- German inflation declines

- German Sentix economic index slows

- Fed members Bowman and Williams send hawkish message to markets

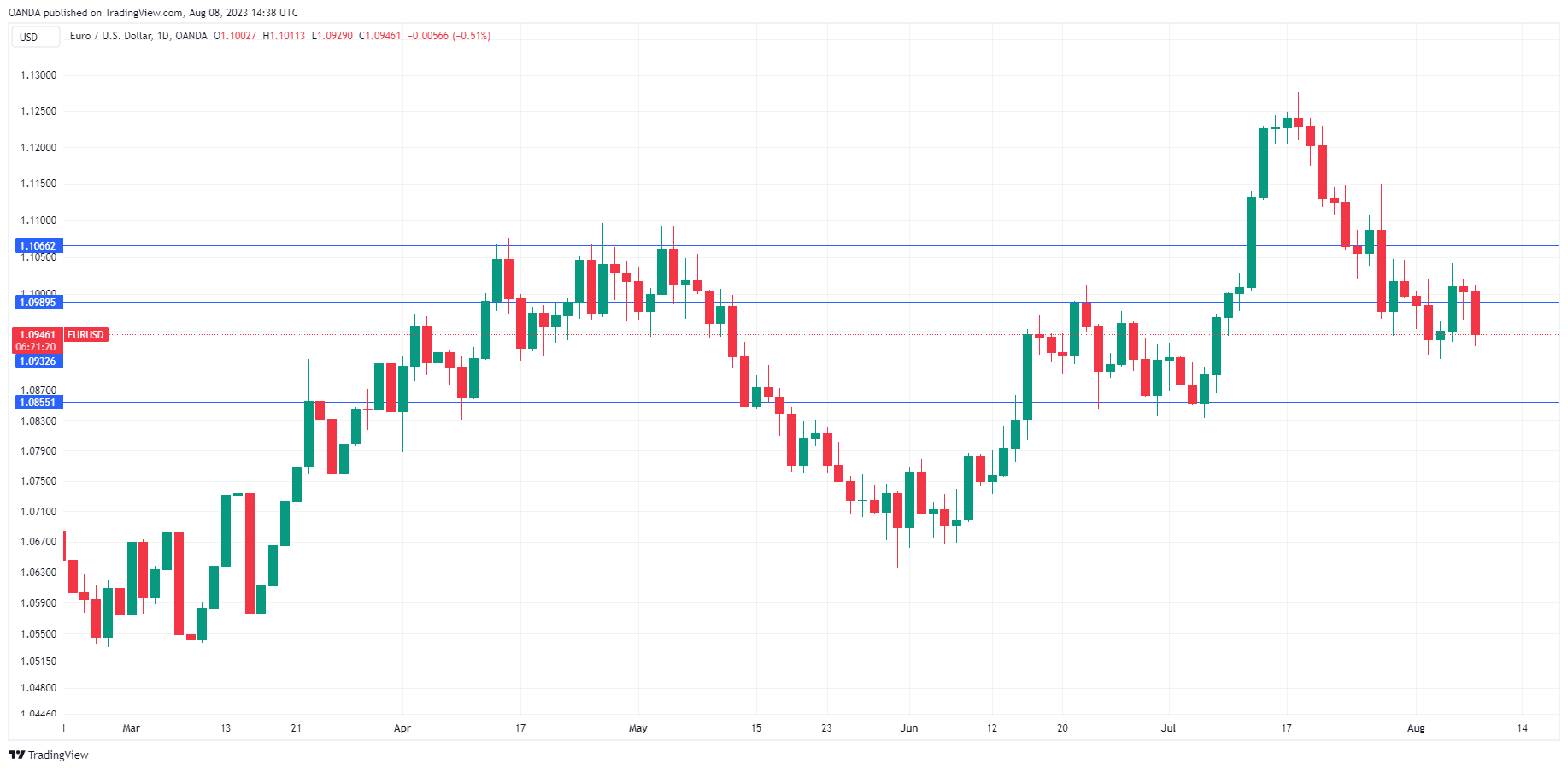

The Euro has fallen below the symbolic 1.10 level on Tuesday. In the European session, EUR/USD is trading at 1.0944, down 0.53%.

German inflation decelerates in July

Germany’s inflation rate for July was 6.2% y/y, confirming the preliminary reading in June. This matched the consensus estimate of 6.2% and was below the consensus estimate of 6.4%. The drivers of inflation were the usual suspects, food and energy. The core rate eased to 5.5%, down from 5.8%.

Germany, once the powerful locomotive which led the eurozone, is struggling. Germany’s economy contracted in the second quarter, the only G7 member to show negative growth in Q2. The week started on a negative note, as industrial production declined by 1.5% in June, below the May reading of -0.5% and the consensus estimate of a downwardly revised -0.1% in May.

Investors remain pessimistic about the eurozone economy. The Sentix economic index for the eurozone improved slightly to -18.9 in August, up from -22.5 in July. However, the index for Germany fell to -30.7, down from -23.4 points. The Sentix report had a blunt assessment, stating that “the largest economy in the eurozone is becoming the sick man of the eurozone”.

The Federal Reserve continues to send a hawkish message to the markets, which has helped boost the US Dollar. Fed member Bowman said on Friday that the Fed might have to deliver “additional rate increases” in order to bring inflation back down to 2%. This would put her at odds with the money markets, which have priced in a pause in September and are looking ahead to rate cuts early next year. On Monday, FOMC member Williams said that he expects that the Fed will need to keep a restrictive stance “for some time”, dependent on the data.

EUR/USD Technical

- EUR/USD tested support at 1.0932 earlier. Below, there is support at 1.0855

- There is resistance at 1.0989 and 1.1066