The ECB confirmed officially its plans to phase out the QE program until the end of 2022. In theory, it should have supported the euro to encourage its growth. In reality, the euro lost its footing in light of the ECB policy meeting.

The thing is that the regulator had to upgrade the basic inflation forecast up to 5.1% for the end of 2022. However, no one doubts that actual inflation will be considerably higher. According to the recent inflation report, consumer prices again jumped in February in the EU. This fact was mentioned in the policy statement by Christine Lagarde.

The ECB President underscored the risks of further inflation acceleration. The regulator will have to fine-tune its stimulus program in this context, though she did not go into details. Perhaps the program might be extended and scaled up with bigger monthly asset purchases.

Christine Lagarde did not say it openly, being aware that it would sharply weaken the single European currency already pinned at lows. Indeed, the hostilities in Ukraine still generate economic risks broadly and for the EU in particular. Christine Lagarde also mentioned it. Besides, she acknowledged that sanctions had already inflicted severe damage to the global trade and financial performance of many European companies.

The US dollar is set to follow the uptrend despite a sharp drop a couple of days ago. So, the single European currency is extending weakness. The speech by Christine Lagarde just smoothed over a sharp fall that comes as no surprise. The tragic events in Ukraine and severe sanctions slapped by the US and its European allies will cause catastrophic economic repercussions. In the face of this challenge, the ECB monetary policy is of no importance. In essence, everything that the regulator can do now is to moderate the euro’s fall from time to time.

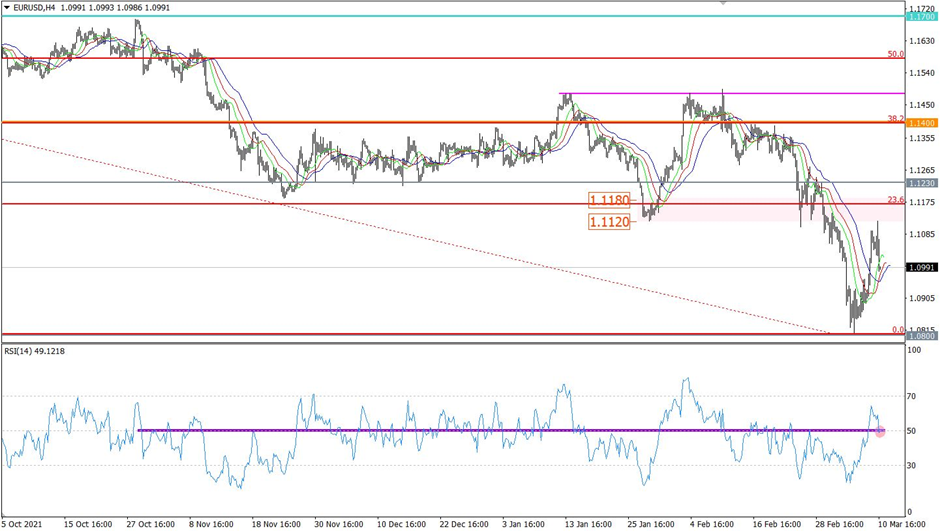

EUR/USD completed a corrective move in the area of the lower border of resistance at 1.1120/1.1180. Traders responded by cutting on long positions. Thus, the price reversed downwards.

On the 4-hour chart, the RSI technical instrument confirms that the correction is over as it is intersected with a 50-period moving average top-down.

The Alligator also intersects moving averages on the 4-hour chart. It indicates a waning correction. On the daily chart, the Alligator signals a downtrend. There is no intersection with moving averages.

Outlook

We suppose that the sellers will have a higher chance of pushing EUR/USD down if the price settles below 1.0990. During the downward move, the price could touch support at 1.0800.

The alternative scenario will come into play if the price rebounds above 1.1030 on the 4-hour chart. In this case, EUR/USD might again climb to the resistance area of 1.1120/1.1180.

Complex indicator analysis suggests a sell signal in the short, medium-term, and intraday on the back of the downward move.