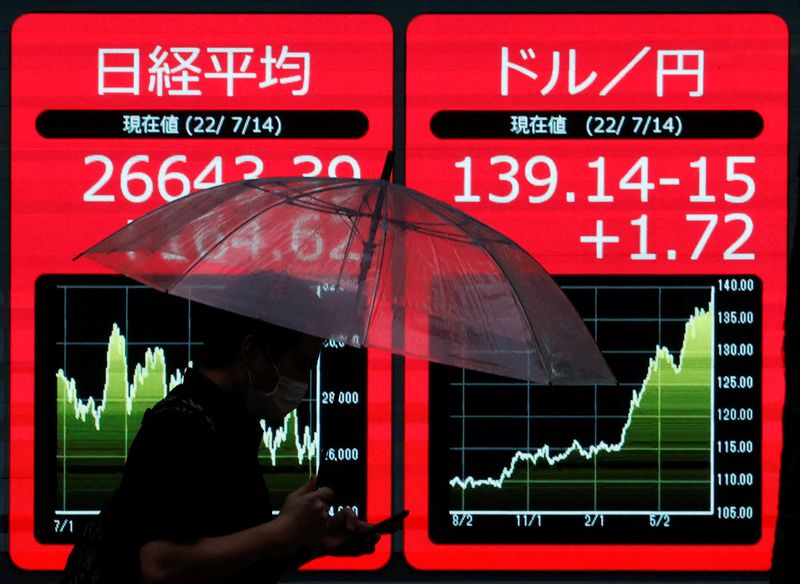

© Reuters. FILE PHOTO: A man holding an umbrella is silhouetted as he walks in front of an electric monitor displaying the Japanese yen exchange rate against the U.S. dollar and Nikkei share average in Tokyo, Japan July 14, 2022 REUTERS/Issei Kato

© Reuters. FILE PHOTO: A man holding an umbrella is silhouetted as he walks in front of an electric monitor displaying the Japanese yen exchange rate against the U.S. dollar and Nikkei share average in Tokyo, Japan July 14, 2022 REUTERS/Issei Kato

By Sinéad Carew

NEW YORK (Reuters) - Equity indexes closed lower on Wednesday while U.S. Treasury yields rose as investors eyed 2023 with caution and weighed hopes for an economic boost from China's relaxed COVID-19 restrictions against concerns about rising infections there.

The yield on benchmark U.S. 10-year Treasuries rose for a third straight day, reversing an earlier decline as investors watched China's reopening and also placed bets on the Federal Reserve's future interest rate hiking path.

In currencies, the dollar hit a one-week high against the yen with a boost from rising Treasury yields and sterling lost ground against the greenback after rallying earlier in the day.

The Nasdaq closed down 1.35%, hitting a new bear-market closing low for the technology-heavy index, as investors shied away from growth stocks and riskier bets. Wednesday's loss marked a drop of more than 36% from Nasdaq's November record closing high.

MSCI's broadest index of global stocks was down 0.92% in the third-last trading day of a brutal year for equities. The global index is on course to end 2022 down more than 20%, for its biggest annual decline since 2008 during the financial crisis.

Investors were still digesting China's announcement on Monday of the end to quarantine requirements for inbound travellers on Jan. 8. China's health system has come under heavy stress since Beijing lifted domestic restrictions. But strategists at JP Morgan forecast a "likely infection peak" during the Lunar New Year holiday next month.

Thomas Hayes, chairman of Great Hill Capital LLC in New York, said reopening of the world's second-largest economy should ultimately benefit the U.S. economy.

"The speed at which they have reversed their stance has caught people off guard," he said. "People are skeptical because the last two years have been such a debacle in China."

But Amit Sinha, head of multi-asset strategy at Voya Investment Management, said Wednesday's stock declines stemmed from "noise" such as low liquidity and tax loss harvesting where investors sell money-losing investments.

"Today there's nibbling away at risk and selling for tax loss harvesting purposes," said Sinha. "Markets have been going down for the course of December. There's a negative sentiment and momentum already."

Sinha sees "reasons why people want to sell" with 2023 presenting uncertainties around the Fed's rate hiking path in terms of whether it can control inflation without damaging the economy.

"There's no compelling reason to be on the other side. It exaggerates the price decline," he said.

The Dow Jones Industrial Average fell 365.85 points, or 1.1%, to 32,875.71, the S&P 500 lost 46.03 points, or 1.20%, to 3,783.22 and the Nasdaq Composite dropped 139.94 points, or 1.35%, to 10,213.29, its lowest closing level since July 2020, in the thick of the COVID-19 pandemic.

In Treasuries, benchmark 10-year notes were up 3 basis points at 3.888%, from 3.858% late on Tuesday. The 30-year bond was last up 3.2 basis points to yield 3.9746%, from 3.943%. The 2-year note was last was down 0.9 basis point to yield 4.3594%, from 4.368%.

"If the 10-year gets to 4%, the flood gates are going to open, there will be a lot of buying at that level," said Jay Sommariva, managing partner and chief of asset management at Fort Pitt Capital Group in Pittsburgh.

In foreign exchange markets, the dollar index rose 0.307%, with the euro down 0.28% to $1.0608.

The Japanese yen weakened 0.72% versus the greenback at 134.45 per dollar, while Sterling was last trading at $1.2018, down 0.02% on the day.

Oil prices closed lower but had regained some lost ground by settlement as traders weighed COVID news from China.

U.S. crude settled down 0.07% at $78.96 per barrel while Brent finished at $83.26, down 1.27% on the day.

Gold prices dropped about 1% earlier in the session as higher Treasury yields weighed and after the precious metal reached a six-month peak on Tuesday.

Spot gold dropped 0.5% to $1,804.33 an ounce. U.S. gold futures fell 0.55% to $1,808.80 an ounce.