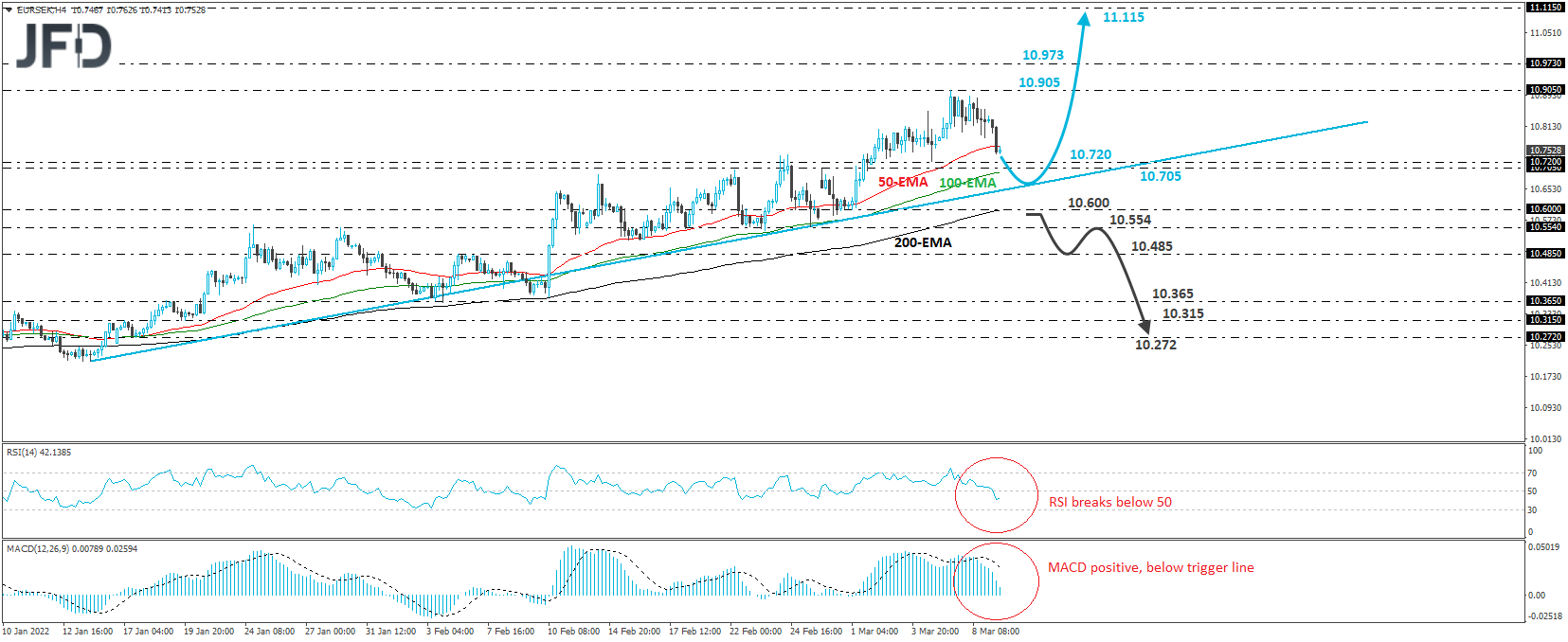

EUR/SEK has been trading lower recently, after it hit resistance at 10.905. However, the rate remains above the upside support line drawn from the low of Jan. 13, and as long as this is the case, we will consider the short-term picture to be positive.

The bulls could take charge again from near the 10.705/20 zone, or even from near the aforementioned upside line, with a potential upcoming recovery having the potential to test again the 10.905 zone. If that zone is not able to hold this time around, a break higher would confirm a forthcoming higher high, and may target the 10.973 barrier, marked by the peaks of Apr. 21 and 22. Another break, above 10.973, could see scope for extensions towards the high of Mar. 30, at 11.115.

Shifting attention to our short-term oscillators, we see that the RSI slid back below 50, while the MACD, although positive, lies below its trigger line and points south. Both indicators add the chances of some further retreat before, and if, the bulls decide to take charge again.

We will start considering the bearish case upon a dip below 10.600, marked by the low of Feb. 28. This will confirm the dip below the aforementioned upside line and may initially target the 10.554 barrier, which provided support between Feb. 22 and 25. If that barrier doesn’t hold, we could see the decline extending towards the 10.485 zone, marked by the inside swing high of Feb. 4, the break of which could carry extensions towards the low of Feb. 3, at 10.365, which also acted as a strong resistance between Nov. 26 and Jan. 6.