- German inflation falls to 3.2%, eurozone inflation next

- US second-estimate GDP improves to 5.2%

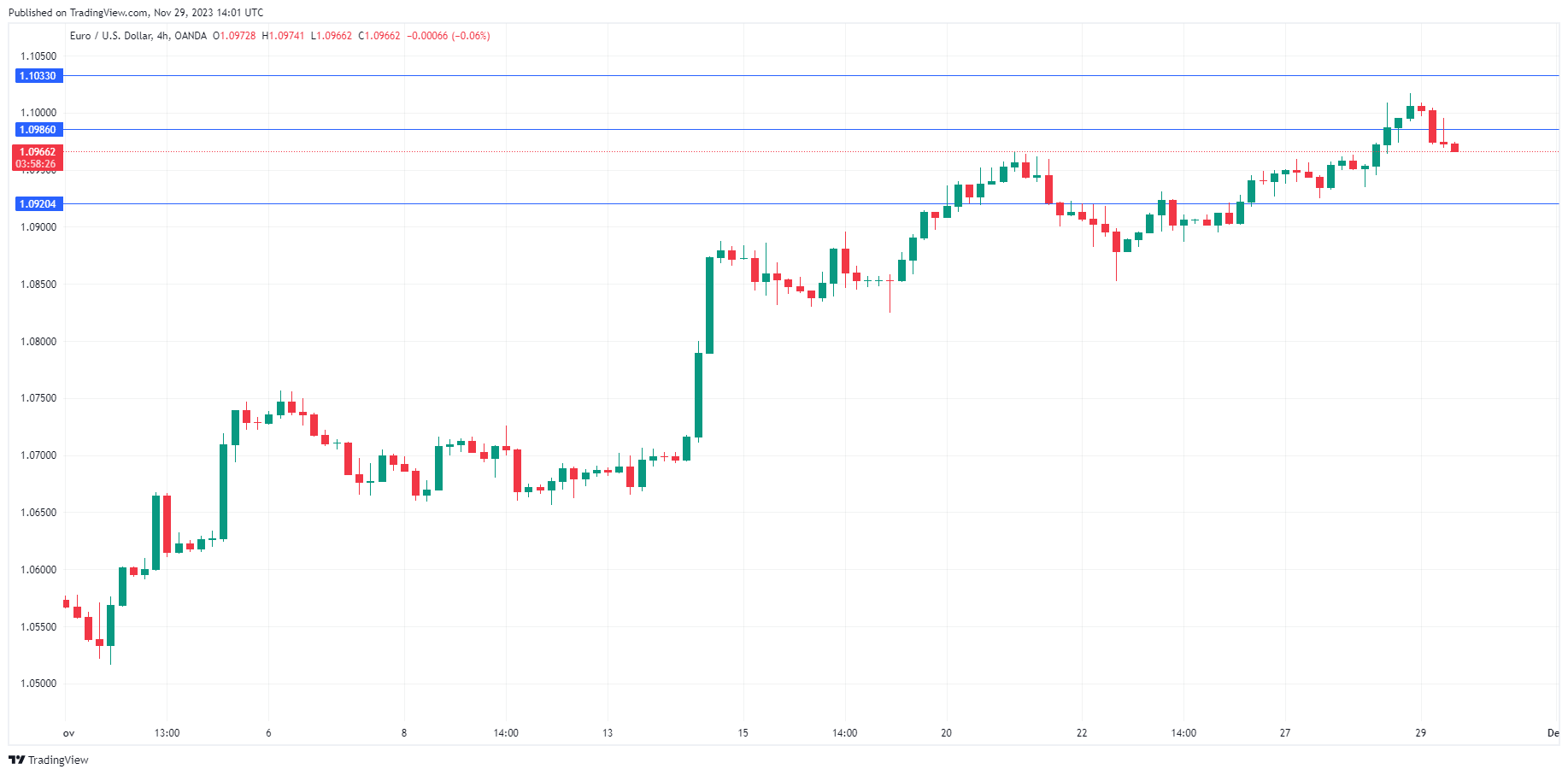

The euro is showing limited movement on Wednesday. In the North American session, EUR/USD is trading at 1.0984, down 0.11%.

German Inflation Falls to 3.2%

Gerrmany’s inflation rate dropped more than expected, coming in at 3.2% y/y in November. This was down considerably from 3.8% in October and below the market consensus of 3.5%. This was the lowest inflation rate since June 2021 and was driven by lower food and energy inflation. Services inflation eased to 3.4%, down from 3.9%. Core inflation dropped to 3.8%, down from 4.3% in October.

There’s a lot to like in this inflation print and ECB policymakers will no doubt be pleased as German inflation continues to fall. The next text is on Thursday, with the release of eurozone inflation for November. Headline inflation is expected to fall to 2.7%, down from 2.9%, and the core is expected to ease to 3.9%, down from 4.2%.

The ECB has signaled a ‘higher for longer policy’, as have the Federal Reserve and other major central banks. Even though inflation has been dropping, it remains higher than the ECB’s 2% target, and the central bank hasn’t given any indications of a rate cut. The markets are more dovish and have priced in a rate cut as early as May. If eurozone CPI follows the German release and declines more than expected, we could see the odds of a rate cut brought forward ahead of May.

The US economy provided another reminder today that the economy is in strong shape. US GDP (second estimate) climbed an impressive 5.2% y/y in the third quarter, the strongest quarter since Q4 2021. The release beat the market consensus of 5.0% and was higher than the preliminary estimate of 4.9%. The economy showed marked improvement compared to the second quarter, which had growth of just 2.1%.

EUR/USD Technical

- EUR/USD is testing support at 1.0986. Below, there is support at 1.0920

- 1.1033 and 1.1099 are providing support