German, Eurozone PMIs show improvement

EUR/USD shows limited movement on Friday, with a muted response to today’s German and eurozone PMIs for December. German manufacturing improved to 47.4, up from 46.1 and above the consensus of 46.1. Eurozone manufacturing rose to 47.8, up from 47.1, which was also the consensus.

There was also an improvement in the services PMIs, although these remain under 50.0, which indicates contraction. The PMIs indicated a shallower downturn in manufacturing and services, with an easing in inflation driving improvement in both sectors.

ECB talks hawkish

Taking a page straight out of the Fed’s book, the ECB eased up at the year's final meeting with a 50-bp increase. This follows two successive 75-bp hikes, bringing its key rate to 2.0%. President Lagarde had a hawkish message for the markets, stating that three more rate increases could be coming. This apparent return to forward guidance is puzzling, as the ECB had previously said rate decisions would be made “meeting-by-meeting” and would be data-dependent.

The ECB remains fixated on inflation. The rate statement said that rates would have to “rise significantly” to tame inflation. The bank revised its inflation forecasts upwards and sees inflation remaining above its 2% target until 2025, with Lagarde warning that inflation could stay high if wage growth is higher than expected. Lagarde echoed the Fed’s Jerome Powell when she said that the lower rate hike was not a pivot and that the ECB was not slowing down.

Eurozone inflation eased to 10.0% in November, down from 10.6% a month earlier, but that was clearly not enough to soften the ECB’s hawkish message. Despite the ECB rate hike and promise of more to come, EUR/USD fell by 0.50% on Thursday, as the hawkish Fed meeting soured risk appetite and boosted the US dollar.

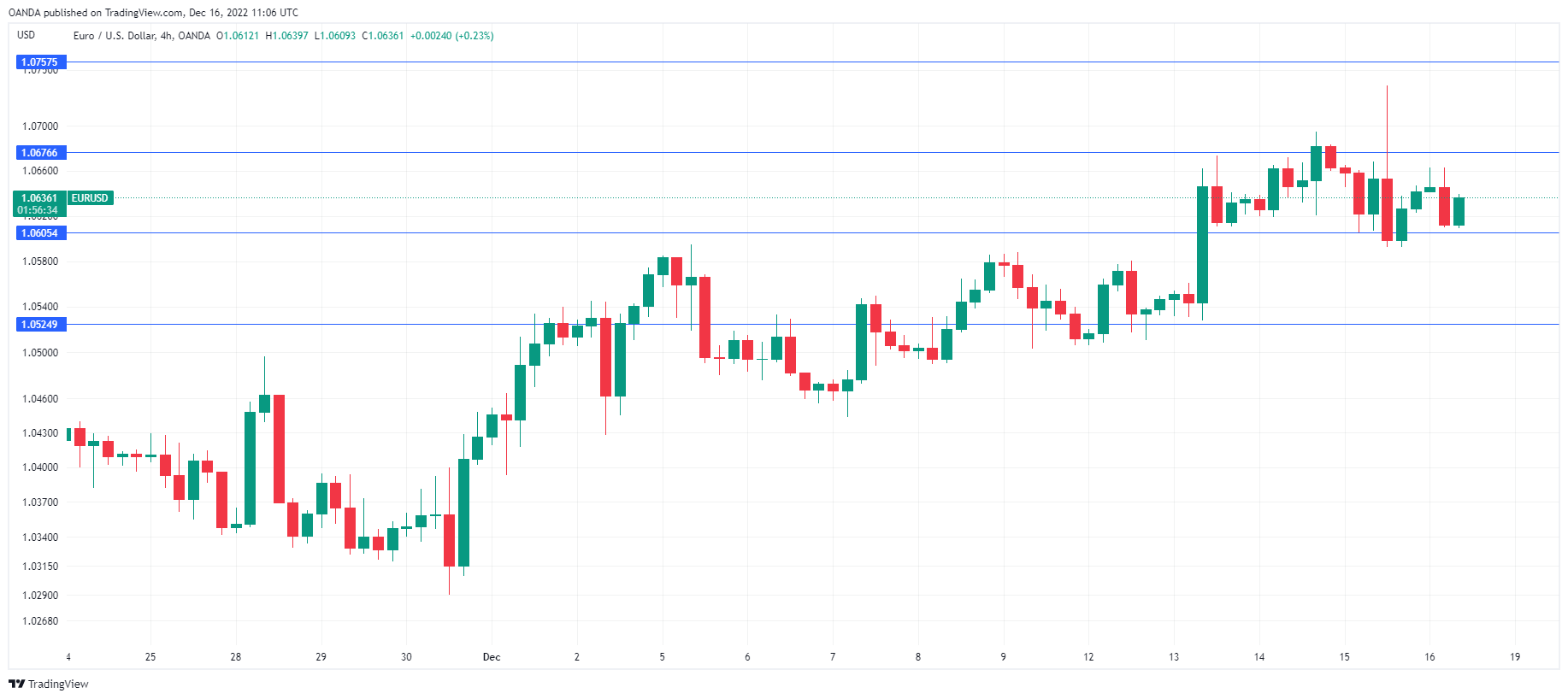

EUR/USD Technical

- There is resistance at 1.0605 and 1.0694

- EUR/USD has support at 1.0524 and 1.0453