The Bank of England has already taken action to tighten its monetary policies. The ECB was expected at least to drop some hawkish hints. In practice, the ECB policy statement was more interesting than expected.

Christine Lagarde said the regulator was ready to introduce some changes in its ultra-loose monetary policy. The market anticipated the ECB would announce that monetary tightening would be considered not until the end of the year.

The ECB unveiled a substantial hawkish shift to make first moves even this spring. The ECB President acknowledged high inflation to be the thorny issue that should be solved promptly. Nobody expected this outcome.

No wonder the single European currency rallied in response. Fundamentally, the euro is set to extend its growth until the FOMC policy meeting held in March. So, the euro is beginning a month-long winning streak.

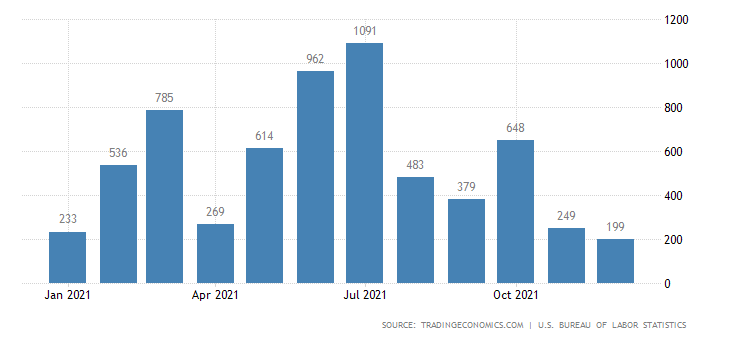

Besides, the US nonfarm payrolls which are due later today, will reinforce the EUR/USD’s bullish trend because the US economy could have added a minor 30K jobs in January, excluding farm employment.

This is a minimal growth that signals increasing unemployment rates. In other words, the situation in the US labor market is getting worse, and that takes the shine off the US dollar.

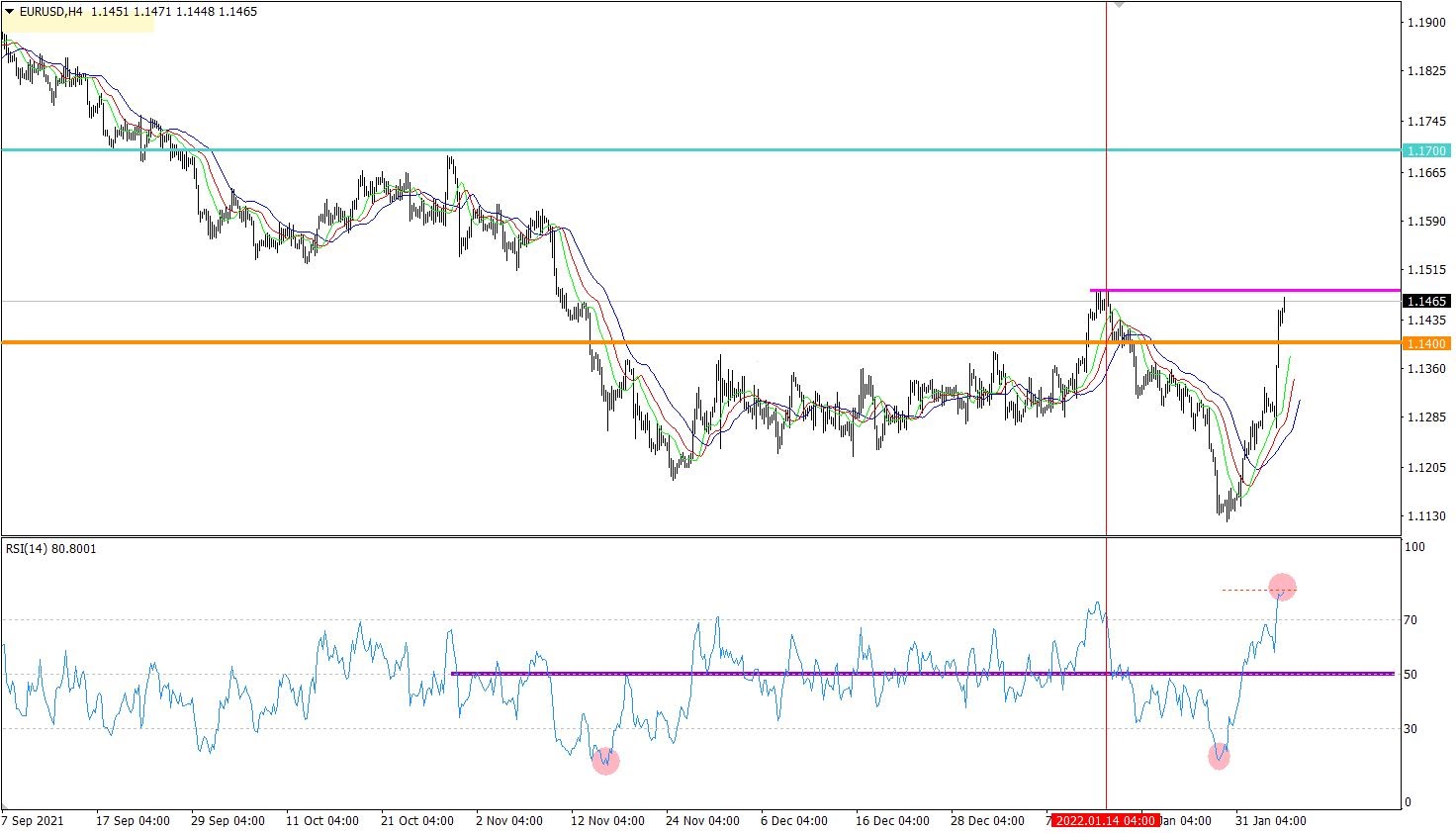

EUR strengthened 200 pips against the US dollar over 24 hours. This triggered an inertial move that smashed important target levels. The underlying reason for such strong price swings is the information noise rather than a technical analysis encouraging speculative activity.

The RSI technical instrument is moving above 81.20 on the 4-hour chart. Such levels have not been seen since June 2019, which proves highly overbought market conditions. So, it could be the right time for a technical correction of EUR/USD.

The Alligator also indicates the upward cycle on the 4-hour chart. At the same time, the Alligator on the daily chart intersects with moving averages. It could signal that traders are revising market sentiment.

On the daily chart, EUR/USD is developing a downward move. So, the common technical correction could turn out into a full-fledged downtrend, provided that some technical conditions are confirmed.

Outlook

The inertial move pushed the price up to the high of Jan. 14. Interestingly, traders did not cut on long positions. It means that speculators are still neglecting signals of technical analysis. To sustain the uptrend of EUR/USD, the price should consolidate above 1.1500. In this case, a long-term correction will be confirmed to attract more speculators.

Notably, any inertial move cannot last for long. Sooner or later, long positions will be overheated, which will create a critical point in the market. Traders will rush to close long positions, thus terminating a downward technical correction.

Complex indicator analysis signals buying the currency pair intraday, in the short- and medium-term amid the ongoing inertial move.