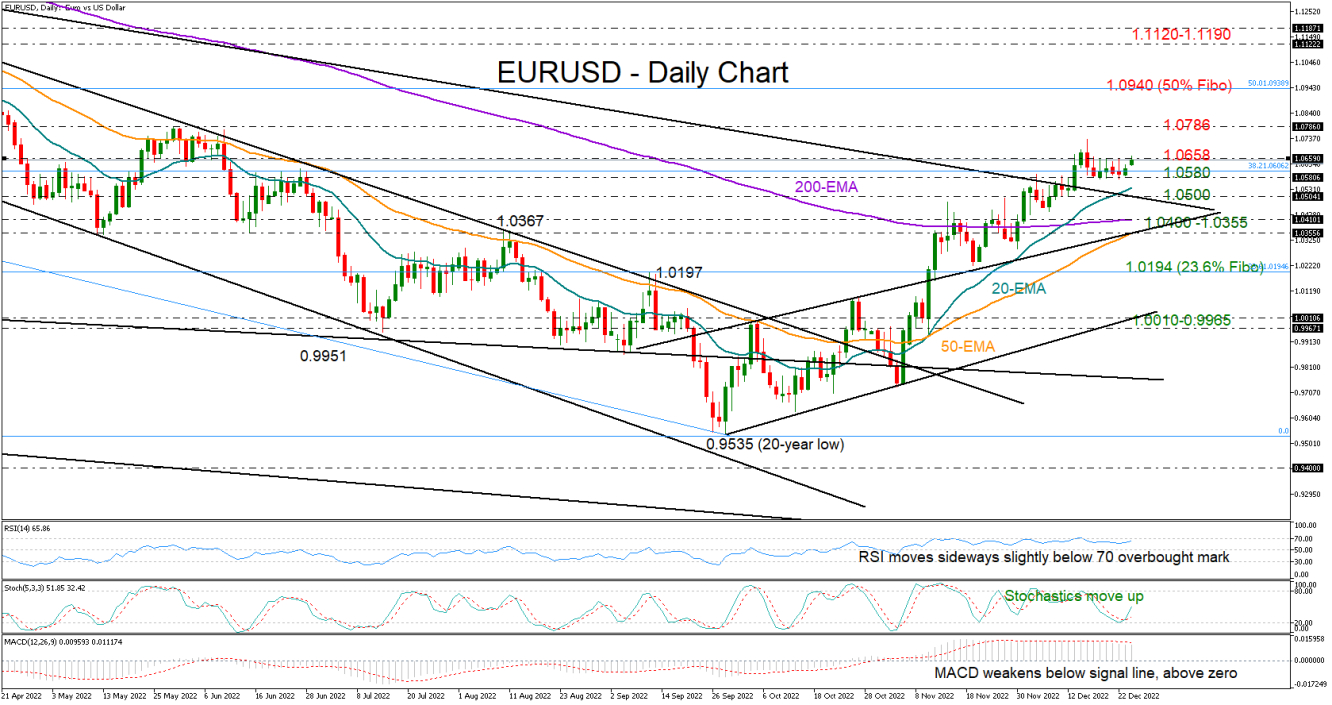

EURUSD kept fighting the tough 1.0658 nearby resistance during the post-Christmas trading session, which has been capping bullish actions for more than a week.

The floor around 1.0580, if sustained, may preserve engagement in the market in the short term. Technically, the bullish cross between the faster 20-day exponential moving average (EMA) and the slower 200-day EMA is feeding hopes that the uptrend from 20-year lows may gain extra legs. Yet, with the RSI maintaining a sideways trajectory near its 70 overbought level and the MACD losing pace slightly beneath its red signal line, the pair might prove sensitive to downside risks.

If the bulls dominate above 1.0658, the next target will be May’s bar of 1.0786. Even higher, the 50% Fibonacci retracement of the 2021-2022 downtrend at 1.0940 could attract special attention ahead of the 1.1120–1.1190 constraining zone. A successful step higher could then clear the way towards the 61.8% Fibonacci of 1.1450.

On the downside, a step below 1.0580 could find immediate support somewhere between the 20-day EMA and the broken descending trendline at 1.0500. Failure to rotate here could shift the bias to the bearish side, producing a quick downfall towards the 200- and 50-day EMAs currently seen within the 1.0400–1.0355 region. The upper trendline of the broken short-term bullish channel may cement this base, potentially preventing another sharp decline to the 23.6% Fibonacci of 1.0194.

All in all, EURUSD seems to have power for more upside in the short term. A close above 1.0658 may renew bullish momentum, whereas a reversal below 1.0500 may trigger the next bearish cycle.