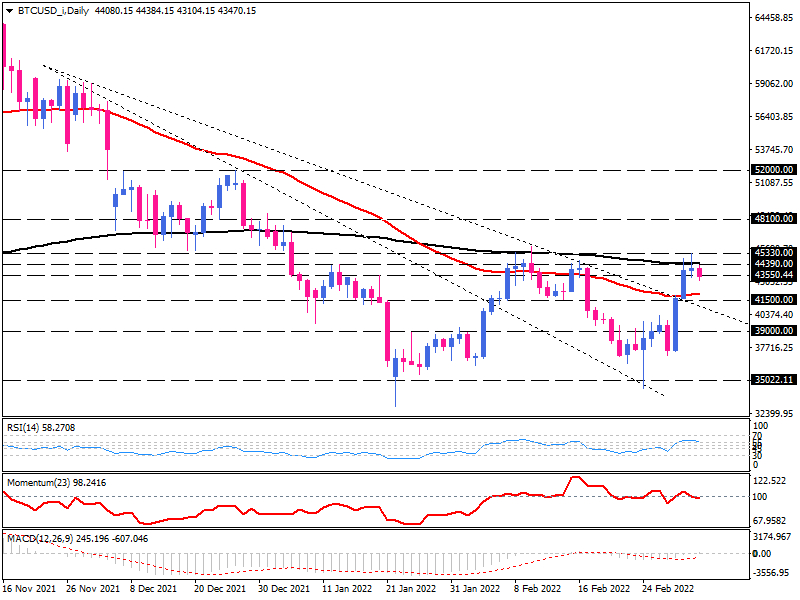

On the daily chart, Bitcoin is trading sideways. After bottoming around $35,000, then pulling back to the broken trend line, buyers also penetrated the less sloping trend line. But the 200-day exponential moving average halted the upward movement earlier this week.

Yesterday's shooting star formation indicates the rejection of higher prices at the confluence of the $44,390 resistance level and the 200-day EMA. In the mid-day European trading session, sellers attempt to drag the price below yesterday's low of $43,550.

With a substantial downward move below this level, they will aim for the 50-day EMA coincides with 41,500 dollars. A further decline below this hurdle may penetrate the descending trend line. If that happens, the $39,000 level may be the following support.

The broad picture of bitcoin is bearish because it is trading below the slow-moving average. Still, the continuation of the long-term downtrend is subject to price dropping below the last bottom at $35,000. Otherwise, should buyers successfully keep above the 200-day EMA, the completion of a double-bottom pattern will be evident. If that's the case, the immediate resistance is at $48,100.

Momentum oscillators convey selling forces are waning. RSI and momentum have posted a divergence between the price and oscillator. At the same time, MACD has crossed above the zero line into buying territory.

Short-Term Outlook

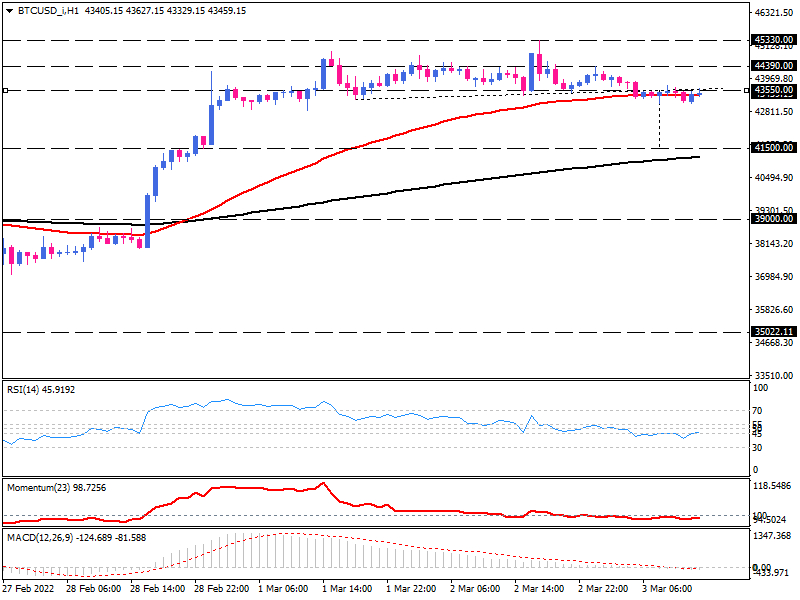

Looking at the short-term time frame on the hourly chart, we see the market sentiment is about to turn bearish by forming a Head and Shoulders pattern. Seemingly, more sellers may cue the broken neckline and crossover the 50-EMA. Once more, the classic projection of the head and shoulder roughly lines up with $41,500 near the 200-EMA.

On the flip side, a sustained move above the right shoulder at $44,390 will invalidate the reversal and may put $45,330 on the buyers' radar. Short-term momentum oscillators indicate a prevailing bearish bias. RSI is trending down, pulling the neutral zone into the selling area.

Meanwhile, momentum is moving below 100-threshold. And MACD bars are dipping below the zero line, while the signal line has also entered the negative territory.