Mixed PMI data from various Euro area countries led to a surge in volatility for European currency pairs on Thursday morning.

Preliminary estimates for France surprised with their strength. The manufacturing PMI jumped from 43.1 to 46.8 (43.5 expected). The services index rose from 45.4 to 48.0 (45.7 expected). These figures came well above expectations, boosting risk appetite and supporting buying in both the single currency and equities.

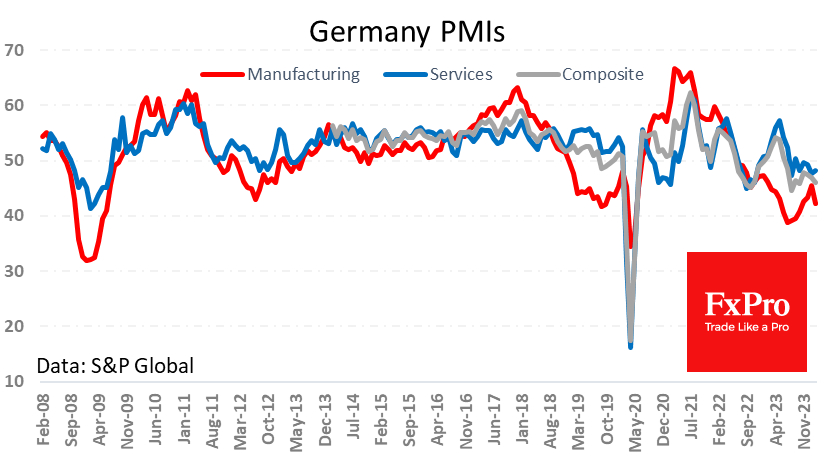

However, the EURUSD's rise to 1.0887 was rudely halted by the release of the exact figures for Germany, where the manufacturing index fell to 42.3 from 45.5 (expected 46.1). The services index rose to 48.2 from 47.7 (48.0 was expected).

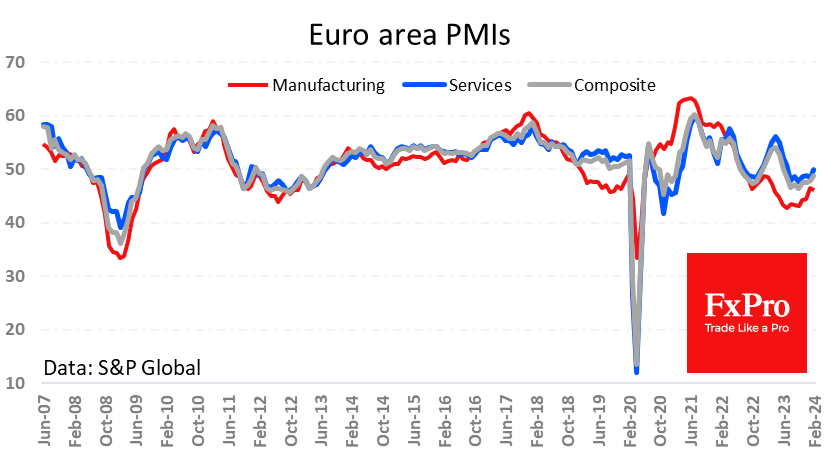

For the euro area, the manufacturing index fell from 46.6 to 46.1, against expectations for a rise to 47.0. The services sector reached the critical milestone of 50.0. Readings below this level indicate a month-on-month contraction, and the overall composite PMI for the euro area remained in contractionary territory for the seventh consecutive month. However, it has risen to 48.9, the highest level since June last year.

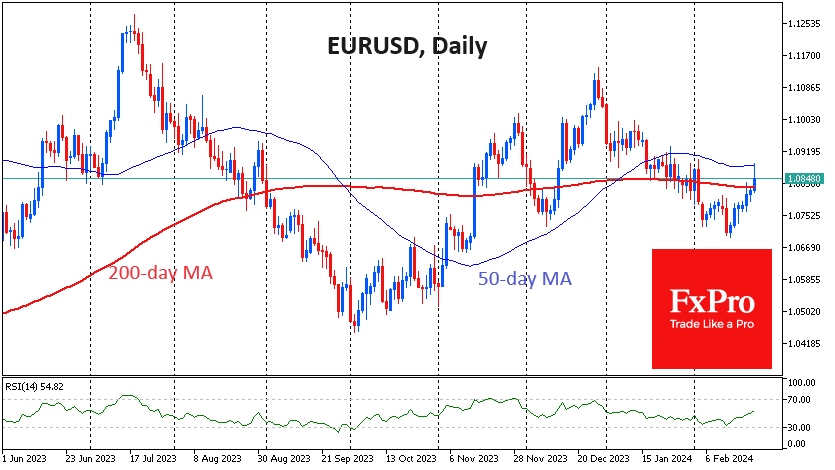

The EUR/USD rose for the seventh consecutive session. The bulls tested the 200-day average earlier in the week, and the pair traded above this important trend indicator on Thursday morning. For much of last month, the pair was bought on dips below this line, and clearly, they did not want to stay away from it for long in February. The ability to attract buyers from these levels could set up a sustained uptrend.

However, the course of trading suggests that it will be a very bumpy and uneven road. On Thursday, in addition to the disappointment of the weak German data, the 50-day moving average acted as resistance. This dynamic suggests that we may see an intense tug-of-war in the coming days before the bulls can mount an offensive.

Fundamental pressures on the dollar against the euro include expectations that the Fed will start cutting rates much sooner than the ECB.

The FxPro Analyst Team