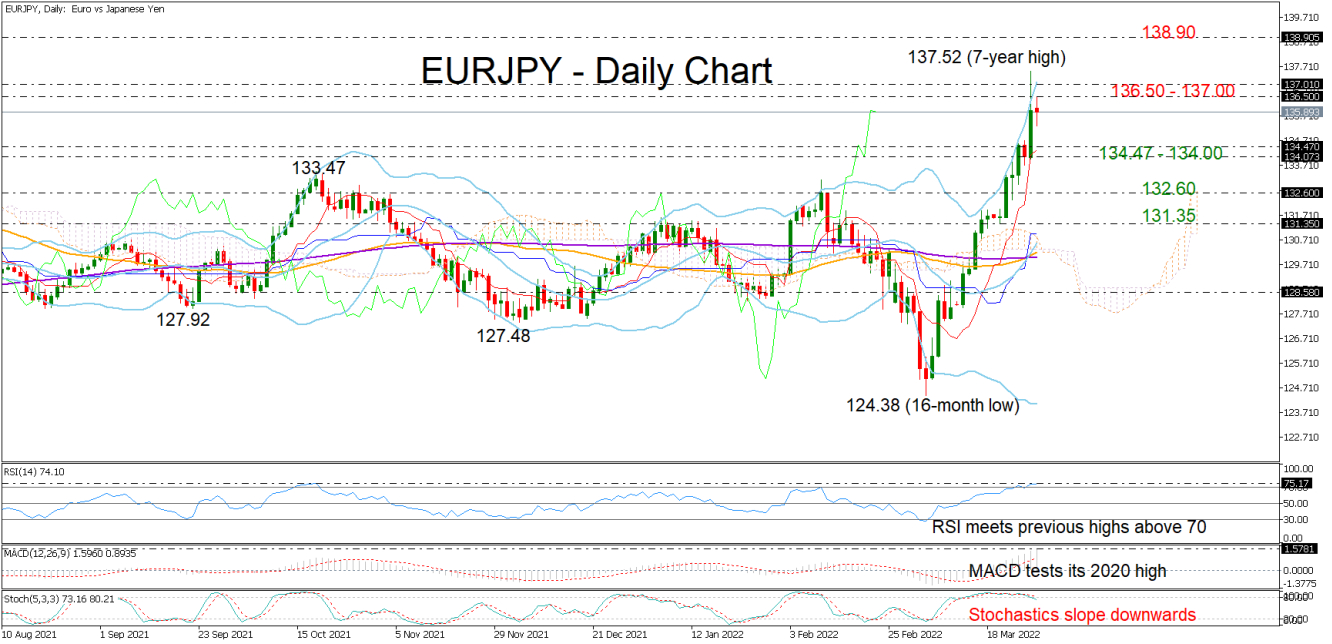

EURJPY pulled back to close at 135.93 on Monday after its aggressive rally topped at an almost seven-year high of 137.52 on Monday.

The price is trying to regain some ground today, but the 2018 resistance of 136.50 – 137.00 is keeping the bulls under control as the widened Bollinger bands foresee some stabilization in the short term. The fact that the Stochastics are sloping downwards to exit the overbought area, the RSI is very close to its October peak, and the MACD is testing its 2020 highs, is also endorsing weaker price momentum in the coming sessions.

Should selling pressures intensify, traders could initially seek support within the 134.47 – 134.00 territory. A break below that base and a step beneath 133.47 would downgrade the bullish long-term outlook back to neutral, likely triggering a sharper decline towards the 132.60 level. Moving lower, the bears may take a rest around 131.35.

In the positive scenario, where the price crawls back above the 136.50 – 137.00 wall, the bulls may attempt to pierce the 137.50 high and reach the 138.90 resistance from August 2015. The next target could be the 140.65 hurdle from June 2015.

Summarizing, the technical picture for EURJPY hints at a potential slowdown, though if the bulls manage to claim the 136.50 – 137.00 region, the pair may chart new higher highs.