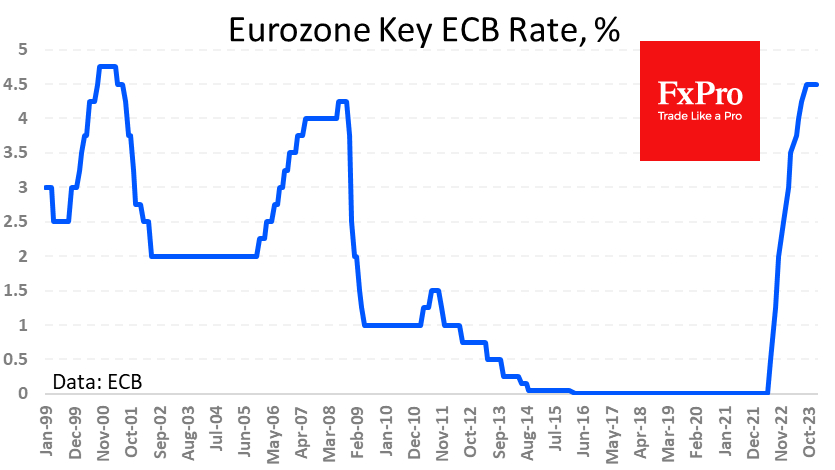

The European Central Bank left monetary policy unchanged, keeping the key rate at 4.5% since September. Much of the focus of the Q&A session revolved around the timing of the first decline, with commentators trying to figure out whether June was indeed the most likely date. Meanwhile, money markets are pricing 0.5 percentage points cut by this date.

At the same time, in an official commentary on the decision, the ECB expressed confidence in the downward trend in inflation, linking the latest acceleration with the base effect and expected changes in Germany’s calculations. Simply put, inflation dynamics are developing in accordance with previously announced forecasts.

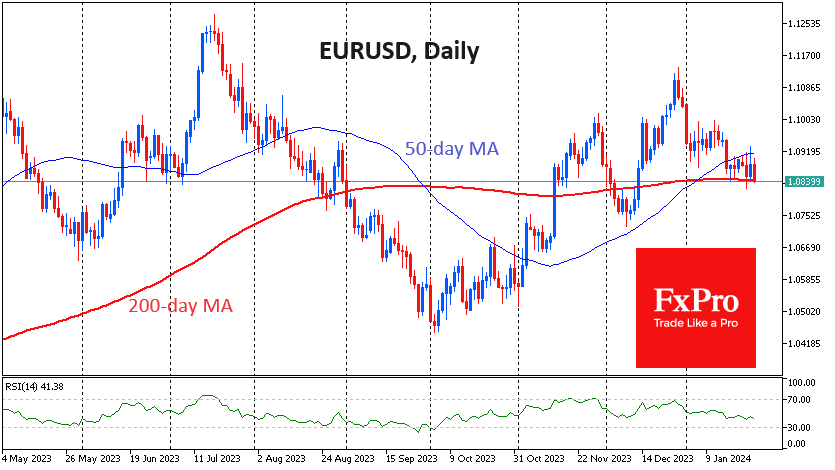

This is moderately bad news for the single currency, which lost up to a third of a per cent against the dollar after the publication of the rate decision. Against the pound, the euro fell for the fifth week in a row, finding itself near the lows of last year. The EURUSD weakening trend continues for the same amount of time.

The single currency's weakness stems from relatively sluggish economic activity, with declining output and stagnant retail sales, contrasting with positive inflation and PMI surprises in the US and UK.

The EURUSD is currently trading near the 1.0850 level, near which the important 200-day moving average is also located. It has been holding back the euro's decline since last Wednesday, and it is worth paying increased attention to whether it will be able to stay above it in the future.

A dip below could intensify the sell-off with immediate targets at 1.07 and further lower towards 1.05. If euro bulls manage to defend important levels against the dollar and pound, a reversal to an upward trend could become a significant medium-term trend.

The FxPro Analyst Team