Recent DES data revealed that Canadian households have become more affluent. In Q4 2023, their "net" worth increased by 1.8%, or 300 billion Canadian dollars, smoothing out the decline seen in the previous quarter.

This increase can be attributed to the recovery in financial market returns, as both stocks and bonds appreciated during the period. This dynamic compensated for the "modest" decline in the country's housing market value. Overall, Canadians became 712.7 billion CAD richer in 2023 than they were the previous year.

Borrowing rates in Q4 of last year increased for the second consecutive quarter, with households attracting 29.5 billion CAD, primarily in mortgage loans, followed by consumer loans. These figures raise concerns, suggesting that some households may become more indebted than others. Canada's economy's loan debt is currently estimated at 2.9 trillion CAD, with three-quarters of these debts being mortgage loans. However, in the economic context, household debt as a percentage of Canadians' disposable income accounts for 178.7% in Q4, slightly lower than in Q3 of last year and the lowest level since the end of 2015. Thus, while debts exist, the overall picture is relatively stable.

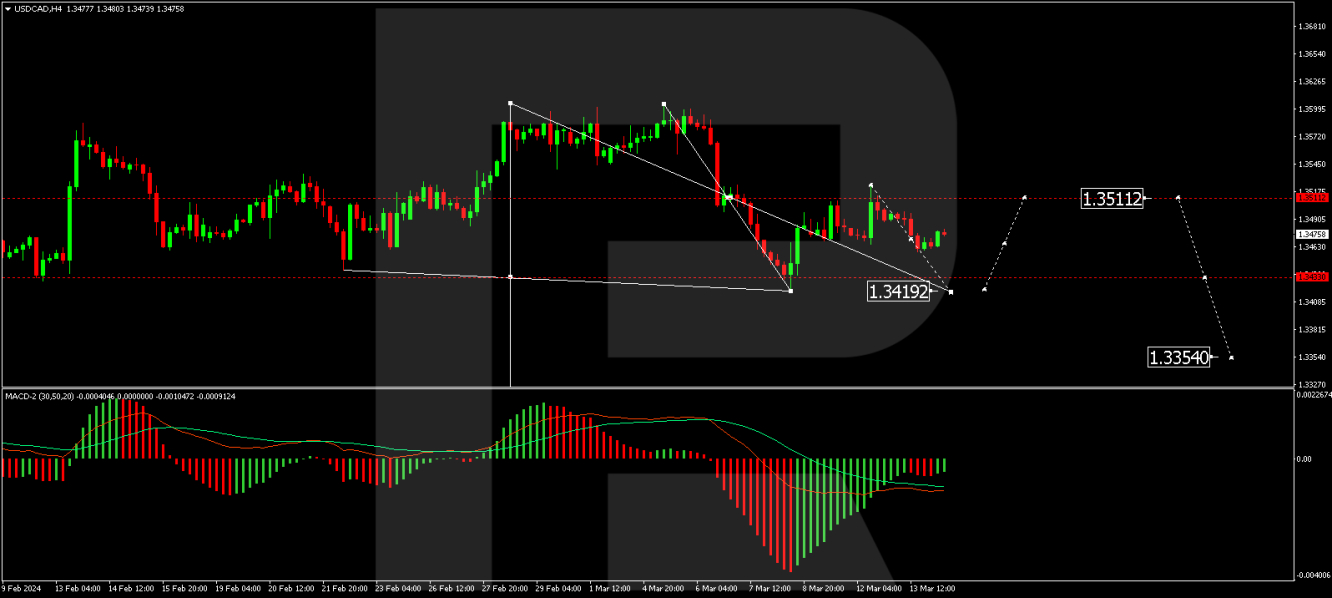

USDCAD technical analysis

On the H4 chart of USDCAD, a declining wave is forming towards 1.3403. Today, we are considering the development of its fifth structure. After reaching the target level, a correction to 1.3511 is possible. Subsequently, we expect the beginning of a new declining structure towards the local target of 1.3354. This scenario is confirmed by the MACD indicator, whose signal line is below the zero mark and heading strictly downward towards new lows.

On the USDCAD H1 chart, the first structure of the fifth declining wave has been completed. Today, we are considering the possibility of a correction to 1.3488. After its completion, we expect a decline to 1.3454, then a rise to 1.3471 (testing from below), and then a decline to 1.3420. This is the first target. The stochastic oscillator, with its signal line above the 80 mark and preparing to drop to 20, also confirms this scenario.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.