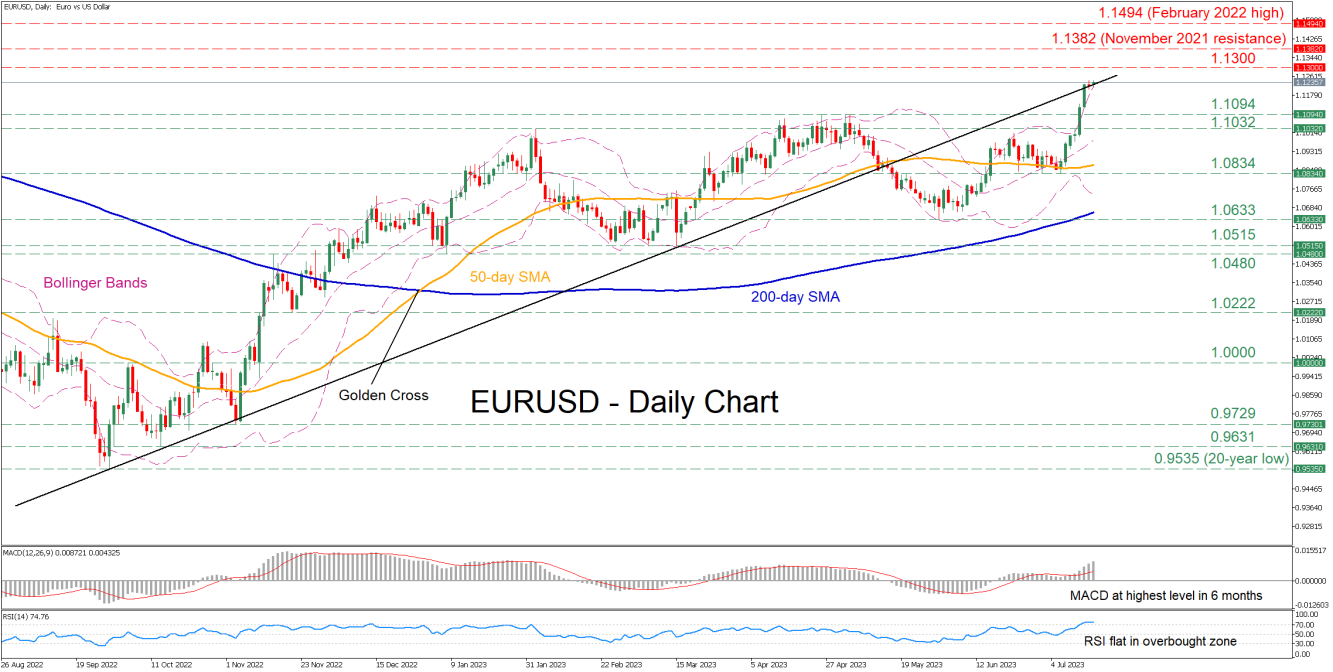

EURUSD has experienced significant gains in the past 10 days, smashing its recent resistance levels and posting a fresh 17-month peak last Friday. However, it seems that the bulls cannot extend the recent rally as the pair has approached overbought conditions.

The momentum indicators currently suggest that the recent rally could be overstretched. Specifically, the MACD is not only above both zero and its red signal line but also at its highest levels since January 2023, while the RSI is directionless within the 70-overbought zone.

Should the advance falter and the pair correct to the downside, the previous peak of 1.1094 could act as the first line of defense. Breaking below that zone, the price could test the February resistance of 1.1032, which could serve as support in the future. Further declines might then cease at the July support of 1.0834.

On the flipside, if the latest rally continues unhindered, the bulls may initially attack the 1.1300 psychological region. Piercing through that wall, the pair could ascend towards the November 2021 resistance of 1.1382. A violation of that zone could pave the way for the February 2022 peak of 1.1494.

In brief, EURUSD’s aggressive short-term rally has stalled as the price is close to overbought conditions, while also battling with the crucial ascending trendline that connects its lows since September 2022. A drop below the trendline could easily trigger a downside correction, but a failure to do so might add more fuel to the bulls' engines.