The Canadian dollar has steadied on Tuesday, after starting the week with sharp losses. In the European session, USD/CAD is trading at 1.3444, down 0.37%.

Canada’s GDP Expected to Slow

Canada will release third-quarter GDP later today, with a consensus of a 1.5% gain. This follows a strong Q2 gain of 3.3%. The economy has been losing steam as interest rates continue to rise, and there are forecasts for negative growth as early as Q1 of 2023. Last week’s retail sales report did not impress. Retail sales for September came in at -0.5% MoM as expected, but lower than the August gain of 0.4%. More worrying, retail sales fell by 1.0% QoQ, the first quarterly decline since Q2 2020. The Canadian dollar should be busy on Friday, as both Canada and the US release the November employment report.

The Fed doesn’t hold a policy meeting until December 14th but Fed members continued to hit the airwaves on Monday. James Bullard said on Monday the markets could be underestimating the likelihood of higher rates and that the Fed funds rate will have to reach the bottom end of the 5%-7% range in order to curb inflation, which has been more persistent than anticipated. John Williams added that the Fed needed to do more work to tame inflation, which is “far too high”. Lael Brainard, a dove, expressed concern about inflation expectations rising above the Fed’s 2% target. The Fedspeak blitz could continue right up the meeting, as the Fed needs the markets to buy into its message that inflation has not peaked and the Fed remains hawkish and plans to keep raising rates.

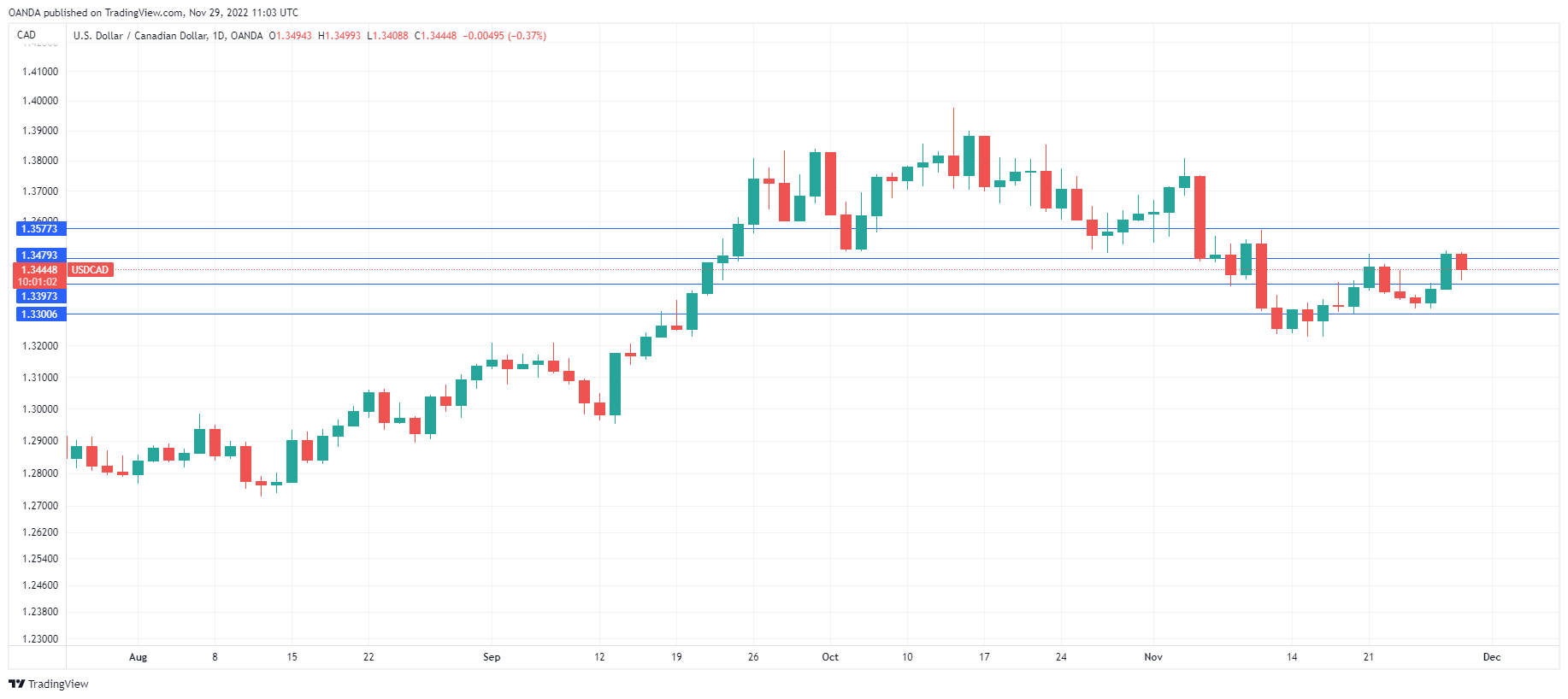

USD/CAD Technical

- USD/CAD is facing resistance at 1.3478 and 1.3576

- There is support at 1.3398 and 1.3300