- Combined with Friday’s NFP report, the US CPI print suggests the US economy may be downshifting.

- While a Fed rate hike later this month is still seen as overwhelmingly likely, markets are increasingly convinced that could be the end of the tightening cycle.

- EUR/USD is trading at a 16-month high above 1.1100, with the next resistance levels to watch at 1.1185 and 1.1270.

Coming off Friday’s NFP report, there were some tentative signs that the US economy may be downshifting, a development that could allow the Federal Reserve to finally wind down the aggressive interest rate increase cycle we’ve seen over the last 16 months…but that was just one (slight) miss after more than a year of stronger-than-expected economic reports.

“One data point could be an outlier, but two is a trend,” as they say and this morning’s US CPI report sent a jolt of lightning through markets. Consumer prices rose 3.0% y/y in June, a tick below the 3.1% rate expected, whereas the “core” (ex-food and -energy) reading missed expectations by even more at 4.8% y/y vs. 5.0% eyed; on a month-over-month basis, both readings rose 0.2%, but the unrounded figures were 0.18% and 0.16% respectively, suggesting that we weren’t far from a mere 0.1% m/m increase in Core CPI.

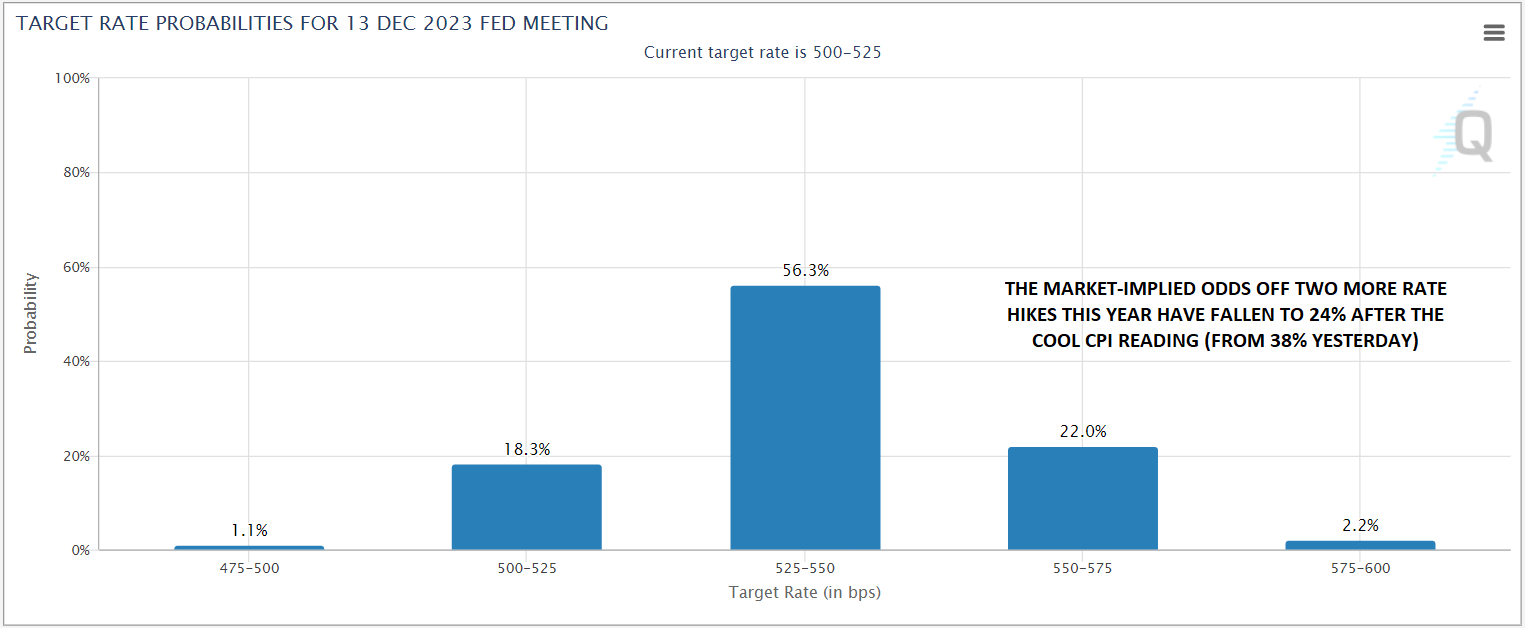

While this month’s economic data may be “too little, too late” to deter the Federal Reserve from raising interest rates later this month (still 92% priced in, per CME FedWatch), the odds of a second 25bps interest rate hike this year fell to just 24% from 38% yesterday:

Source: CME FedWatch, StoneX

Euro Technical Analysis – EUR/USD Daily chart

Source: TradingView, StoneX

Not surprisingly, the US dollar is the weakest major currency pair on the day, but the move in EUR/USD is especially notable. As we go to press, the world’s most widely-traded currency pair is surging by more than 100 pips to break above 1.1100, its highest level in 16 months!

Looking at the chart, a close near current levels would confirm the breakout and open the door for a continuation toward March 2022 high at 1.1185, with a breakthrough in that resistance zone potentially exposing the 61.8% Fibonacci retracement of the entire 2021-2022 drop at 1.1270.

Meanwhile, a reversal back below 1.1100 by today’s close, though not our base case, would hint at near-term bullish exhaustion and could open the door for a retracement toward previous-resistance-turned-support at 1.10 heading into next week.