world’s second-largest economy, continues to struggle with deflation. CPI fell by 0.3% y/y in December, the third consecutive monthly decline. That hasn’t happened since 2009. Monthly, CPI rose 0.1% rebounding from -0.5% in November but missed the market estimate of 0.2%. Core CPI increased by 0.6% y/y for a third straight month.

The lack of inflation points to a bumpy recovery for the Asian giant, which is not good news for Australia as China is its number one export destination. Weaker activity in the Chinese economy means less demand for Australian exports and that could have a negative impact on the Australian dollar.

Mester Pushes Back Against March Rate Cut

The markets have become accustomed to inflation falling in the US, which made the upswing in December’s inflation report a rude surprise. Inflation rose 3.4%, up from 3.1% in November and higher than the market estimate of 3.2%.

The rise in US inflation is a reminder that the battle to bring inflation back to the 2% target will be bumpy. The Fed has done a good job in lowering inflation but the final stretch is looking to be the most difficult. Services and housing inflation remains sticky and deflationary pressures from goods and energy have been fading.

The markets have trimmed their expectations for a March rate cut in response to the inflation release and last week’s nonfarm payrolls, which was also higher than expected. The odds of a March rate hike are around 70% but the Fed hasn’t signaled what timeline it has in mind for an initial rate cut. Cleveland Fed President Mester pushed back against market expectations on Thursday, following the inflation release. Mester said that it was “too early” to cut rates in March because the upswing in inflation showed that restrictive policy was needed to bring down inflation to the 2% target.

AUD/USD Technical

- There is resistance at 0.6732 and 0.6824

- 0.6625 and 0.6533 are providing support