- NZDUSD in the green today but sentiment mixed

- Key market events increase possibility of stronger moves

- Momentum indicators on the brink of giving bearish signals

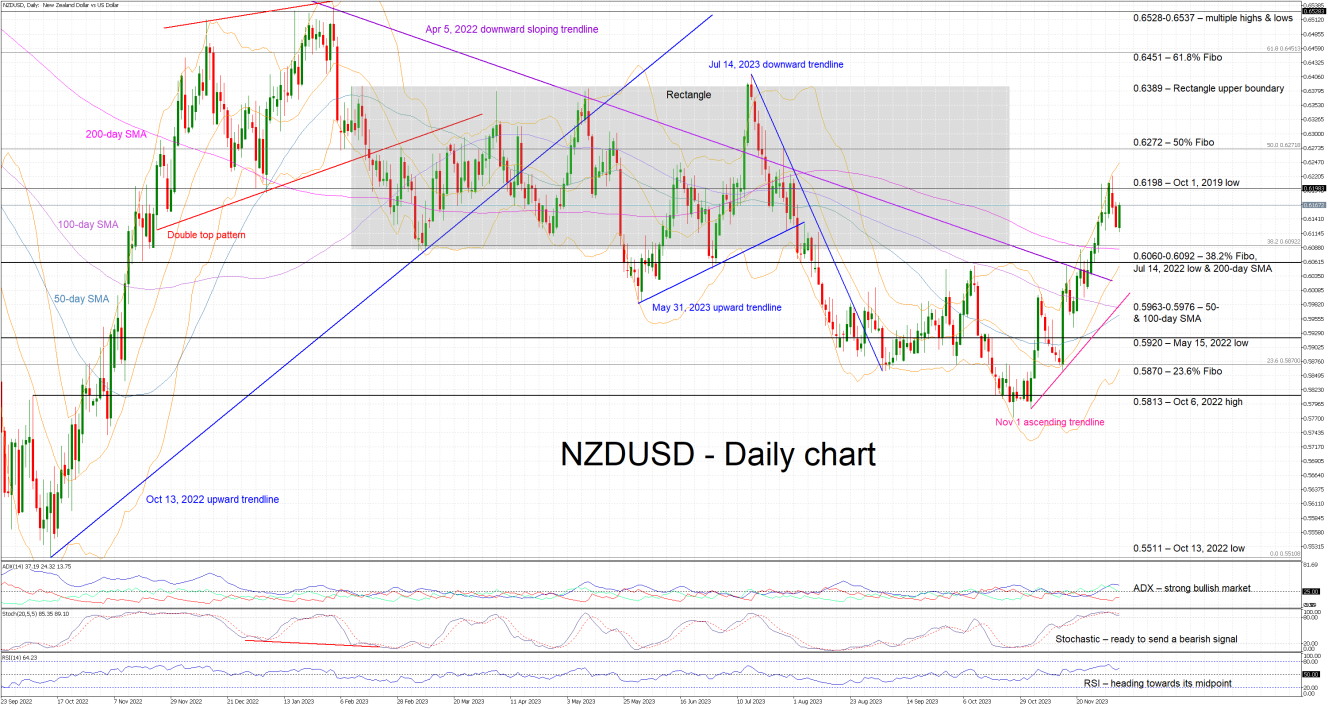

NZDUSD is edging higher today, reacting to the previous two sizeable red candles. It has been an aggressive rally from the November 1 low of 0.5788 as NZDUSD bulls took advantage of the widespread USD weakness and the relative hawkishness of the RBNZ to record a 3-month high of 0.6222. In the meantime, the convergence of the 50- and 100-day simple moving averages (SMA) means that volatility could remain high this week.

Amidst these developments, the focus has turned to the momentum indicators.

More specifically, the Average Directional Movement Index (ADX) is above its threshold, but it is now trading sideways and thus casting a shadow over the current upleg. Similarly, the RSI is edging slightly higher but remains below its recent peak. More importantly, the stochastic oscillator has broken below its moving average and prepares to exit the overbought area. Should such a move take place, it could be seen as a first strong bearish step.

If the bulls are keen to record a higher high, they could try to push NZDUSD above the October 1, 2019 low at 0.6198 and then potentially set their eyes on the 0.6272 level. This is defined by the 50% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend, and, if broken, it could open the door for a more protracted rally towards the 0.6389 level.

On the flip side, the bears are trying to regain market control. They could try to push NZDUSD towards the busy 0.6060-0.6092 region, which is populated by the 38.2% Fibonacci retracement, the July 14, 2022 low and the 200-day SMA. Even lower, the path looks clear until the 0.5963-0.5976 region that is set by the 50- and 100-day SMAs.

To sum up, NZDUSD bulls have managed to record a 3-month high, but their aim for a higher high appears to be more difficult now since the momentum indicators are preparing to turn bearish.

- Beta

Beta feature