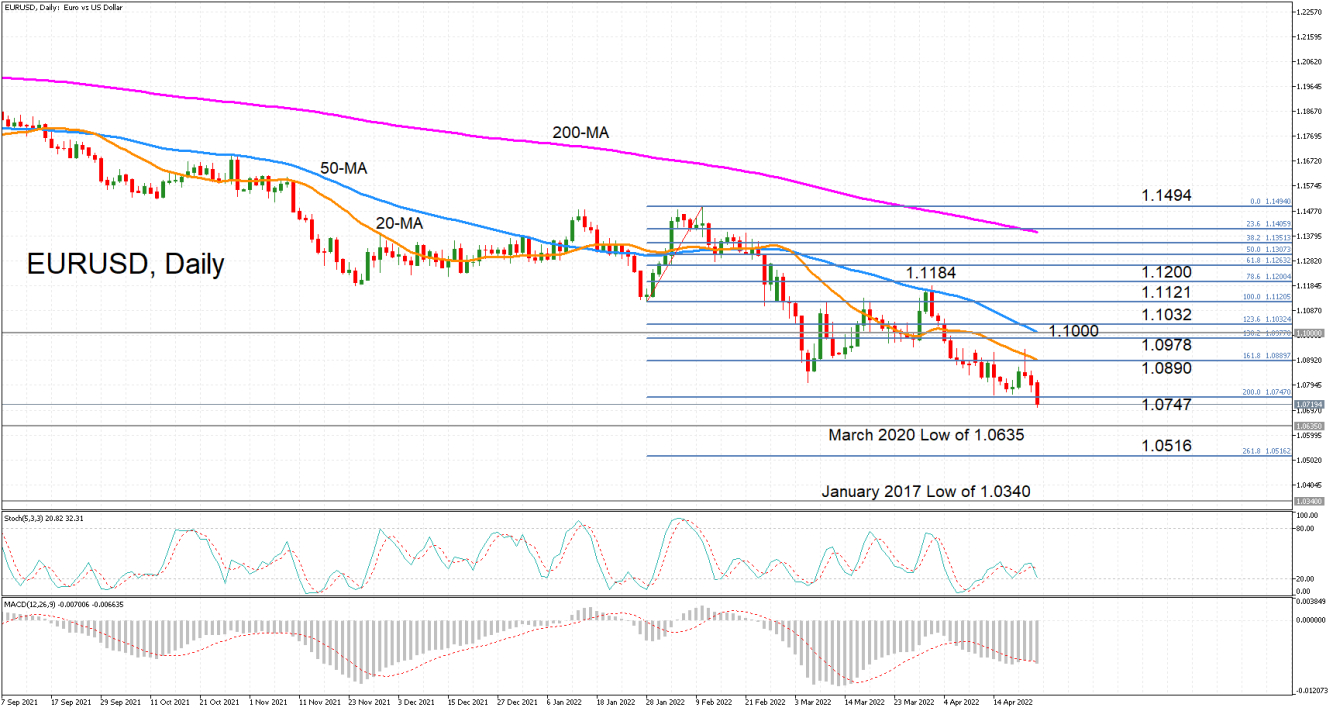

The pair has slipped below the 200% Fibonacci extension of the January-February upleg at 1.0747 as the momentum oscillators are deteriorating.

The %K line of the stochastic oscillator has dipped below the slower moving %D line and is about to cross into oversold territory. The MACD histogram is in the process of intersecting its red signal line, reversing back down after a slight improvement in recent days.

Should the bearish bias increase further, the next key support could come from the 1.0635 level, which is the March 2020 trough. Further down is the 261.8% Fibonacci extension of 1.0516. Breaking this barrier too would open the way for the January 2017 low of 1.0340.

In the event of a turnaround, EURUSD would first need to fight resistance at the 161.8% Fibonacci of 1.0890, which is also where the 20-day moving average (MA) is currently located. Climbing above this point would strengthen any positive momentum, but there’s likely to be another battle in the 1.10 region of the 50-day MA, which is surrounded by the 123.6% and 138.2% Fibonacci extensions.

However, for any meaningful rebound, the bulls would need to aim for the March peak of 1.1184. Otherwise, the bearish outlook in the longer run is not about to change anytime soon, while in the short term, the negative bias is deepening.