The value of the US dollar has returned to prominence this year, reaching near new annual highs.

Since July, the value of the dollar against a basket of foreign currencies (as measured by the US Dollar Index) has increased from 99 to 105.

This means that the greenback is regaining strength after a period of weakness.

The dollar's rise was surprising, considering that many experts had predicted a decline in 2023.

With the U.S. economy uncertain and estimates of possible recessions, the Fed was sure to cut rates in the following year.

However, the currency's rally proved otherwise.

Despite ups and downs, the dollar continues to maintain an upward trend ahead of the December 13 Fed meeting.

Although no further interest rate increase is expected at this meeting, an aggressive approach by Powell is expected in light of the latest statements.

It is expected that the Fed will keep options open for further tightening if necessary and may delay possible interest rate cuts until late 2024.

However, even if rate cuts are made, they are not likely to be significant because of inflation below the 2 percent target.

To understand the recent increases in the dollar and the reasons behind them, it is necessary to look at global economic dynamics.

The global economic situation is currently deeply divided.

As the United States continues to defy pessimistic forecasts and growth in China and Europe falters, the dollar has regained strength, rising sharply against major currencies in the past two months.

In late 2022, most economists predicted that the Federal Reserve would act to prevent a possible recession by reducing interest rates.

However, at the present time there appears to be no threat of recession to the economy.

The latest estimate of U.S. GDP shows that the economy is in excellent condition.

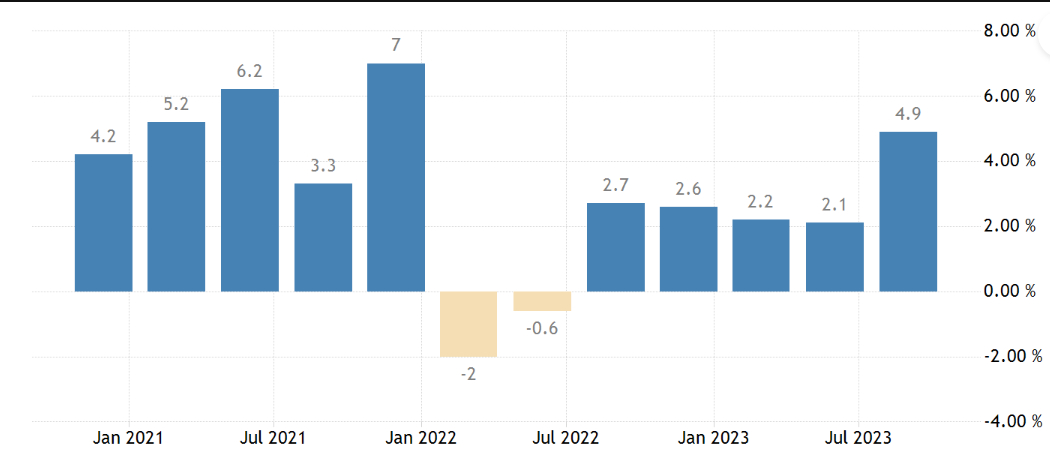

The U.S. economy revitalized in the third quarter of 2023, registering an annual growth rate of 4.9 percent.

This represents the highest growth rate since the fourth quarter of 2021 and exceeds market forecasts that were on 4.3 percent.

A strong dollar is not good news for the United States, as an increase in its valuation could reduce profits earned abroad.

Companies such as Apple (NASDAQ:AAPL) and Walt Disney (NYSE:DIS) Co. have already been affected by this trend in Europe and Asia, with theme park visitors from abroad expected to decline.

Many estimates indicate that even an 8-10 percent increase in the dollar can cause an average 1 percent decline in U.S. companies' profits.

Finally, I anticipate a strong dollar for this quarter and the first quarter of 2024, which is affecting my portfolio choices.

Given my market analysis, I have chosen to avoid U.S. indices such as the Nasdaq and instead focus on Japan's Nikkei index.

Japan's weak currency makes it favorable for my forecast.

The Euro/dollar exchange rate could also be at risk of a retest of the 1.00 level.

In my portfolio, I still have investments in Bitcoin and Bitcoin mining stocks, but I anticipate possible short-term weakness with the negative seasonality for this cryptocurrency.

However, news about an ETF that would allow investors to participate in the Bitcoin market without owning it directly could temporarily support prices.