Dollar to take its cues from Fed minutes, ISM PMI and geopolitics

Expectations about how many times the Fed will raise interest rates this year have gone through the roof lately as there’s been no let-up in the relentless upsurge in inflationary pressures. Crucially, Fed officials have come out in droves since the mid-March gathering to back a 50-bps increase at the next meeting.

It’s unlikely therefore that the March minutes published on Wednesday will reveal anything new on voting intentions. However, what might draw more interest is what FOMC members discussed about reducing the Fed’s humongous $9 trillion balance sheet. The Fed put off any decisions about the balance sheet until the May meeting but any hints on the pace of quantitative tightening could spark a reaction in Treasury yields, and in turn, the US dollar.

On the data front, the ISM non-manufacturing PMI due Tuesday will be the main data to watch out for in the United States. The services activity composite is expected to have edged up from 56.5 to 58.0 in March, which would reinforce the view that the US economy is in robust shape. However, any unforeseen weakness might heighten fears of an economic slowdown induced by the Ukraine crisis, potentially weighing on the greenback.

Euro to remain sensitive to Ukraine fallout

In Europe, recessions risks also look set to dominate the market theme. Aside from the final readings of the March services PMIs that are due on Tuesday, the Eurozone sentix index for April released a day earlier will be the other business survey that will be monitored.

With the euro area economy more exposed to the fallout from the Russia-Ukraine conflict than any other, investors will be keeping a close eye for any signs that point to a deterioration in growth. Although any weakness is not likely to show up in the hard data just yet as next week’s numbers on German industrial orders (Wednesday), industrial production (Thursday) and Eurozone retail sales (Thursday) are all for February, a downward revision to the final PMI prints would be worrisome.

The ECB’s account of its March meeting out Thursday might not necessarily spur a huge market response either as European policymakers have become even more data-dependent than their US counterparts amid the very uncertain outlook. Still, following the somewhat confusing viewpoints of Governing Council members recently, an overall inclination in either a hawkish or dovish direction with regards to the timing of the first post-pandemic rate hike could sway the euro.

RBA will probably stick to familiar language

The RBA holds its April policy meeting on Tuesday but is not expected to join the wave of central banks that hiked rates in March. Although the Australian economy has bounced back strongly from the Omicron wave and the labour market is tightening, policymakers are in no hurry to raise borrowing costs.

The RBA will likely again stress that it wants to see inflation hit its 2-3% target sustainably, and for that to happen, wage growth will need to pick up more substantially than it has done already. Therefore, no change in policy is expected next week but Governor Philip Lowe may hint that the cash rate could rise later this year.

Investors think liftoff will come in June. But even if there is a reasonably strong possibility of that, the market pricing of more than 200 bps for the whole year seems too aggressive. Yet, it’s unlikely anything the RBA says will cause a rethink by traders just yet. Thus, the Australian dollar will be guided by the broader market mood, as well as by the direction of commodity prices.

Canada’s jobs report could further boost BoC rate hike bets

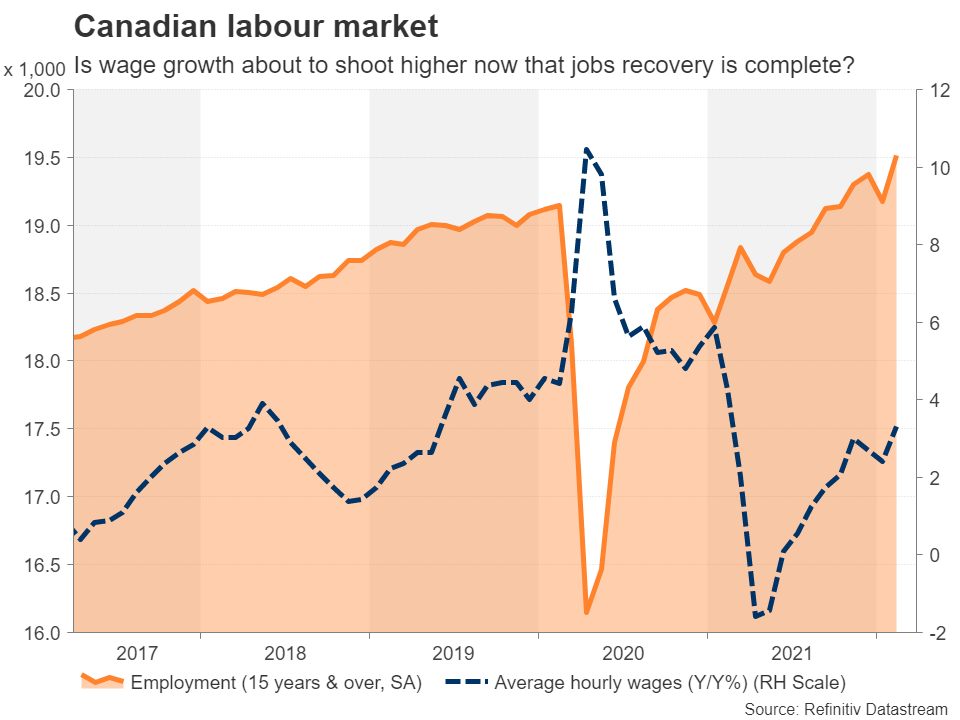

Expectations on the number of rate increases by the Bank of Canada have also risen sharply ever since Western sanctions against Russia sent commodity and energy prices spiralling higher. But the BoC had already been gearing to tighten policy considerably this year as Canada’s labour market has now completely recovered from the pandemic and wage growth could soon accelerate above the current modest pace of around 3%.

The next employment report is due on Friday and it’s projected that another healthy gain in jobs was recorded in March.

Like the Fed, the BoC has been dropping hints recently that it may need to move in 50-bps increments, so a strong jobs print could push up the odds even higher than the current probability of about 70%. It would also help cushion the Canadian dollar against any further possible slides in oil prices following the past week’s pullback that was brought about by the improved risk tone as well as by America’s decision to release more of its strategic petroleum reserves.