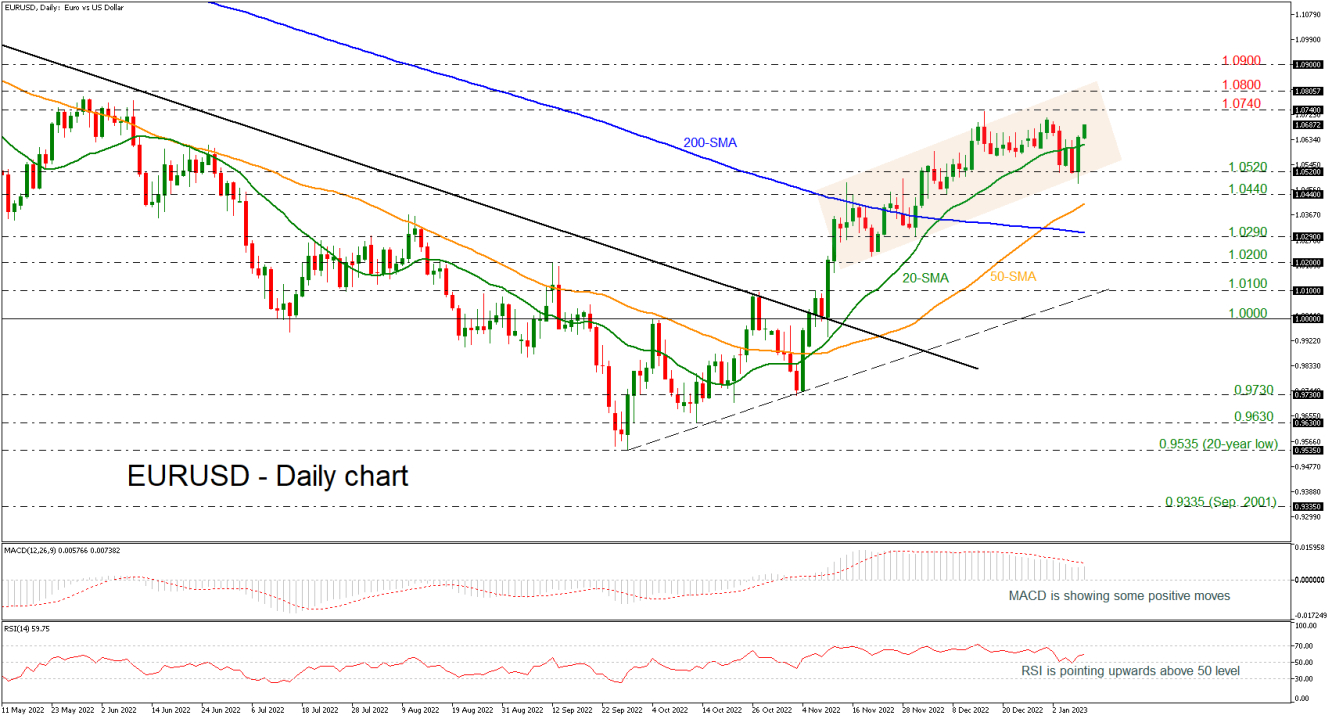

The technical indicators suggest that the market could be boosted a little bit more in the short term.

The RSI is currently increasing positive momentum above its neutral threshold of 50, while the MACD is gaining ground in the bullish area, remaining beneath its trigger line. Both are hinting that the next move in prices could be on the upside rather than on the downside.

An extension to the upside and above the 1.0740 resistance could meet a restrictive region between the 1.0800 round number and the 1.0900 handle, while even higher, steeper increases could also touch the 1.1180 barrier, registered in March 2022.

On the other hand, if the pair weakens, the 1.0520 barrier could provide immediate support ahead of the 1.0440 line. Even lower, the 50-day simple moving average (SMA) at 1.0407 could attract greater attention as any leg lower could worsen the market’s bearish outlook, opening the way towards the 200-day SMA near the 1.0290 support.

To summarize, EURUSD looks bullish in the short-and medium-term timeframes and only a close beneath the 200-day SMA may change this outlook.