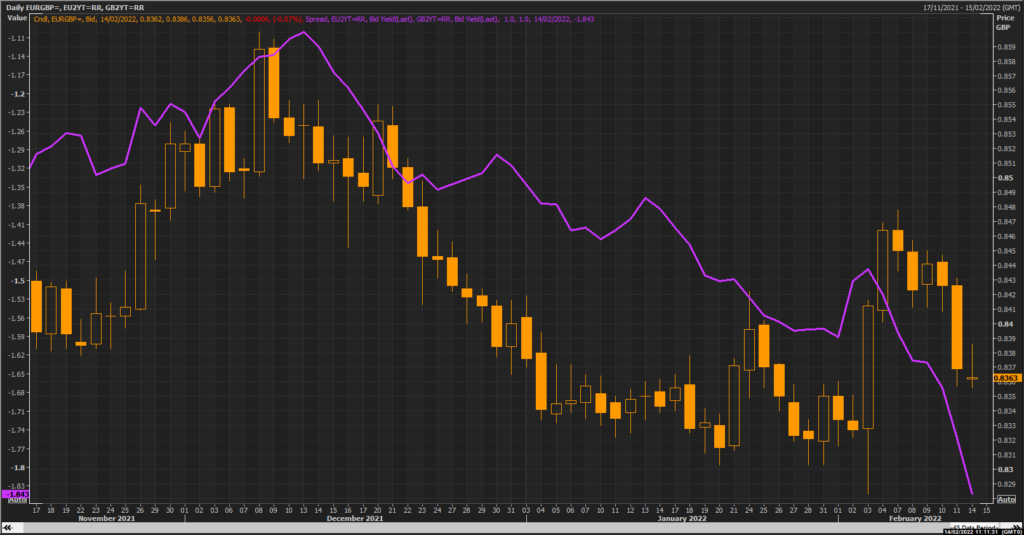

EUR/GBP is in a very precarious place now. Since October last year, the pair, for the most part, has been confined to a wide range between 0.91390 and 0.83079. The rangebound nature of a cross-currency exchange rate like EUR/GBP is expected. But in recent months, the pair has drifted lower, forming a clean downward channel.

Then on Feb. 3, EUR/GBP experienced some aggressive price action. After snapping to a low 0.82852 after the last BoE meeting proved more hawkish than most expected, EUR/GBP quickly shot back up to a high of 0.84169 on more hawkish comments from the ECB meeting.

At that time, this sent a clear sign that even marginally hawkish comments from the ECB trump more tangible action from the BoE. However, in the days after the central bank meetings, the pair has lost much of its ECB gains, in part due to comments from ECB speakers talking down the potential for an earlier than expected interest rise.

Much of the EUR/GBP’s future will depend on UK and euro data, what their respective central bankers have to say and how that shifts relative yields. Tensions in Ukraine are another factor to consider, which could impact the EUR more than GBP. Nevertheless, the technical overlay paints a conflicting message.

On the one hand, the long-term rectangular range implies that EUR/USD should experience a continuation of the upward trend between November 2015 and October 2016. Likewise, we haven’t seen the upper band of trend channel support tested three times, which would give greater confidence of a larger move downwards at this juncture. EUR/GBP could quickly bounce back to the middle of its long-term range.

On the other hand, EUR/GBP’s current position is nevertheless telling. If we see EUR/USD break to the downside, it would potentially represent a significant revaluation. The size of the rectangular range of EUR/GBP has been sizable at 0.08271, which could be the potential losses it faces. Where that to be the case, EUR/USD could fall to a low of 0.74808, should April 2016’s resistance area of 0.80987 fail to turn to support.