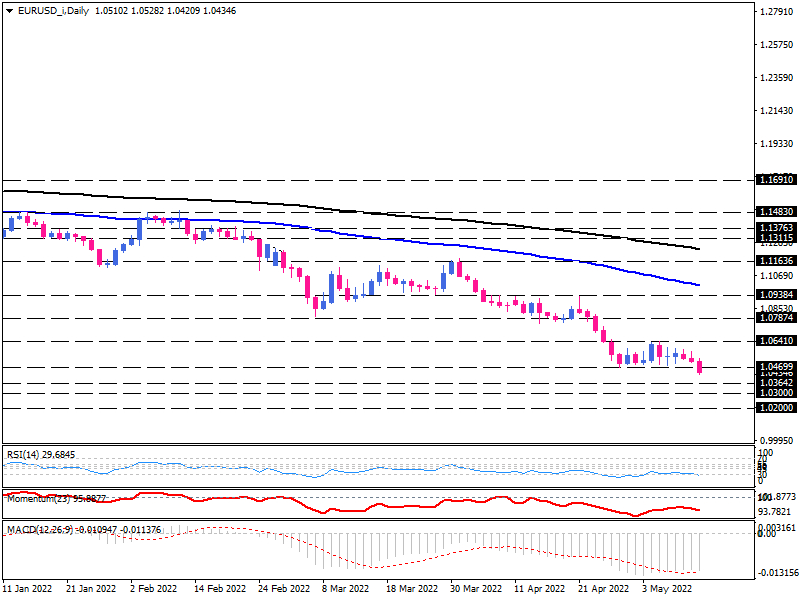

EUR/USD is dropping for the sixth week in a row. It resumed its downward trend on the daily chart by breaking through its two-week low.

The common currency, trading in the range of 1.06410 and 1.04699 since Apr. 28, broke its support level in Thursday's trading session. High inflation in the United States has paved the way for Federal Reserve's tightening policies, resulting in a stronger US dollar.

According to Wednesday's inflation report, the consumer price index increased to 8.3% in April, higher than the expected 8.1%. Meanwhile, the war in Eastern Europe goes on, and the economy of the Green Continent continues to deteriorate due to concerns about natural gas' supply.

A recession worry also prevents the European Central Bank from tightening policies as aggressive as its counterpart in the US. The divergence between central banks' monetary policies plays a significant role in keeping the euro's outlook against the US dollar dim.

While speculation of a rate hike by 50 to 75 basis points has increased on the Federal Reserve Monitor tool, the European Central Bank has not yet decided to raise rates.

If sellers continue to dominate the market, breaking the support of 1.04699 can lead to a further decline towards the 1.03642 mark. If fundamentals continue to be a headwind and sellers overcome this obstacle, the following price stop could be estimated at around 1.03.

Alternatively, a change in the European Central Bank's policies or the fading shadow of war over Europe's economy could prompt buyers to accept the euro again. In that case, the price could reach its two-week high of 1.06410. The breaking of this barrier could signal a trend reversal.

Short-term momentum oscillators support the bearish bias. The RSI is moving in the selling area on the verge of the 30 level, indicating about 2.5 times more selling forces. Momentum is also falling below the 100 threshold. Moreover, the MACD bars are also in the selling area, dipping towards the signal line.