After Fed Chairman Powell came off as extremely hawkish in last week’s FOMC meeting, you would be excused for thinking ECB President Christine Lagarde is dealing with a similar macroeconomic environment on the other side of the Atlantic.

As it stands however, the ECB is unlikely to strike the same hawkish tone and instead will try to walk a tightrope between acknowledging the current price pressures while not giving even a hint of an interest rate hike any time soon.

Our full guide to the European Central Bank.

What to expect from the ECB meeting

As close followers know, the ECB has already laid out its plans to continue asset purchases this year and indicated that an increase in interest rates is highly unlikely in the near term as the Eurozone’s economic recovery continues to lag that of the US and UK.

Despite that warning, markets have started to price in the potential for one interest rate hike from the ECB at the end of the year; we would expect Lagarde and company to push back against that possibility given the central bank’s subdued outlook for medium-term inflation.

Speaking of price pressures, the Eurozone will release its Flash CPI estimate for January on Wednesday, the day before the ECB meeting. With the headline inflation reading expected to moderate from 5.0% last month to 4.4% this month and the “core” (excluding food and energy) measure expected to fall to 1.8% from 2.6% last month, the macroeconomic calendar should provide cover for Lagarde to be flexible, rather than sounding overly concerned about persistent inflation for now.

We also anticipate that the central bank will blame lingering price pressures on supply-side constraints, rather than excess demand that may be influenced by monetary policy. Put simply, the ECB can do little to reduce energy prices, alleviate shipping congestion at ports, or address most of the biggest issues driving prices higher in the current environment.

ECB meeting impact on EUR/USD

When it comes to the world’s most widely-traded currency pair, the ECB meeting is likely to affirm that the gap between monetary policy on the two sides of the Atlantic is wider than the ocean itself.

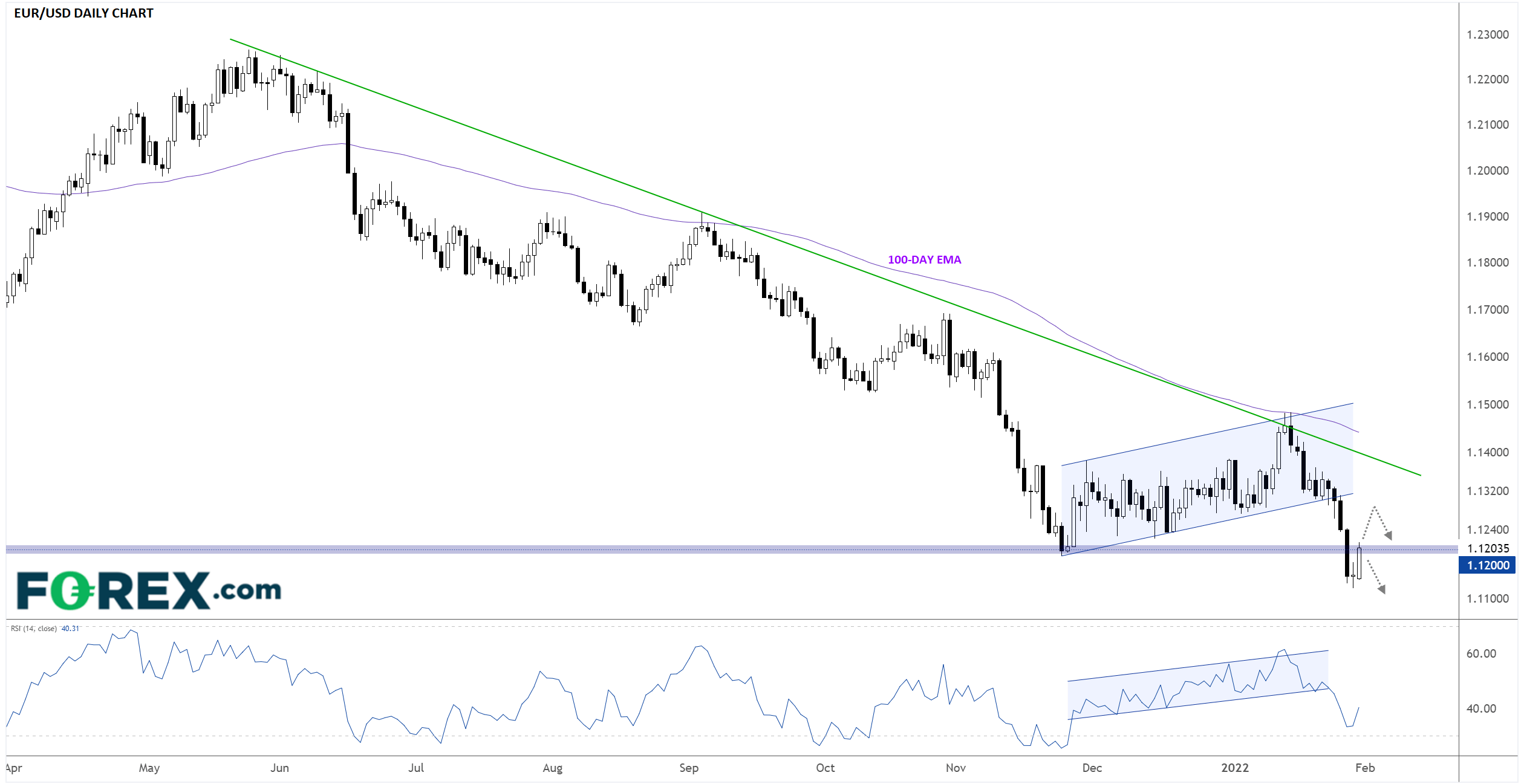

From a technical perspective, EUR/USD broke down from a bearish flag pattern to close last week at a fresh 18-month low in the mid-1.1100s:

Source: StoneX, TradingView

While the pair saw an impressive recovery rally that started yesterday, the medium-term trend on EUR/USD remains clearly to the downside as long as rates remain below bearish trend line resistance and the 100-day EMA near 1.1400.

With the ECB on track to remind traders that it’s far behind the Fed in terms of normalizing monetary policy, EUR/USD may well resume its downtrend by mid-week, with little in the way of meaningful support until down around 1.1000.