BoJ to tighten next year?

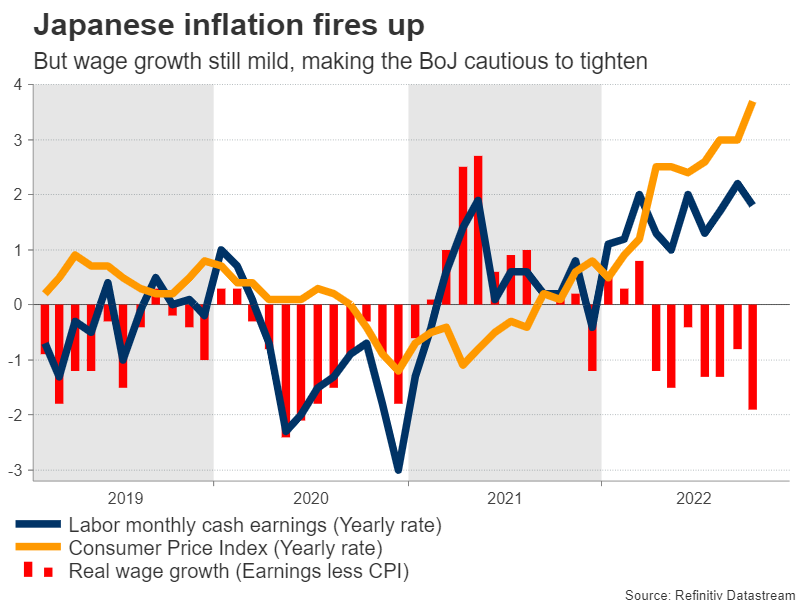

Economic developments in Japan have been encouraging lately, raising speculation that the central bank might finally consider an exit from its decade-long stimulus program. Inflation has fired up and is currently running at 3.7%, the Tankan survey suggests business conditions are improving, and the government has unveiled a $200bn spending package to shield consumers and boost wages.

The Bank of Japan will conclude its meeting on Tuesday and despite all this economic progress, it is not expected to adjust policy. While inflation has accelerated, wage growth hasn’t picked up as much speed, so policymakers can argue that inflation dynamics are not self-sustaining yet. With the economy also contracting last quarter, it’s probably too early for any tightening moves.

Nevertheless, it is becoming clear that policy changes are coming, possibly next year. Not only is the economic landscape improving, but Governor Kuroda also opened the door to adjusting yield curve control recently - the strategy that has decimated the yen.

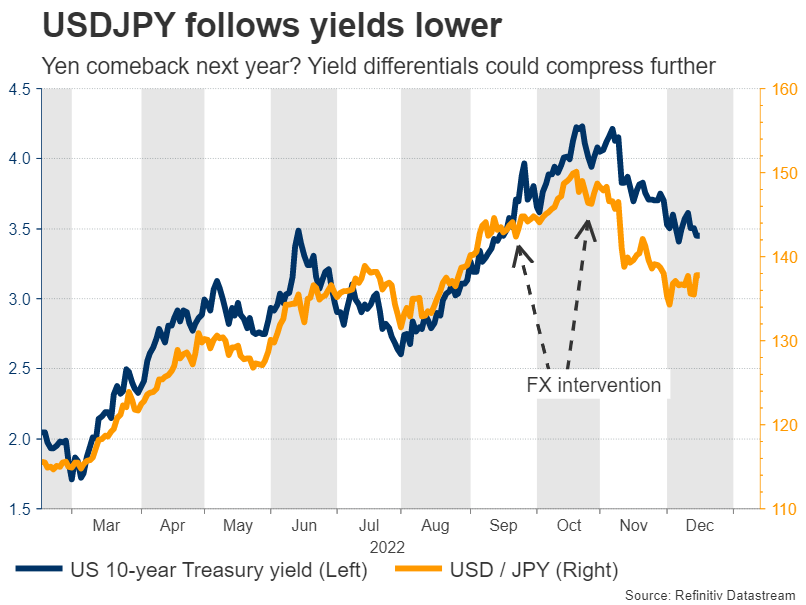

By extension, the stars seem to be aligning for a comeback in the yen. Most of the elements that ravaged the currency this year - widening interest rate differentials, soaring energy prices, and a lack of tourism - have started to reverse.

Looking into next year, the BoJ might start to tighten just as foreign central banks end their own tightening cycles. With recession risks also intensifying in other major economies, rate differentials could continue to compress. Meanwhile, oil prices have declined and tourists are allowed to visit Japan again, helping to boost demand for the currency.

Add everything together and it’s a solid setup for the yen, which might come from behind to be the surprise winner of 2023 as the global economy tips over. One crucial variable will be who will replace Kuroda as BoJ Governor when his term expires in April. If traders get the sense it will be someone more open to raising rates, that could be the catalyst for the comeback.

Deluge of US data

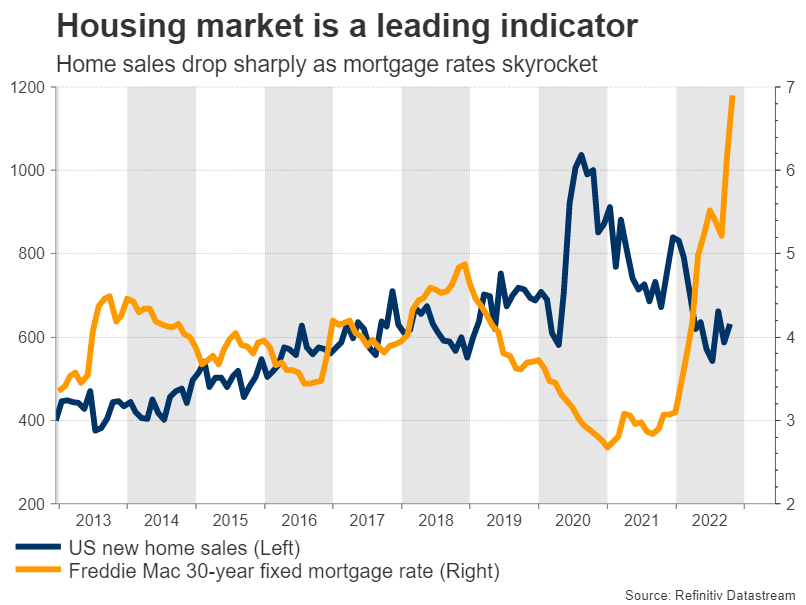

In the world’s largest economy, there’s a barrage of second-tier data releases coming up. The ball will get rolling on Tuesday with housing data for November, which has increased in importance lately as investors view the housing market as a barometer for how much interest rate increases are affecting the economy.

Consumer confidence data for December will hit the markets on Wednesday, before the week concludes with durable goods orders, personal income and spending, and the latest core PCE price index on Friday. New home sales are out on the same day.

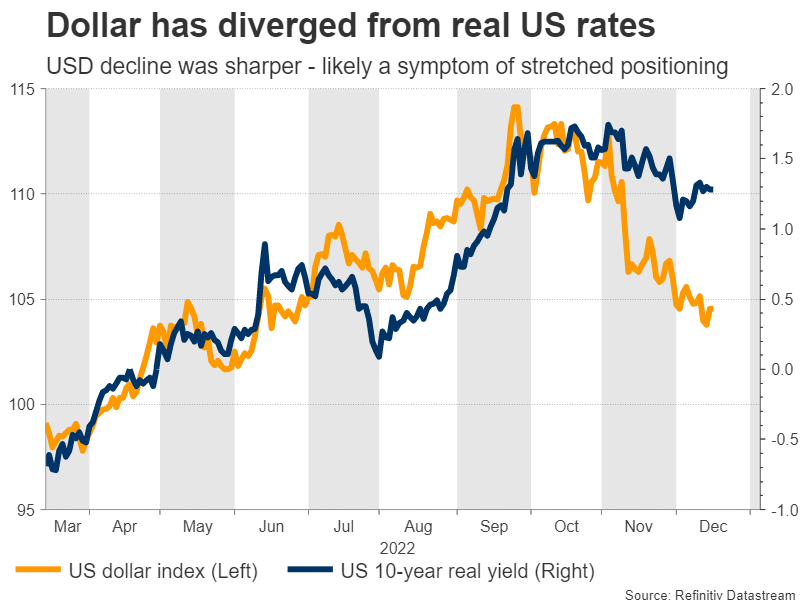

The Federal Reserve resorted to shock tactics this week, signaling it will raise rates beyond 5% and keep them there until the end of next year. Even though this message was much more hawkish than market pricing, which currently sees rates ending next year at 4.3%, the dollar fell in the aftermath.

It seems that investors didn’t really ‘buy it’. There’s a sense that the Fed is either bluffing to tighten financial conditions or that a weakening economy next year will force policymakers to renege on their rate promises. Either way, it’s never a good sign when a currency cannot rally on positive news.

The reaction function in the dollar has turned asymmetric lately. Negative developments tend to hurt the reserve currency more than positive developments boost it, something that was on full display this week after the US inflation report and the Fed decision. This dynamic likely reflects how crowded the ‘long dollar’ trade was just a few weeks ago, but it could also be a sign that the tide is turning.

All told, the outlook for the dollar appears neutral, as it is difficult to envision either massive losses or massive gains from here. On the bearish side, US inflation is simmering down and traders clearly don’t believe the Fed will follow through on its rate plans. That said, other major economies are in even worse shape than America, so the world’s reserve currency is unlikely to enter a full-blown downtrend while Europe and China are so fragile.

Canadian data releases

Across the Canadian border, there’s another flurry of data on the menu, starting with retail sales on Tuesday. Then on Wednesday, the latest inflation report will be released, ahead of the monthly GDP print for October on Friday.

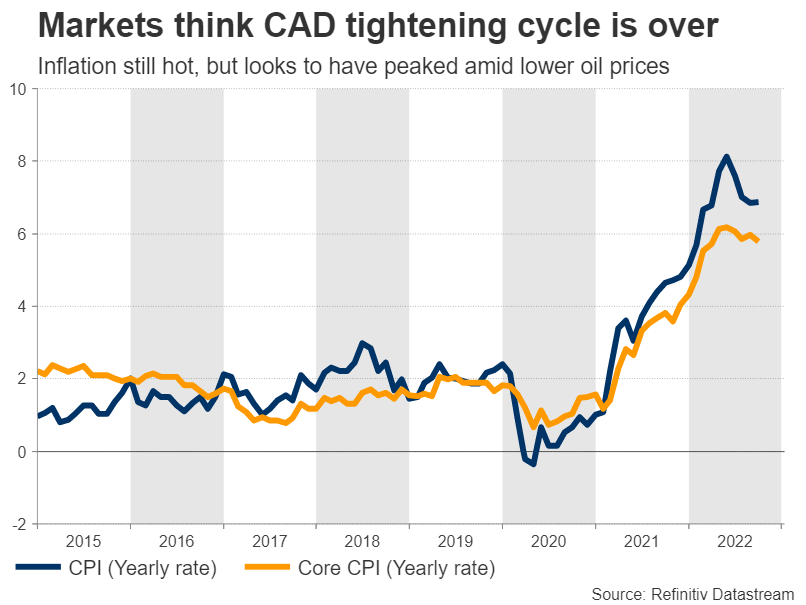

Investors will inevitably focus on the inflation prints, as those will be the most crucial for what the Bank of Canada does next. Market pricing suggests the tightening cycle is probably finished already, assigning just a 50% chance for another small rate hike next year.

As for the Canadian dollar, its fate is linked to oil prices and global risk sentiment, so it is difficult to be optimistic heading into a potentially stormy 2023 with stock market valuations still expensive and global economic momentum fading.