- ECB rate decision expected to be a close call

- US to release retail sales and producer prices

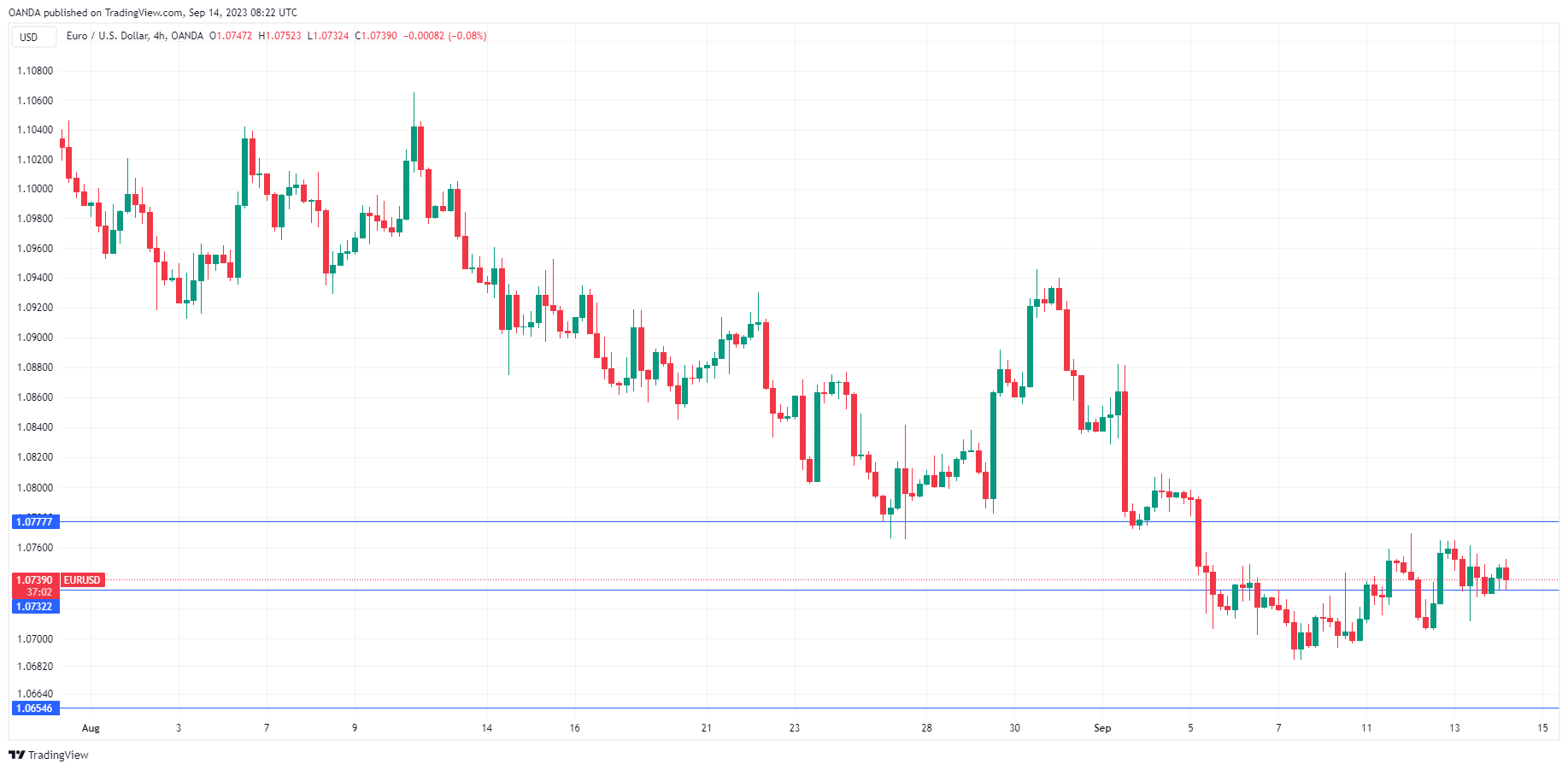

The euro is showing limited movement on Thursday, ahead of today’s ECB rate decision. In the European session, EUR/USD is trading at 1.0736, down 0.06%.

Will She or Won’t She?

All eyes are on ECB President Christine Lagarde, who will decide whether the ECB will increase rates by a quarter-point or hold off and take a pause after nine straight increases. Interest rate futures have priced in a hike at 65% but there is a lot of uncertainty among economists and the decision is expected to be a close call, as the Governing Council appears split on the issue. There are strong arguments on both sides, and Lagarde could end up with a type of compromise that ends up being a ‘hawkish hold’ or a ‘dovish hike’. The latest development was a report in Reuters on Wednesday that the ECB inflation forecasts will be increased at today’s meeting, which raised expectations for a hike.

Traders should be prepared for volatility from the euro after the decision, which is a binary risk event for the euro. A rate hike would likely boost the euro while a hold could weigh on the currency. Still, any swings in EUR/USD could be immediate and short-lived. The markets will be paying close attention to the policy statement and whether the Governing Council decision was a close call.

It’s a busy day in the US as well, with the release of retail sales and producer prices for August. Retail sales are expected to ease to 0.2% m/m, down from 0.7% m/m, while PPI is forecast to rise to 1.2% y/y, up from 0.8% m/m. The releases could trigger volatility from EUR/USD in the North American session.

The US inflation report on Wednesday was a mix, as headline inflation rose in August from 3.2% to 3.7%, while core CPI eased to 4.3%, down from 4.7%. The jump in headline inflation may have attracted media attention, but the Fed will be pleased with the drop in core CPI, which is a better gauge of underlying inflation. The inflation report has cemented a pause at next week’s meeting, with the future markets pricing in a pause at 97%, up from 93% prior to the inflation release.

EUR/USD Technical

- EUR/USD is testing resistance at 1.0732. Above, there is resistance at 1.0777

- There is support at 1.0654 and 1.060