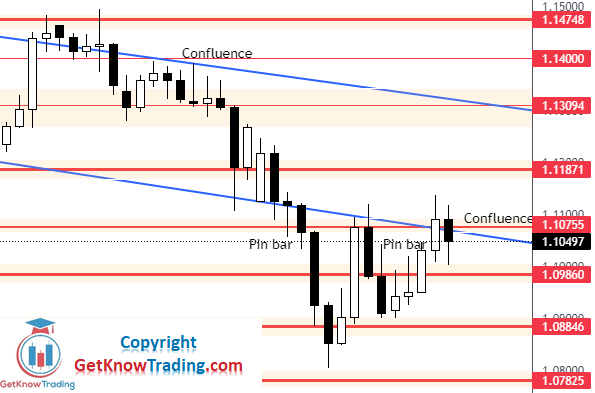

EUR/USD made some moves last week, which we can see on the chart below. The price formed all bullish candles starting from Monday with only Friday showing a bearish candle. On Monday the price made a bullish candle with a large wick on the upper side next to $1.09860 resistance but was eventually pushed back down.

On Tuesday EUR/USD made a similar move by reaching $1.09860 resistance, but this time the price break rose above Monday's level. Once again, price found itself being pushed back down creating a larger wick on the upper side. A candle formation on the chart shows a bearish Pin bar on the resistance level.

Even though this was a bearish price action signal, the price did not follow, rather it broke above on Wednesday with a strong bullish candle and closed the day above the $1.09860 resistance level. This was the first sign bulls were stronger than bears.

On Thursday, we saw the price making new highs and closing the day above the $1.10755 resistance level which was a strong signal.

Friday saw the market experience a sell off on the strong resistance level. EUR/USD reached the $1.09860 support level forming a wick, which displayed bulls' strength on that level.

Reviewing the previous week’s analysis, the bullish scenario was realized at the point where the price closed the day above $1.10755, which indicated bullish market sentiment. Since the price had broken above a strong confluence of resistance and managed to close the day above, we can prepare for a bullish market scenario—at least in the short term.

The current $1.09860 support level is where the price will continue to find support since that was the level at which sellers were pushing the price down on Monday and Tuesday. This time the bulls that were making a wick on the candles will support the price from falling further. And from this level we could see the price move higher.

If the price creates a bullish price action signal at $1.09860, then that will be a bullish entry signal. It will have a hard time breaking above $1.10755 because there are still sellers in wait mode, as we see via the large wick on Thursday's candle. However, there are bulls that are pushing the price higher. In this case, I would wait for Monday to close. After that, the market will show the price's direction based on trader action.

Bulls seek to break above $1.11871 to secure further moves up since that was the previous level holding the price up. From there the price will transition into a range area and we'll need to analyze where the market will move.

On the down side, we need the price below $1.08846 to revert to bearish mode, which is important support that must be broken.