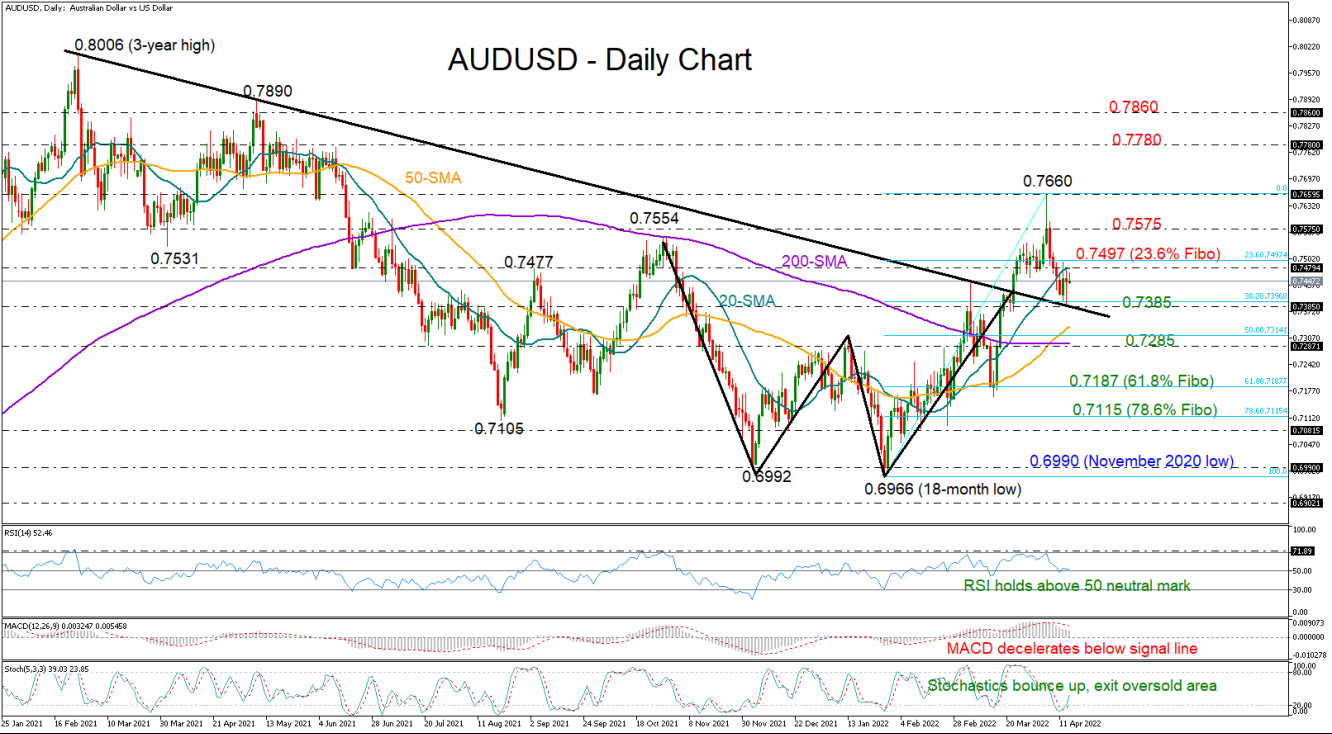

AUDUSD recouped most of Wednesday’s losses to stay within the 0.7400 zone after stepping on the resistance-turned-support trendline. Despite that, bullish actions were limited as the 20-day simple moving average (SMA) prevented any increases above 0.7480.

This line continues to block the way higher so far on Thursday, questioning the upside reversal in the RSI and the Stochastics. The MACD remains negatively charged below its red signal line, feeding some caution as well. As regards the market trend, however, the golden cross between the 50- and the 200-day SMAs is preserving optimism that the short-term positive pattern following the completion of a bullish double bottom structure around 0.6992 could gain extra legs.

For now, a decisive move above 0.7480 and, more importantly, an extension above the 23.6% Fibonacci retracement of the 0.6966 – 0.7660 upleg at 0.7497 is required to boost the price towards last week’s barrier of 0.7575. The previous peak at 0.7660 could be the next target, with the bulls likely aiming to upgrade the short-term positive outlook above that bar and drive the price towards 0.7780.

In the negative scenario, where the 20-day SMA fortifies selling tendencies, the spotlight will shift back to the trendline and the 0.7385 level. The 38.2% Fibonacci is in the neighborhood too. Hence, any violation at this point could confirm additional declines towards the 200-day SMA at 0.7287, unless the 50-day SMA manages to add strong footing beforehand at 0.7336. Should the bears persist, the door would open for the 61.8% Fibonacci of 0.7187.

In brief, despite its latest bounce in AUDUSD, negative risks continue to linger in the background. A continuation above 0.7497 could reduce skepticism, while a drop below 0.7385 could enhance selling appetite.