The Australian dollar reversed directions on Wednesday and climbed sharply. In the European session, AUD/USD was trading at 0.6937, up 0.98% on the day.

If your fancy is a currency with wild swings, then stay put and don’t change the channel. The Australian dollar continued to fluctuate and was up sharply today after a nasty 5-day slide, in which the Aussie plunged almost 400 points.

Just yesterday I wrote how risk appetite was nowhere to be found and the Australian dollar was taking it on the chin. Fast forward 24 hours, and the markets have regained their bullish outlook, sending equities and risk currencies like the Australian dollar sharply higher.

If anything, the sharp swings were reflective of the nervous markets, ahead of the Federal Reserve meeting. The ECB grabbed the spotlight earlier, announcing an emergency meeting today. This raised speculation that the ECB could take a dovish pivot and suspend rate hikes, which had the markets in a positive mood.

Will the Fed hike by 75 basis points?

The markets have priced in a massive 75-bp hike from the Federal Reserve at virtually 100%, with some voices calling for a nuclear salvo of 100-bp. The Fed hasn’t hiked by 75-bp since 1994 and such a move should be bullish for the US dollar, even though it has been priced in.

The extent of the rate hike will be closely watched, as will Fed Chair Powell’s rate statement. Hold onto your seats for what could be a volatile North American session.

With market attention squarely on the Fed, investors completely ignored a sharp decline in Australia’s consumer confidence, which declined by 4.50% in June, after a -5.60% reading in May.

Following the Fed announcement, Australia releases inflation expectations and the May employment report.

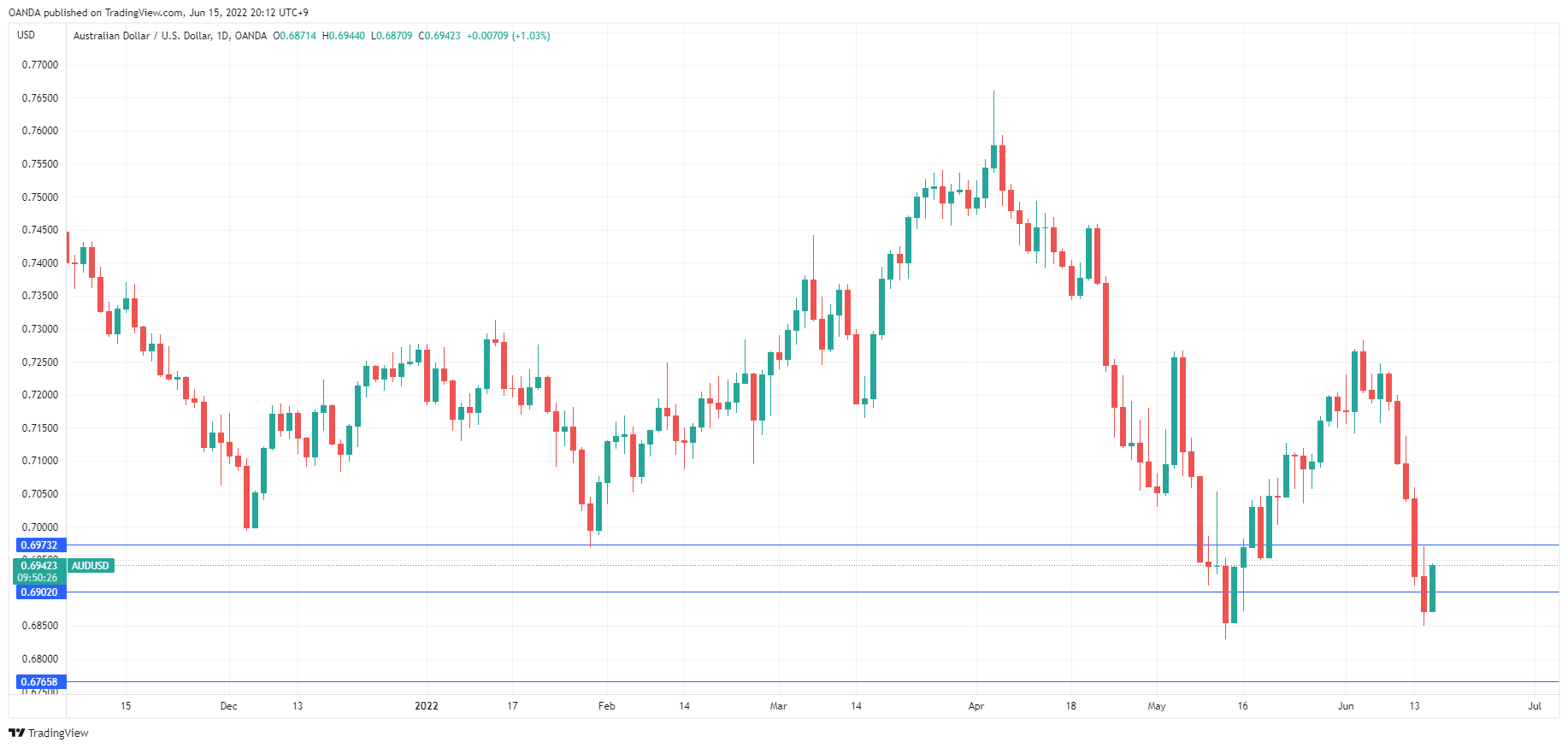

AUD/USD Technical

- AUD/USD was testing resistance at 0.6902. Above, there was resistance at 0.6973

- There was support at 0.6765 and 0.6654