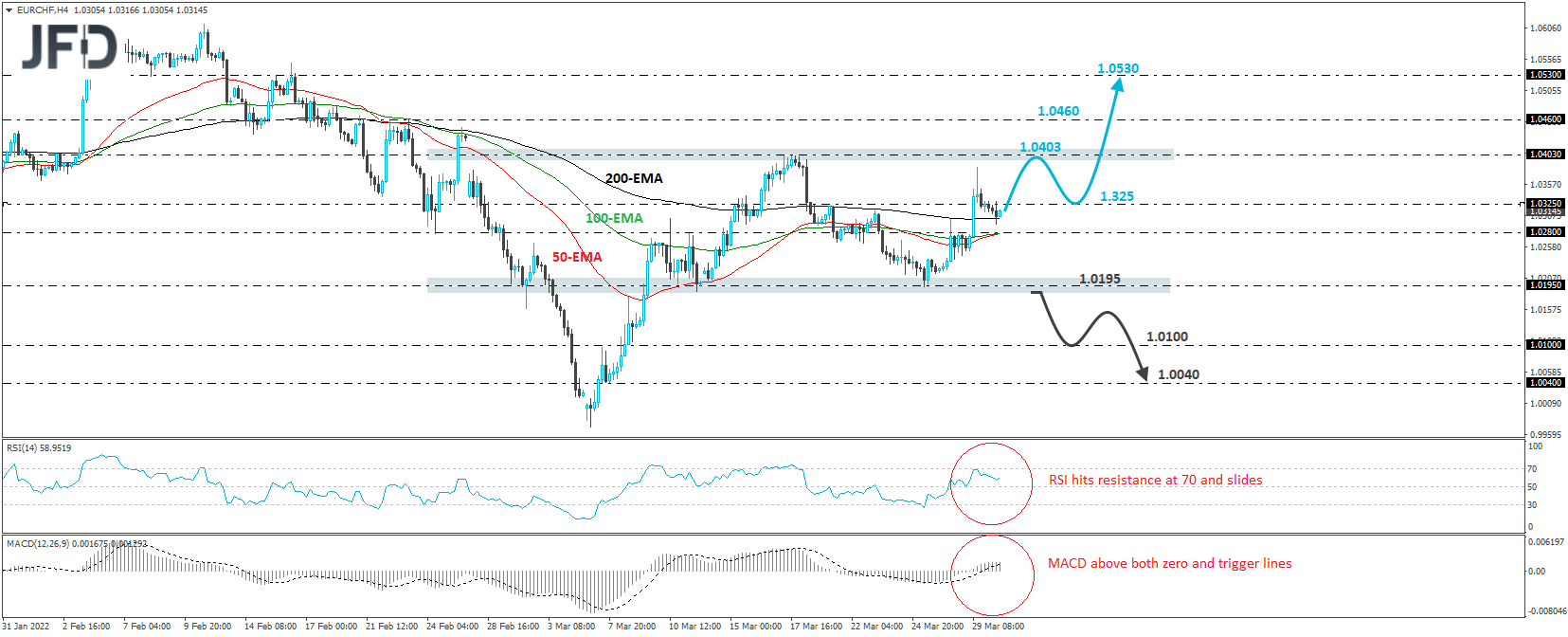

EUR/CHF traded lower yesterday after it hit resistance slightly below the 1.0403 barrier, which has been acting as the upper bound of the trendless range the pair has been trading within since Mar. 9. The lower bound is at around 1.0195, and as long the rate trades between those two bounds, we will hold a neutral stance.

Even if the bulls retake charge and decide to push for another test near 1.0403, we prefer to wait for a break above that zone before getting confident that they are in complete control. This could signal the upside exit out of the range and pave the way towards the 1.0460 zone, marked by the highs of Febr. 22 and 23.

Another break above 1.0460 could signal extensions towards the 1.0530 territory, which was a resistance on Feb. 15 and 16. Shifting attention to our short-term oscillators, the RSI moved lower after hitting resistance at 70. Still, it has ticked up again, while the MACD, although pointing sideways, remains above its zero and trigger lines.

Both indicators point to weak upside momentum, and that’s why we prefer to wait for a break above 1.0403 before we get more optimistic about further advances in this exchange rate. On the downside, we would like to see an apparent dip below 1.0195, the lower end of the aforementioned range, before assuming that the outlook has turned bearish.

This could confirm a forthcoming lower low and may initially pave the way towards the 1.0100 zone, marked by the inside swing high of Mar. 7, the break of which could carry extensions towards an intraday swing low formed that same day, at around 1.0040.