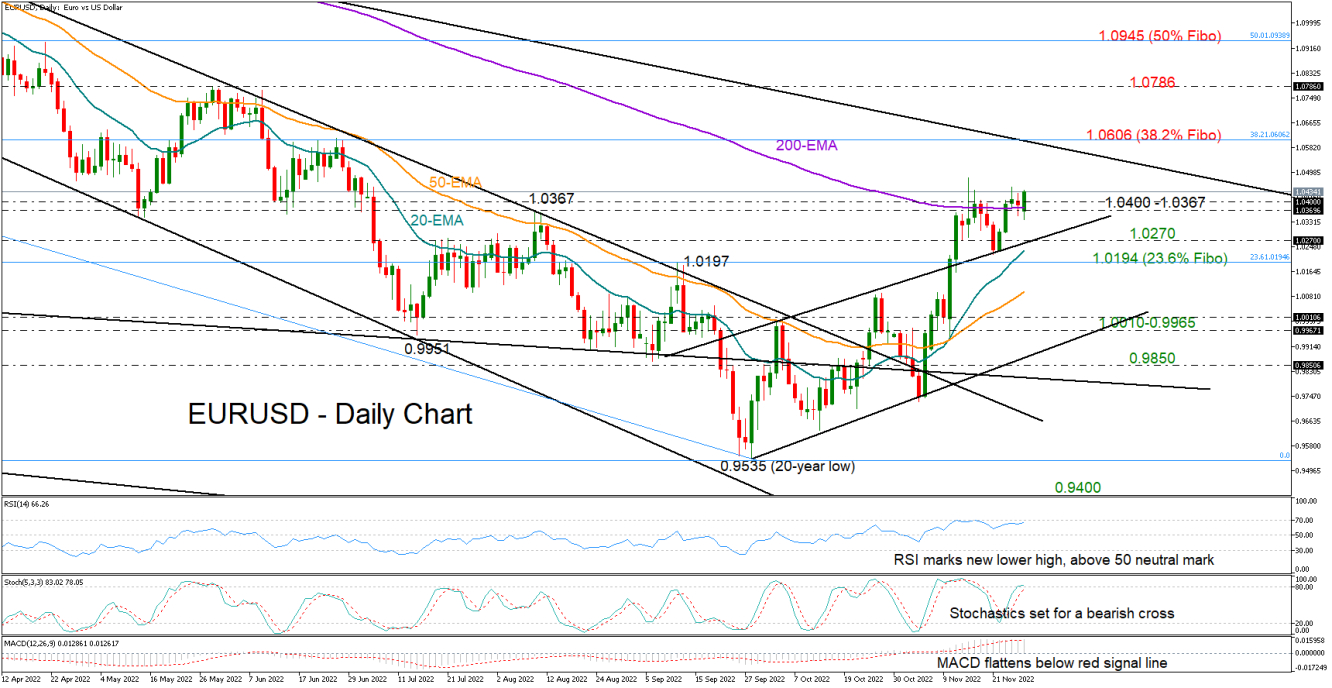

EURUSD opened with a slight negative gap on Monday after getting rejected around the 1.0400 psychological level for the second time last week.

The bulls are currently making another attempt to breach that wall and keep the bullish bias intact above the 200-day exponential moving average (EMA). But the momentum indicators are reflecting some cracks in buying interest. Specifically, the RSI has made a new lower high after peaking near its 70 overbought level, the stochastics are looking to change direction to the downside, while the MACD is flattening marginally below its red signal line, increasing the risk for a downside reversal.

That said, a potential downside correction may not discourage buyers unless the price flips back into the channel at 1.0270 and beneath the 20-day EMA. In this case, the 23.6% Fibonacci retracement of the 1.2348-0.9535 downleg at 1.0194 may immediately attract attention. The 50-day EMA could next come into the spotlight ahead of the 1.0010-0.9965 constraining area, while even lower, all eyes will turn to the channel’s lower band seen around 0.9900.

Alternatively, should the price successfully claim the 1.0400 bar, the recovery is expected to pick up steam towards the tentative long-term descending trendline from May 2021. Note that the 38.2% Fibonacci level of 1.0606 is positioned in the same location. Hence, another victory at this point could bolster buying appetite up to May’s bar of 1.0786. Running higher, the pair may give more credence to the uptrend, if it manages to overcome the 50% Fibonacci of 1.0938 too.

Summarizing, although buying appetite seems to be showing some weakness, traders may keep supporting EURUSD as long as the floor around 1.0270 stays valid.