(Bloomberg) -- The rush to add liquidity into the monetary system is “the most overt sign” of financial stress and a clear negative for the dollar, according to Alan Ruskin, chief international strategist at Deutsche Bank AG (NYSE:DB).

“The Fed adding to its balance sheet but being slow to resolve the underlying financial problem, is among the worst outcomes for the USD,” Ruskin said after the Federal Reserve and five other central banks announced a coordinated effort Sunday to inject US dollar liquidity in an effort to ease growing strains in the global financial system.

“We are inclined to take a USD negative line, in so much as the SVB problem has triggered a crisis of confidence that has long-term structural ramifications for the US banking system,” he wrote in a note to clients.

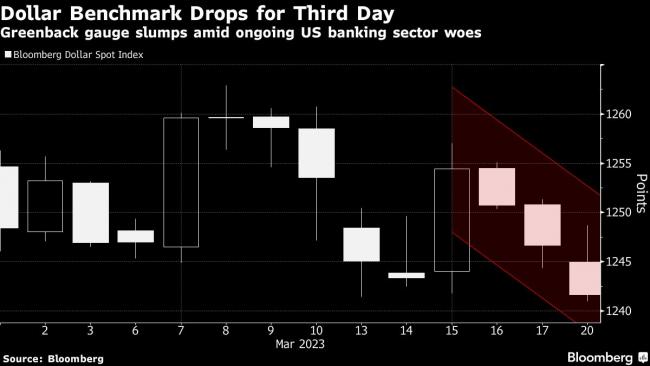

The greenback extended its decline into a third day Monday as investors curtail bets on the Fed tightening its monetary policy this week in the aftermath of the Silicon Valley Bank collapse and the Credit Suisse Group AG bailout.

Apart from the question of whether the Fed is about to pause its interest-rate hikes, the markets are also keenly attuned to what the Fed will say about its $8.6 trillion balance sheet. It was shrinking, but now started expanding again over the recent emergency lending programs. Fed Chair Jerome Powell and his colleagues are gathering Tuesday for a pivotal two-day policy meeting.

“A shock of this nature, that has deep-seated implications for a sector’s structure, is typically not responsive to immediate fixes,” Ruskin wrote about the SVB fallout. “The issues as they relate to banking sector structure, are also very specific to US, which is another reason why we draw USD negative conclusions.”

Bloomberg Dollar Spot Index fell 0.4% on Monday, shedding about 2% in value since the recent peak earlier in March.

©2023 Bloomberg L.P.