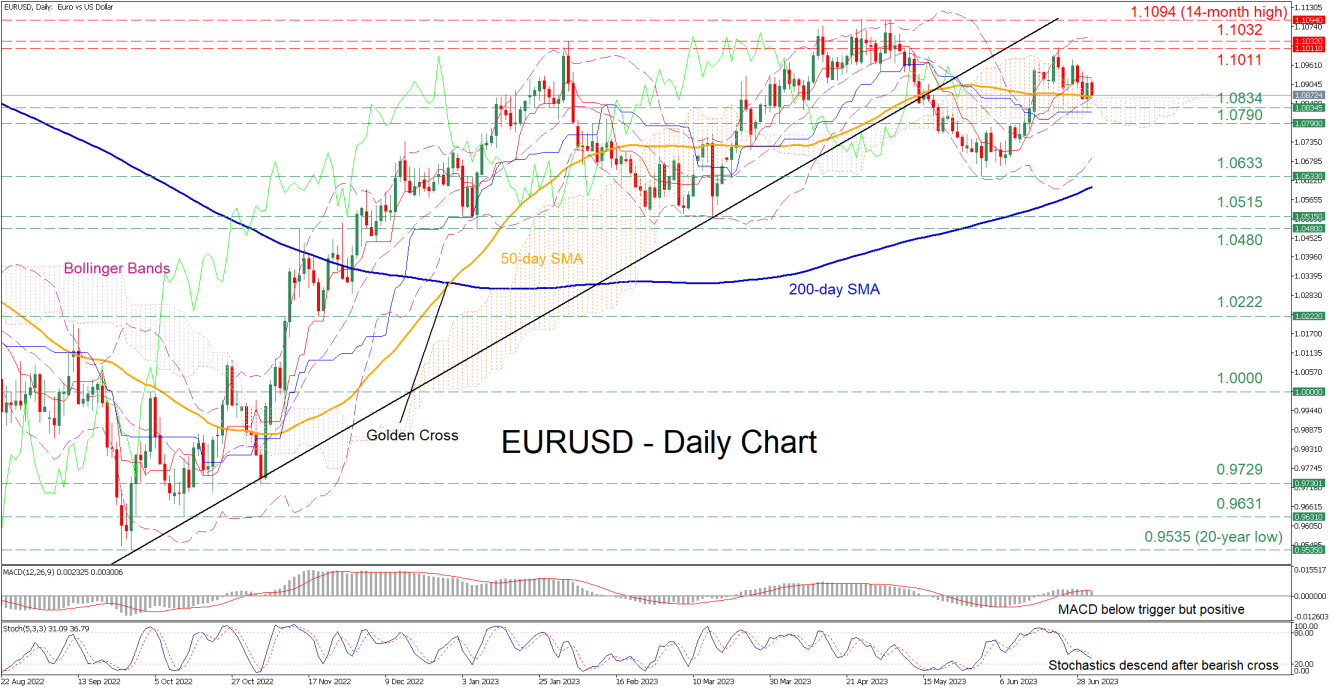

EURUSD has experienced a downside correction after its latest advance got rejected at the 1.1011 territory on June 22. Even though the pair temporarily bounced off the congested region that includes its 50-day simple moving average (SMA) and the upper boundary of the Ichimoku cloud, the bears continue to apply downside pressure.

The momentum indicators currently suggest that the positive momentum is waning. Specifically, the MACD has dropped below its red signal line but remains positive, while the stochastic oscillator is descending after posting a bearish cross.

Should the price pierce through its 50-day SMA, the recent support of 1.0834 could act as the first line of defense. A violation of that zone could turn the attention to 1.0790 before the May low of 1.0633 gets tested. Failing to halt there, the pair may retreat towards the March double-bottom region of 1.0515.

On the flipside, if the bulls manage to regain control, the price could initially face the recent rejection region of 1.1011. Clearing this level, the pair could advance towards the February peak of 1.1032. A break above that zone could open the door for the 14-month high of 1.1094.

In brief, EURUSD’s latest pullback came to a halt at the 50-day SMA, but the momentum indicators are currently tilted to the bearish side. Therefore, a potential break below this crucial technical zone could trigger a significant decline