The FX market is off to a relatively quiet start to the week with the UK on a bank holiday, but volatility is likely to pick up as we move through the week.

The two most important economic data releases of the week will Wednesday’s Flash CPI estimate out of the Eurozone and Friday’s highly-anticipated US Nonfarm Payroll (NFP) report, giving us an opportunity to zero in on the world’s most widely-traded currency pair, EUR/USD

Traders and economists are expecting the headline inflation reading from the Eurozone to come in at 9.0% after last month’s 8.9% print, with the Core CPI figure to come in at 4.0%, in-line with last month. Energy prices will be a major focus for traders heading into the cooler months, and with inflation likely to show no signs of slowing in the interim, the report could reaffirm the dire situation the European Central Bank (and European citizens broadly) will face in the coming months.

Then, heading into a US holiday weekend, the Bureau of Labor Statistics (BLS) will release the monthly NFP report. After four months of creating roughly 400K net new jobs, the US economy saw strong jobs growth in excess of 500K jobs in July, but economists are, once again, expecting a slowdown to closer to 290K net new jobs in August. Will economists finally nail a (slight) slowdown in the labor market? Or will NFP continue to defy the broader economic trends and show an ever-tightening jobs market? Stay tuned for Thursday’s full NFP preview report to get our analysis based on the leading indicators.

Technical view: EUR/USD

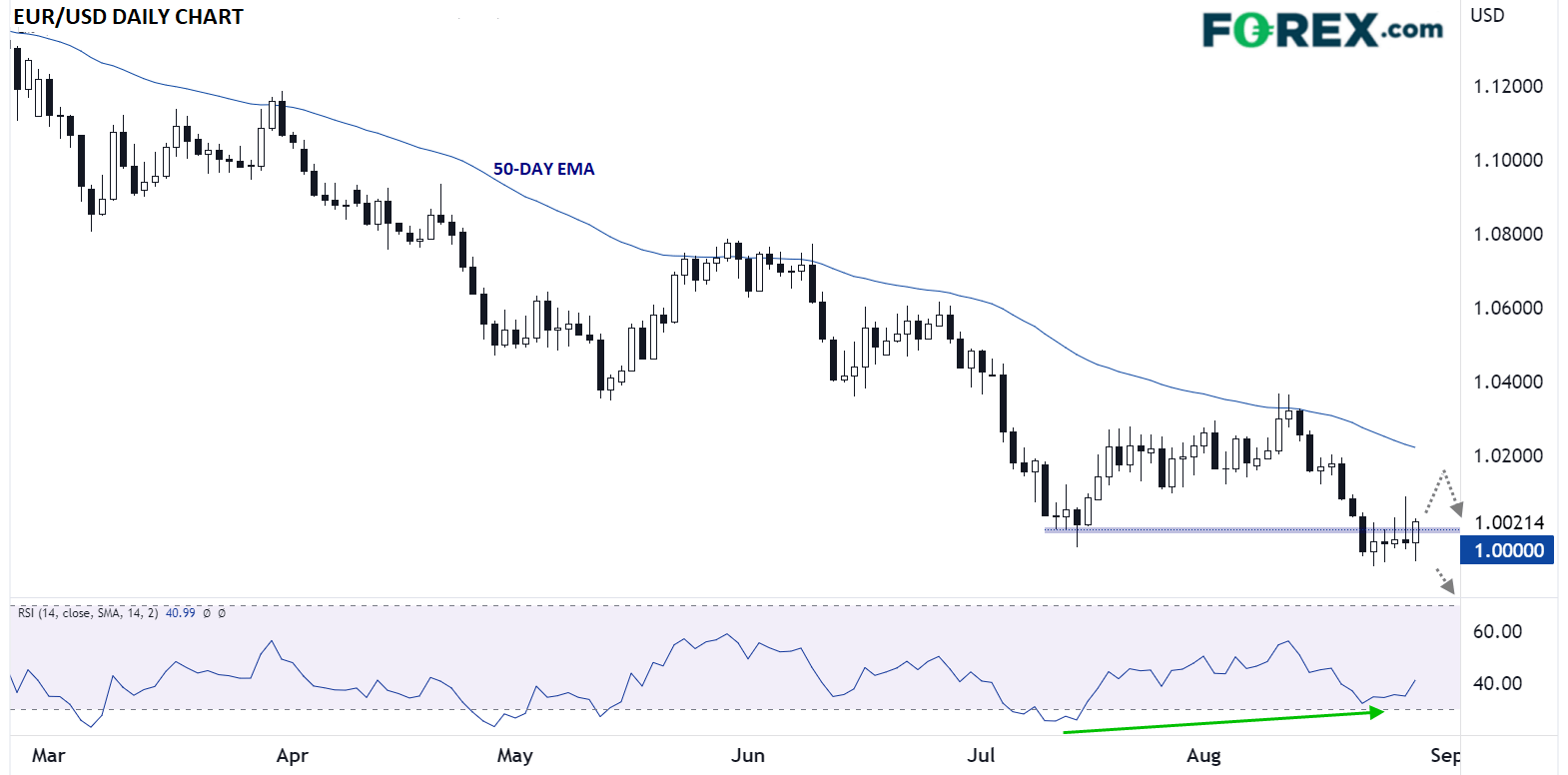

EUR/USD made headlines for briefly dropping below parity (1.00) for the first time in nearly 20 years in mid-July, then again throughout most of last week’s trade, but the pair is starting this week’s trade on a bullish note as it peeks above that key psychological level. Interestingly, the pair’s RSI indicator is showing a bullish divergence with rates over the last two lows, meaning that price made a lower low (so far) while the RSI has made a higher low; these types of divergences show waning selling pressure and are often seen at lows in a market.

That said, the medium- and longer-term trends are still pointing lower in EUR/USD, so even if we do see a bounce over the next week or two, sellers are still likely to emerge around the 50-day EMA near 1.0200. As the chart below shows, that moving average has reliably capped any counter-trend bounces since February. Meanwhile, a break below last week’s low would likely erase the bullish divergence and point toward a continuation of the downtrend toward 0.9800 or lower next.

Source: TradingView, StoneX