- Recent turn of events have interrupted the EUR/USD pair's surge, prompting a broad correction

- Fed members have remained cautious in recent speeches, hinting at a potential status quo in interest rates

- As EUR/USD corrects above $1.07, breaking the resistance at 1.0770 is crucial to resume the uptrend

Over the past 8 days, several key factors, from the recent Fed meeting to US economic data and a series of statements by Federal Reserve board members, have halted the EUR/USD pair's resurgence. Currently, the pair finds itself amidst a broad correction, but there's still a possibility that the uptrend could resume.

However, this momentum has somewhat slowed due to cautious statements from Fed officials, suggesting a swift Fed policy pivot is unlikely. Market probabilities indicate the interest rate cut cycle may commence around mid-2024. What's coming into sharper focus now are the GDP readings, revealing the surprising strength of the US economy, a stark contrast to earlier-year predictions of a continuous march towards recession.

Fed Members Maintain Cautious Tone

Fed members have been active this week, sharing insights on the current monetary policy. Michelle Bowman, a prominent hawk, has maintained her stance, emphasizing the necessity to continue the cycle of interest rate hikes. This is despite promising new data in the fight against inflation.

Neel Kashkari of Minneapolis has echoed similar sentiments, highlighting the strength of the U.S. economy and stressing the need for additional Federal Reserve intervention to bring inflation down to the defined 2% target. On a more general note, Austan Goolsbee expressed satisfaction with the Fed's work so far, while Deputy Secretary Christopher Waller conveyed that sustained high economic growth demands increased attention.

Thus, there is a conspicuous lack of dovish phrases, which increases the likelihood of the Fed keeping interest rates at current levels for at least the next six months with the door open for one more hike.

What's Behind the Economy's Strength?

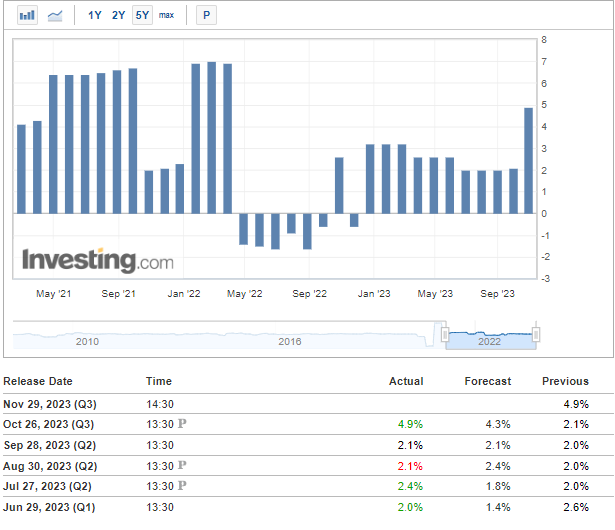

According to the latest readings, GDP from the U.S. economy grew quarter-on-quarter by 4.9%, clearly beating forecasts of 4.3%. At the same time, this is a performance significantly above the average of the last several months and the highest since March 2022.

Despite the preliminary nature of these estimates, a closer look at the GDP data reveals that consumption holds the largest share, with a result of 2.69%. This underscores the robustness of the US consumer, providing a rationale for the Fed to persist with the restrictive monetary policy, trying to curb inflationary pressures from the demand side.

EUR/USD Bulls Struggle to Keep Resurgence Going

Since the start of October, EUR/USD has been undergoing a correction, presently hovering just above the $1.07 per euro mark. The pivotal factor for a sustained upward trajectory lies in breaking through the immediate resistance zone, situated around 1.0770. A successful breakout here would pave the way for an assault on the price range of 1.09.

With the conservative statements of the Fed members in the back of traders' minds, one should also watch for the possibility of the continuation of the downtrend, which would be confirmed by a drop below the local support at 1.05 with a target below the 1.04 level.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.