- ECB convenes this week, expected to maintain the status quo.

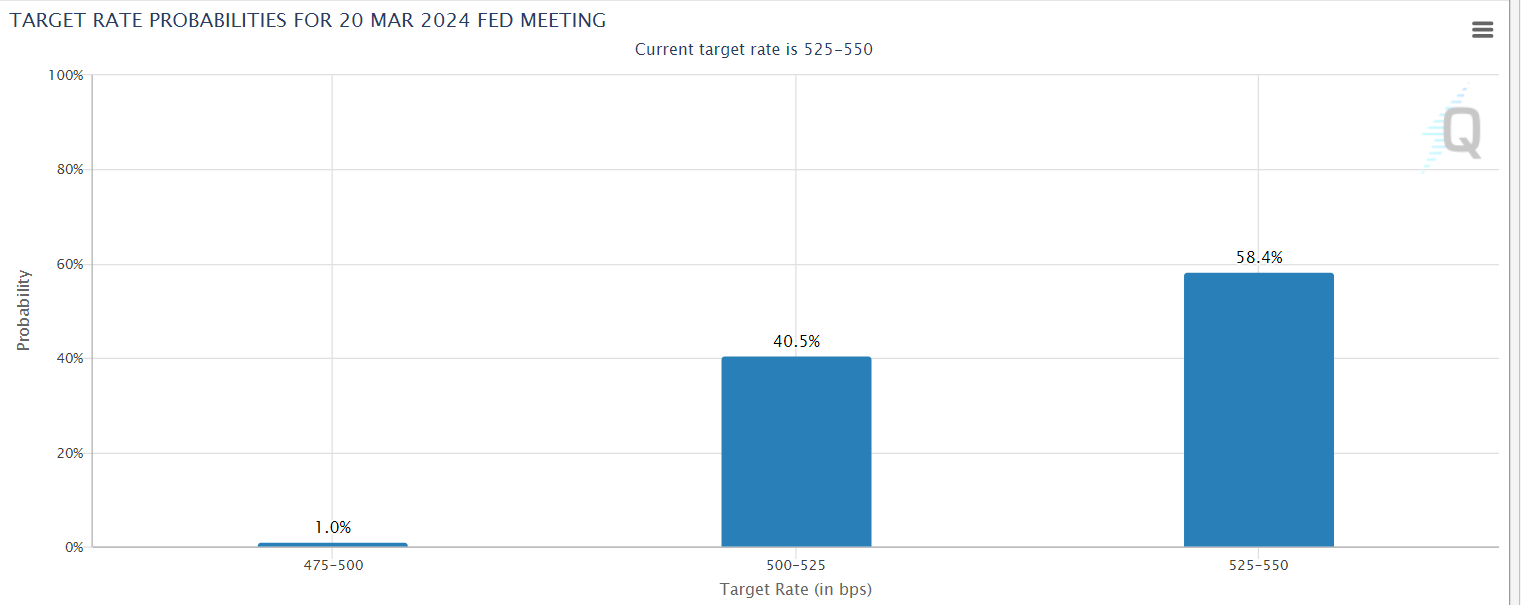

- Likelihood of US interest rate cuts in March diminishes.

-

Bearish outlook targets 1.08 next for EUR/USD.

- Creating a market-beating portfolio has never been as easy as with ProPicks. Join now and access the six strategies that outperformed the S&P 500 by triple digits over the last decade!

This week, investors will closely watch the European Central Bank's announcement on interest rates and monetary policy guidance scheduled for Thursday. While expectations lean towards unchanged rates, the crucial factor will be the accompanying statement and its tone.

With improved U.S. economic data and easing disinflation, the likelihood of March interest rate cuts has diminished. Consequently, the EUR/USD pair is gradually moving southward, approaching another demand zone.

Regarding potential rate cuts in the eurozone, though the market anticipates the first cut in April, this date appears improbable. The ECB typically issues advance guidance before such moves, aiming to communicate with the market and prevent surprises.

ECB President Christine Lagarde hinted at a dovish turn this summer during the Davos economic conference. The decisive factor may come in April with the release of quarterly wage growth data for Q1 in the eurozone, influencing future decisions.

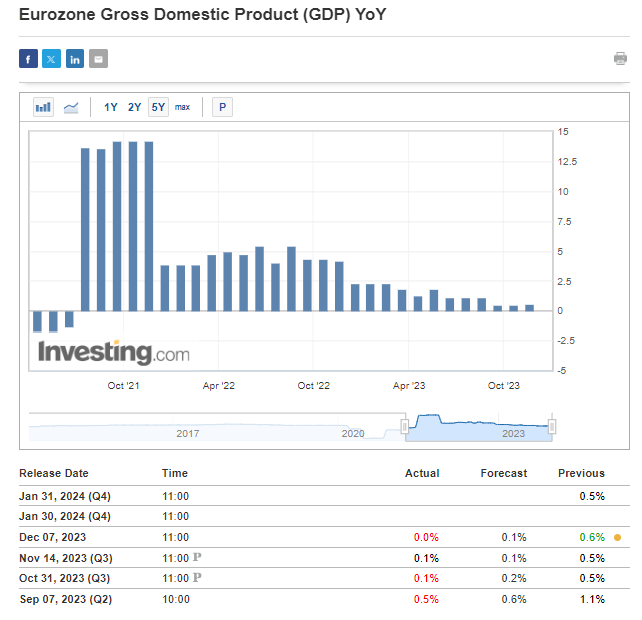

A compelling argument for initiating a cycle of interest rate cuts promptly lies in the evident slowdown of the GDP growth rate, currently signaling a delicate balance between growth and recession.

The forthcoming data, set to be released at the end of this month, holds substantial importance and, contingent on the results, could significantly influence the outcome of the upcoming ECB meeting in March.

Will the Fed Stay Higher for a Little Longer?

In recent weeks, the probability of a US interest rate cut in March has declined sharply from around 70% to just over 40%.

Source: www.cmegroup.com

The shift, driven by robust labor market data and a slowdown in disinflation, is resulting in intermittent strength in the US dollar, causing it to advance against major currencies.

The trend finds support in statements from Federal Reserve board members, such as Christopher Bostic, who floated the idea of commencing cuts only at the start of the third quarter this year to ensure that inflation is moving toward the targeted levels in the medium term.

Technical Indicators Also Favor the Greenback

In recent days, the EUR/USD currency pair has shown the development of another flag formation, hinting at a possible extension of the existing downward trend.

A comparable pattern was notably replicated in the first half of the month, displaying a nearly model-like resemblance.

Considering the likely delay in the Fed's pivot and anticipating interest rate cuts in the eurozone as early as summer, the downward trajectory may persist. This would entail the manifestation of a corrective formation, with the next target around the demand zone of 1.08 and the support approaching 1.0750.

Given the robustness of the upward momentum initiated in this zone, there is a favorable opportunity for at least a short-term upward movement, presenting a potential buying position in the near term.

***

Beating the market has now become a lot easier with our Flagship AI-Powered ProPicks

Oftentimes, investors will miss incredible market opportunities simply by not knowing which companies to bet on.

Luckily, those times are long gone for InvestingPro users. With our six cutting-edge AI-powered strategies, including the flagship "Beat the S&P 500," which outperformed the market by 829% over the last decade, investors now have the best selection of stocks in the market at the tip of their fingers every month.

Strategies are rebalanced monthly, guaranteeing that our users stay ahead of the curve amid shifting market dynamics and an ever-changing macroeconomic environment.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.