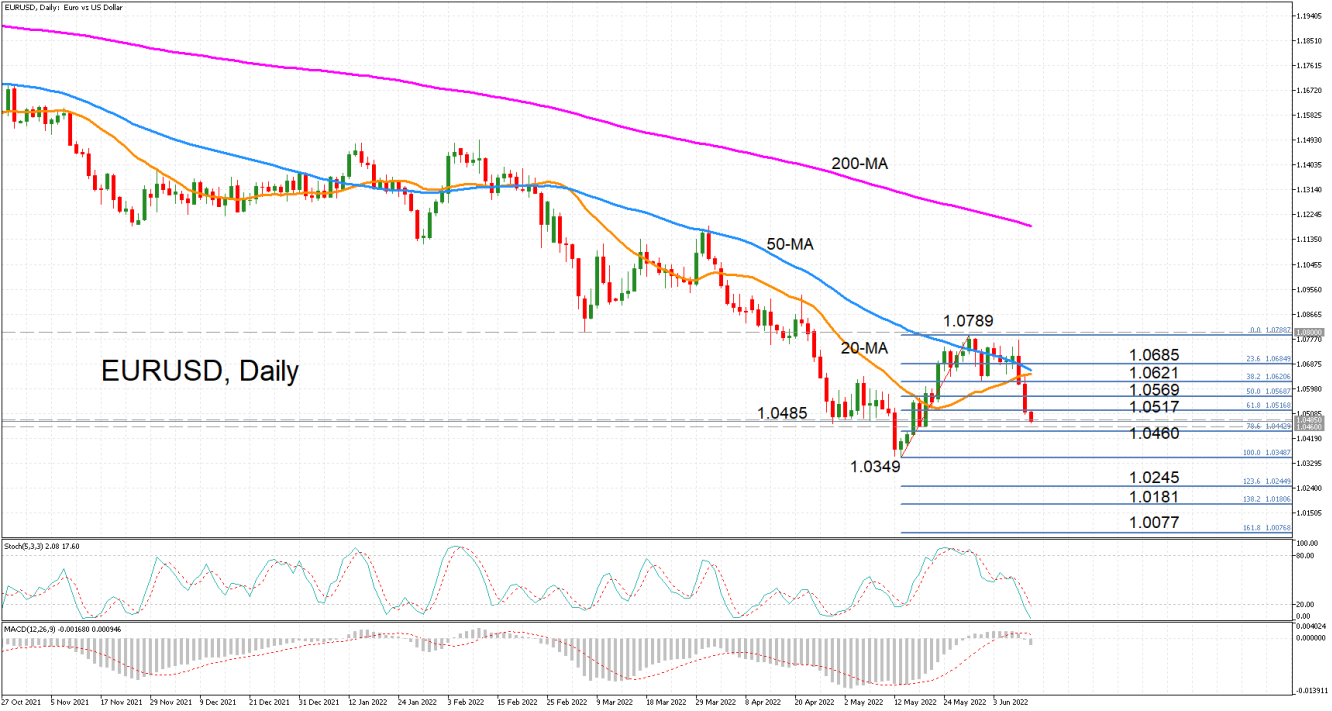

on Monday, dropping below the 1.0485 level, which acted as an important support barrier in late April/early May. The price has currently steadied near this congestion point, but momentum indicators suggest more losses are likely.

The MACD histogram has fallen below zero, increasing its distance below the red signal line, which is also turning southwards. The stochastics are plunging too, but although the %K line is deep in oversold territory and the %D line is about to cross into this zone as well, this could be an indication that a near-term correction is on the cards.

If the selloff pauses for breath, the 61.8% Fibonacci retracement of the May upleg at 1.0517 could act as immediate resistance. Higher up, the 50% Fibonacci of 1.0569 could stall further advances before the price comes into contact with the 20- and 50-day moving averages (MA). The 20-day MA is on the verge of climbing above the 50-day MA, but the bullish cross is unlikely to be completed unless there is a sharp upside reversal in the price.

Still, the area between the 23.6% Fibonacci of 1.0685 and the 38.2% Fibonacci of 1.0621 could be a major obstacle for the bulls. But if successfully overcome, it would clear the path for the 1.08 handle, which lies just above the May peak of 1.0789.

To the downside, the 1.0460 level could block further declines. Failing so would open the way for the May trough of 1.0349, while steeper losses would put the spotlight on the 123.6%, 138.2% and 161.8% Fibonacci extensions of 1.0245, 1.0181 and 1.0077 respectively.

To sum up, falling below the 1.0460 region would reinforce the short- and longer-term bearish picture and increase the prospect of fresh lower lows. But a positive reversal might struggle to reach the 1.08 level, which is needed for a convincing rebound.