After sharp losses yesterday, the US dollar has stabilized today arguably ahead of Fed Chair Powell's speech at the Riksbank symposium. Yesterday's Fed speakers stuck to the hawkish rhetoric, and this seemed to help reverse the equity market gains, though the greenback remained soft. If Powell does not push back against the easing of financial conditions, it could very well fan risk-taking appetites and lead to a further easing of financial conditions.

Asia Pacific equities were mixed, while Europe's STOXX 600 is snapping a two-day advance. US equities are little changed. Benchmark yields are mostly higher, and the US 10-year yield may be based around 3.50%. The new Chinese quota for oil imports and the weaker dollar seemed to help crude oil prices. The market continues to look past the current Covid crisis in China and anticipates recovery and new stimulus measures. Iron ore prices jumped 2.4%. Several of the currency pairs we review near the Bollinger Bands are set two-standard deviations for the 20-day moving average.

Asia Pacific

As expected, Tokyo's December CPI rose to new cyclical highs. The headline rate firmed to 4.0% from 3.7%. The core measure, which excludes fresh food rose a little more than expected to 4.0% from 3.6%. The measure that excludes fresh food and energy rose from 0.3% to 2.7% as anticipated. Fiscal measures and the recovery of the yen should help cap price pressures shortly. The subsidies for energy starting this month are expected to lower core CPI by as much as 0.8% here in Q1. A measure of the trade-weighted yen has risen by about 10% since bottoming on October 21.

The price of Brent crude oil has fallen by a little more than 15% over the past period. Wheat prices are off nearly as much. The BOJ meets next week and there is some speculation that it will lift its inflation forecast, which stands at 2.9% this fiscal year and falls to 1.6% in the next two. The median forecasts in Bloomberg's survey see 2.4%, 1.8%, and 1.2% respectively. Separately Japan reported that household spending collapsed in November, falling 1.2% year-over-year. The median forecast in Bloomberg's survey called for a 0.5% increase. It is the weakest since April when the economy contracted in Q2 22. On a month-over-month basis, this is a 0.9% slump after rising 1.1% in October.

Tomorrow, Australia reports November retail sales and its newly minted monthly CPI estimate. Retail sales are expected to recover from the 0.2% fall in October and rise by 0.6%. The monthly CPI reading slowed from the cyclical high of 7.3% in September to 6.9% in October. The median forecast in Bloomberg's survey sees the rate bouncing back to 7.2%. The trimmed mean may set a new high of 5.5%. Before the central bank meets on February 7, the traditional and broader quarterly inflation figures will be published. The futures market shows about a 56% chance of the RBA hiking 25 bp then, which would bring the cash target rate to 3.35%. There are some observers who think the RBA may signal the end of its tightening cycle with a smaller hike of 15 bp to bring it to 3.25%.

The dollar is consolidating inside yesterday's range (~JPY131.30-JPY132.65). The US 10-year yield appears to be based around 3.50% and that may take some pressure off the greenback. For the better part of three weeks, the dollar has been carving out a range of roughly JPY130 to JPY135. The Australian dollar is also trading inside yesterday's range (~$0.6870-$0.6950). It has been mostly straddling the $ 0.6900 level in quiet turnover. A break below the 200-day moving average (~$0.6840) would weaken the technical tone. Note that the upper Bollinger Band comes in today near $0.6915.

Initially, the greenback extended its losses to about CNY6.7530 before recovering to the CNY6.79 area. The dollar has spent most of the days so far this year below its lower Bollinger Band against the yuan. For the second consecutive session, it did not even enter the band, which is found near CNY6.7975 today. Still, the PBOC set the dollar's reference rate weaker than expected (CNY6.7611 vs CNY6.7640 median projection in Bloomberg's survey). Reports suggest importers were dollar buyers and hedging activity in the forwards and options market by mainland corporates helped the greenback recover. Separately, while bank lending last month was a bit stronger than expected lending from shadow banking was weaker than this holding down aggregate lending.

Europe

At the last ECB meeting, President Lagarde warned that the fiscal measures to ease the higher energy costs would have only a temporary impact on headline inflation. In the short run, lower energy bills may boost the demand for other goods and services. However, the ECB's focus, like many central banks is on wages. Although wage settlements have been modest so far, the ECB's research warns of stronger wage settlements in the coming quarters. Also, the minimum wage has been lifted in several countries. Moreover, the ECB staff's latest forecasts see inflation above 2% through 2025.

Meanwhile, although some observers have talked made references to Russia's blockade of energy to Europe, it seems that the facts on the ground are more complicated. The EU (and others) have embargoed Russian oil and gas, and as of February 5, the embargo will extend to oil products. The EU had been importing about 1.3 mln barrels a day of refined products, with diesel accounting for around half. It looks like Kuwait is set to double its diesel sales to the EU to 100k barrels per day and boost its jet fuel shipments as well. The price of Brent oil tumbled 8.5% last week but has begun the new week on firm footing following Beijing's increase of oil import quotas.

There is still a hope that the economic weakness in the eurozone will prove to be brief and shallow. French November industrial output data lend support to this less pessimistic view. Industrial production, which the median in the Bloomberg survey anticipated a 0.8% gain, instead jumped 2%, led by a 2.4% surge in manufacturing. This is a robust recovery from the 2.1% drop in October's industrial output and the 2.5% decline in manufacturing. Spain's figures are due tomorrow, while Italy's and the aggregate estimate will be reported at the end of the week.

The euro is consolidating after rising to around $1.0760 yesterday, its highest level since last June. It has remained firm today, although it has not extended its gains. The single currency has held above $1.0720. On the upside, nearby resistance is seen near $1.08, while the 50% retracement of the euro's decline since peaking on January 6, 2021, is around $1.0950. We suspect a break of $1.07 is more likely first, in which case, support may be found initially around $1.0650. The sterling is moving sideways today at the upper end of yesterday's range. It has been in about a half-cent range above $1.2140. Support is seen near $1.2100, and a break could see another half-cent range extension. Note that the $1.2215 area that capped sterling yesterday corresponds to the (61.8%) retracement of the decline since the middle of last month when it peaked near $1.2450.

America

Fed Chair Powell is to discuss central bank independence at the Riksbank symposium shortly. Usually, independence is meant in the context of political pressure. However, the criticism sometimes levied against the Fed is not that it bends to the political wishes of the president or Congress but is slavishly follows the market. Hence, it could be an opportunity for Powell to push back against the easing of financial conditions. At the end of last week, the market seemed to react more dramatically after the ISM services than the decline in average hourly earnings.

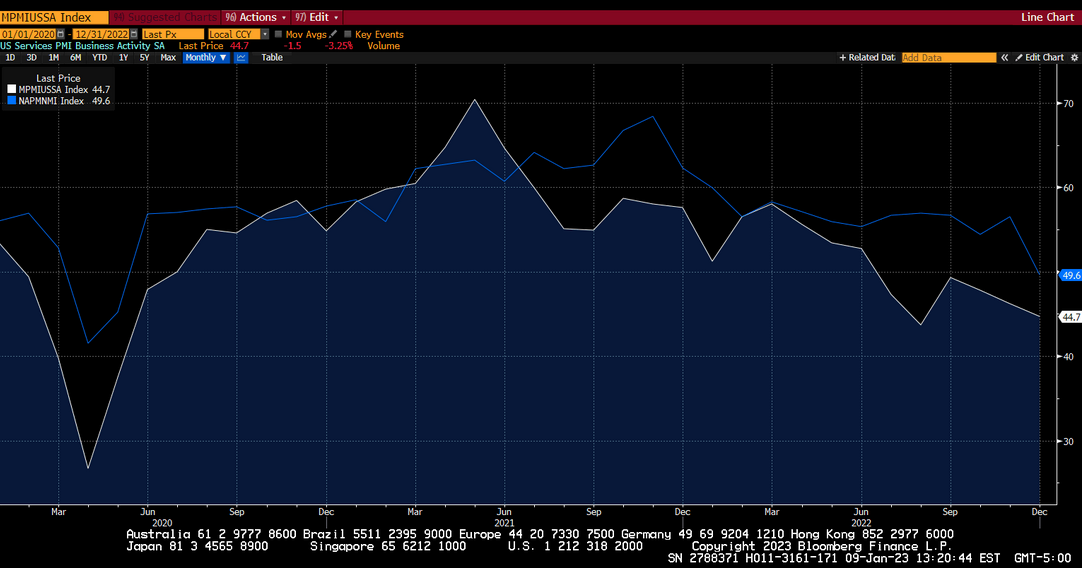

Average hourly earnings suffer from composition issues and do not seem like the preferred measure for tracking labor costs. On the other hand, ISM services had been (blue line in chart) more than the PMI services (white line) and seemed to play catch-up. December was the sixth consecutive month that the services PMI was below the 50 boom/bust level, while it was the first time the ISM services fell below 50 since May 2020. The market has taken US rates and the dollar lower and sent stocks sharply higher. This easing of financial conditions is precisely what the December FOMC minutes cautioned against. If Powell does not at least reiterate the FOMC minutes, the risk is financial conditions ease further.

Last month, seven of the 19 Fed officials thought a Fed funds rate ought to peak at 5.25% or higher. The Fed funds futures market sees the peak near but not quite 5%. Moreover, the implied yield of the December contracts settled 32 bp below the yield of the September contract. The discount has widened by about seven basis points since the day before the December minutes were released. That shows the market continues to anticipate a cut in the target rate in Q4. The FOMC minutes were clear that no official anticipates this. For the record, both Daly and Bostic were more hawkish yesterday that the market. Daly acknowledged 25 bp or 50 bp is on the table at the next meeting, and that the peak rate will be somewhat above 5%. Bostic opined that it would be fair to say that the Fed is willing to overshoot and that he wants to see 5.00%-5.25% before pausing. Bostic also acknowledged that a recession was not his base case.

Mexico's December CPI was in line with expectations. The headline rate ticked up to 7.82% from 7.80%. The core rate eased to 8.35% from 8.51%. The headline rate appears to have peaked at 8.70% in September and October. The core rate may have peaked in November. The overnight target rate is 10.5% and the swaps market shows a peak rate between 10.75% and 11.00%. Today, Brazil reports IPCA inflation for December. The year-over-year pace is expected (median, Bloomberg survey) to ease to 5.6% from 5.9%. It peaked last April slightly above 12.10%. The Selic rate stands at 13.75%, leaving real rates punishingly high, and among the highest in the world. Still, when the central bank meets on February 1, it is unlikely to cut rates. Indeed, the swaps market is pricing in as much as another 50 bp increase over the next six months. The apparent concern is over the fiscal policy of the new government.

Follow-through Canadian dollar buying after strong employment data at the end of last week, greater confidence that the Bank of Canada will hike later this month, and the initial gains in US equities saw the greenback tumble. It fell to nearly CAD1.3355, its lowest level since late November. It is little changed now in a tight range straddling CAD1.34. Watch US equities for directional cues. Note that the lower Bollinger Band is slightly below CAD1.3400. The greenback slipped below MXN19.10 to reach its lowest level since approaching MXN19.04 in late November. Its lower Bollinger Band is found near MXN19.0775 today. We suspect the US dollar may recover near-term and target the MXN19.15 area. After the weekend riots in the capital, the Brazilian stock market, which has underperformed recently, stabilized, but the currency snapped a three-day advance. The BRL5.20-BRL5.30 range may confine the greenback until a clear picture develops.