After a dreadful showing on Tuesday, the EUR/USD has rebounded today. In the European session, the euro is trading at 1.0618, up 0.66%.

Investors eye German CPI

German CPI was lower than expected in December. CPI slowed to 9.6%, down sharply from 11.3% in November and below the consensus of 10.7%. This marked the first time that German inflation has fallen into single digits since the summer. Spanish inflation, released last week, also slowed in December. The next test is the release of eurozone inflation on Friday. Inflation is expected to fall to 9.7%, down from November’s 10.1%.

The drop in German inflation is welcome news, but two caveats are in order. First, the German government enacted a price cap for electricity and gas in December, which meant that energy inflation slowed in December. However, services inflation, which is a more accurate gauge of price pressures, rose to 3.9% in December, up from 3.6% a month earlier. Second, inflation remains at unacceptably high levels. Germany’s annual inflation in 2022 hit 7.9%, its highest level since 1951.

If eurozone inflation follows the German lead and heads lower, can we say that inflation has peaked? Some investors may think so, but I wouldn’t expect ECB policymakers to banter around the “P” word. The central bank reacted very slowly to the surge in inflation and has been playing catch-up as it tightens policy. Lagarde & Co. will therefore be very cautious before declaring victory over inflation. If eurozone inflation drops significantly in the upcoming release, it will provide some relief for the ECB in its battle with inflation. The ECB has adopted a hawkish stance, and the markets are still expecting a 50-bp hike at the February 2nd meeting.

In the US, the markets are back in full swing after the holidays. Today’s key events are ISM Manufacturing PMI and the minutes from the Fed’s December meeting. In October, the PMI contracted for the first time since May 2020, with a reading of 49.0 (the 50.0 threshold separates contraction from expansion). Another weak reading is expected, with a forecast of 48.5 points. The Fed minutes will make for interesting reading, providing details about the Fed’s commitment to continue raising rates, which surprised the markets and sent the US dollar sharply higher.

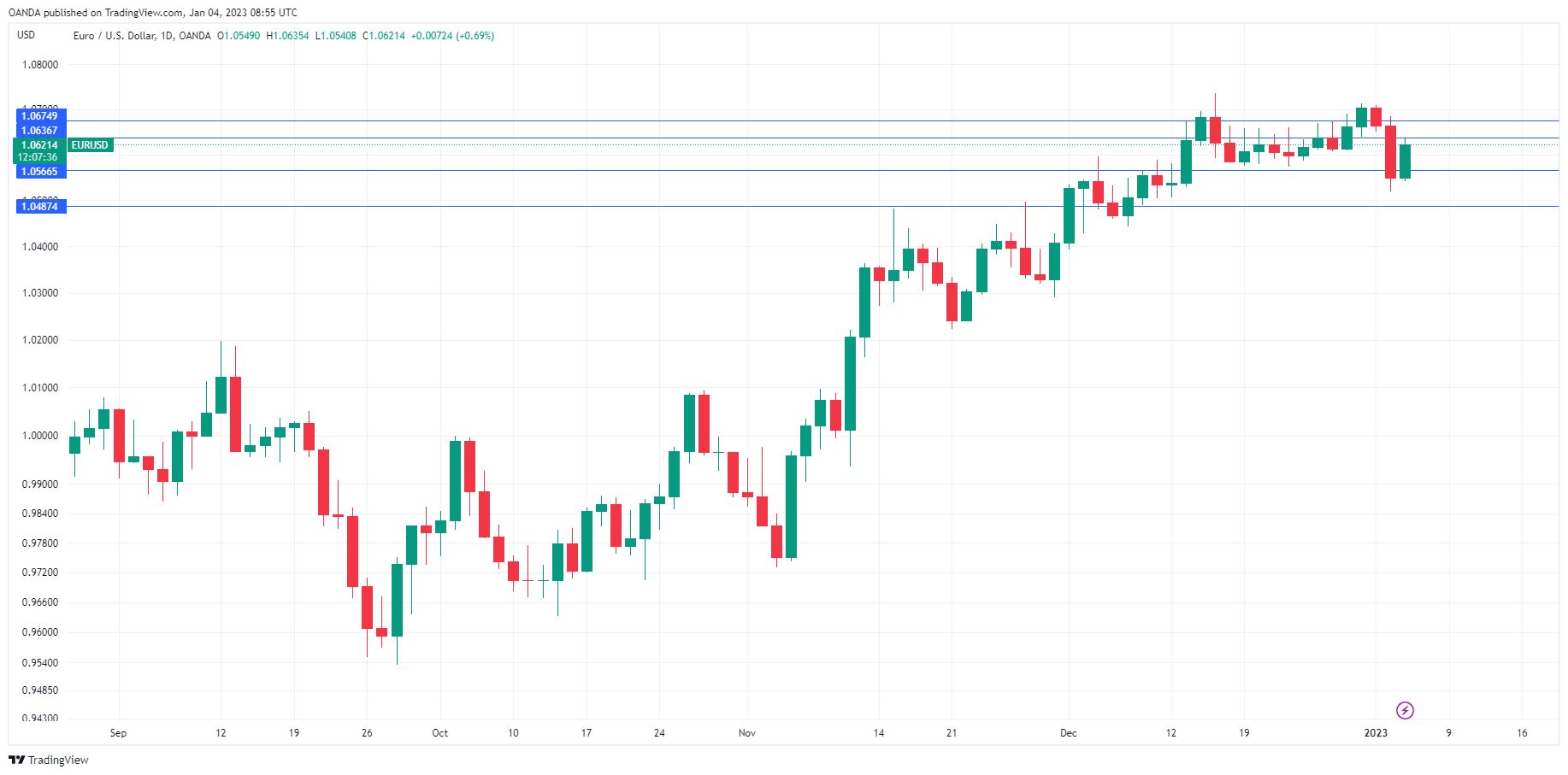

EUR/USD Technical

- EUR/USD is putting pressure on resistance at 1.0636. Next, there is resistance at 1.0674

- There is support at 1.0566 and 1.0487