- Eurozone inflation falls to 2.4%

- US ISM Manufacturing PMI expected to improve to 47.6

- Fed Chair Powell will deliver remarks in Atlanta

The euro is showing limited movement on Friday. In the European session, EUR/USD is trading at 1.0897, up 0.09%.

Eurozone inflation falls more than expected

Eurozone inflation has been falling and the November report brought good tidings. Headline inflation eased to 2.4% y/y, down from 2.9% in October and below the market consensus of 2.7%. A sharp drop in energy prices was a key driver in the significant decline. Core inflation, which is running higher than the headline figure, dropped to 3.6%, down from 4.2% in October and below the market consensus of 3.9%.

The soft inflation report sent EUR/USD lower by 0.74% on Thursday, but ECB policymakers are no doubt pleased by the release, as it indicates that the central bank’s aggressive tightening continues to curb inflation. Headline CPI has dropped to its lowest level since July 2021 and is closing in on the 2% inflation target. Still, core CPI, which excludes food and energy and is a better gauge of inflation trends, will need to come down significantly before the ECB can claim that the battle against inflation is over.

The ECB has signaled a ‘higher-for-longer policy’, and hasn’t given any indications that it plans to cut rates anytime soon. This has resulted in a significant disconnect with the financial markets, as traders believe that the ECB will have to respond to falling inflation and weak growth by trimming rates. The markets have brought forward expectations of a rate cut to April due to the soft inflation report. Just one month ago, the markets had priced in an initial rate cut in July. It will be interesting to see if ECB President Lagarde clings to the higher-for-longer stance or will she acknowledges the possibility of rate cuts in 2024.

The US wraps up the week with the ISM Manufacturing PMI. The manufacturing sector has been in a prolonged slump and the PMI has indicated contraction for twelve consecutive months. The PMI is expected to improve to 47.6 in November, compared to 46.7 in October. A reading below 50 indicates contraction.

Investors will be listening closely to Jerome Powell’s remarks today, looking for hints about upcoming rate decisions. Powell has stuck to his script of a ‘higher for longer’ rate policy, but the markets have priced in a rate cut in May at 84%.

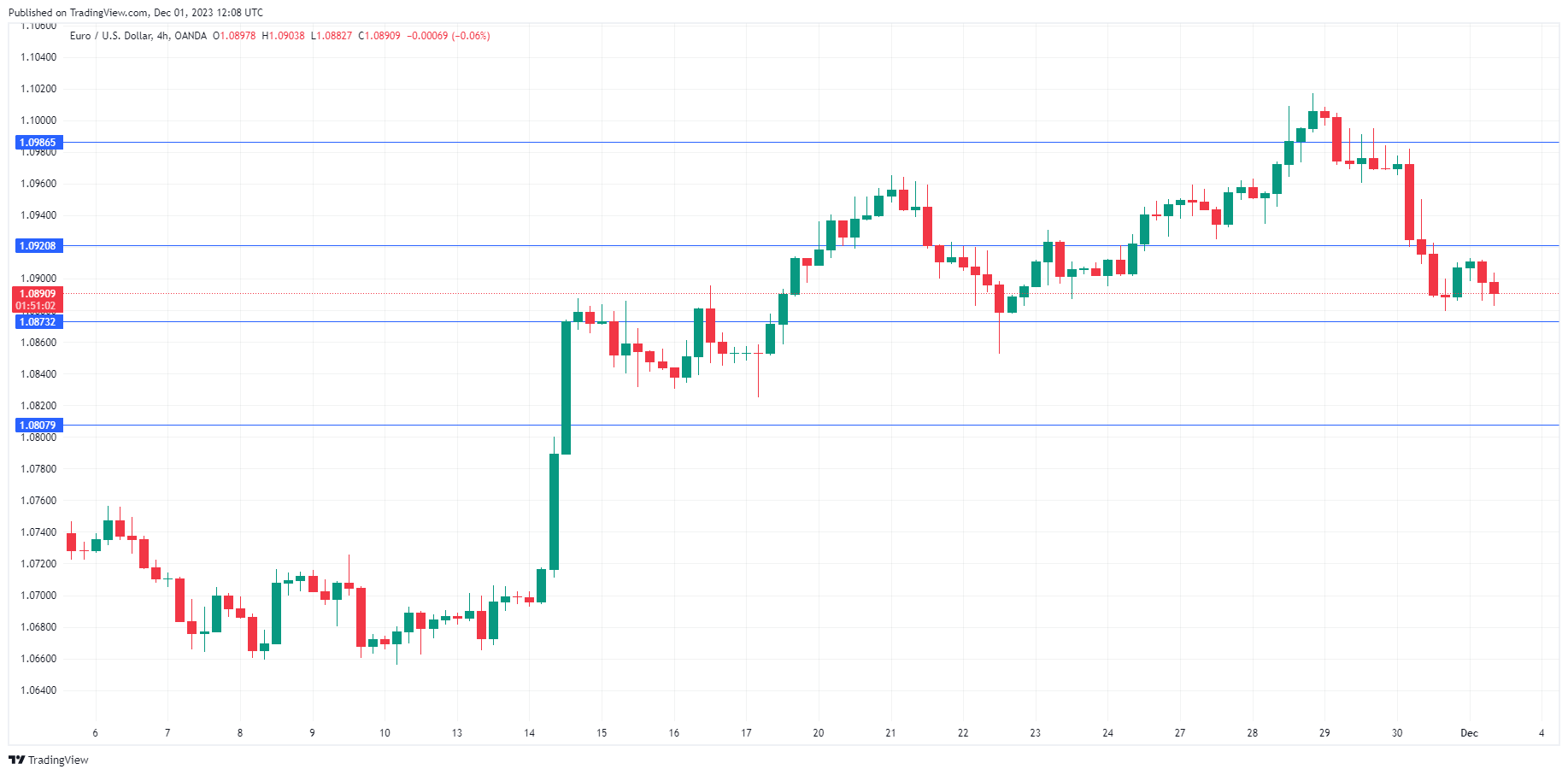

EUR/USD Technical

- There is resistance at 1.0920 and 1.0986

- 1.0873 and 1.0807 are the next support levels