Dollar rally enters final chapter

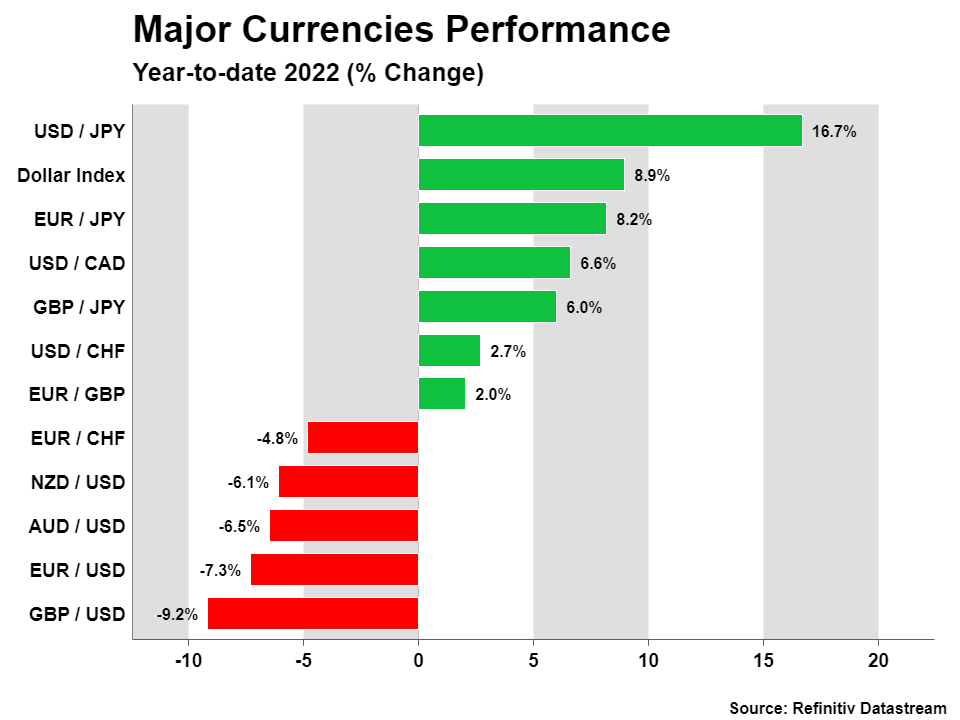

It’s been a stormy year for FX markets, characterized by severe episodes of volatility as central banks and governments across the world unwound the extraordinary stimulus rolled out during the pandemic. Being long the US dollar was the only trade that worked, with the reserve currency crushing everything in its path as the Fed rolled out the big guns.

Looking into next year, this wave of dollar strength could persist early on, but perhaps reverse later in the year. The logic behind this call is that even though some of the elements that fueled this stunning rally seem to be losing their kick, it’s still premature to envision a bearish trend reversal because the fundamentals of other currencies are even gloomier.

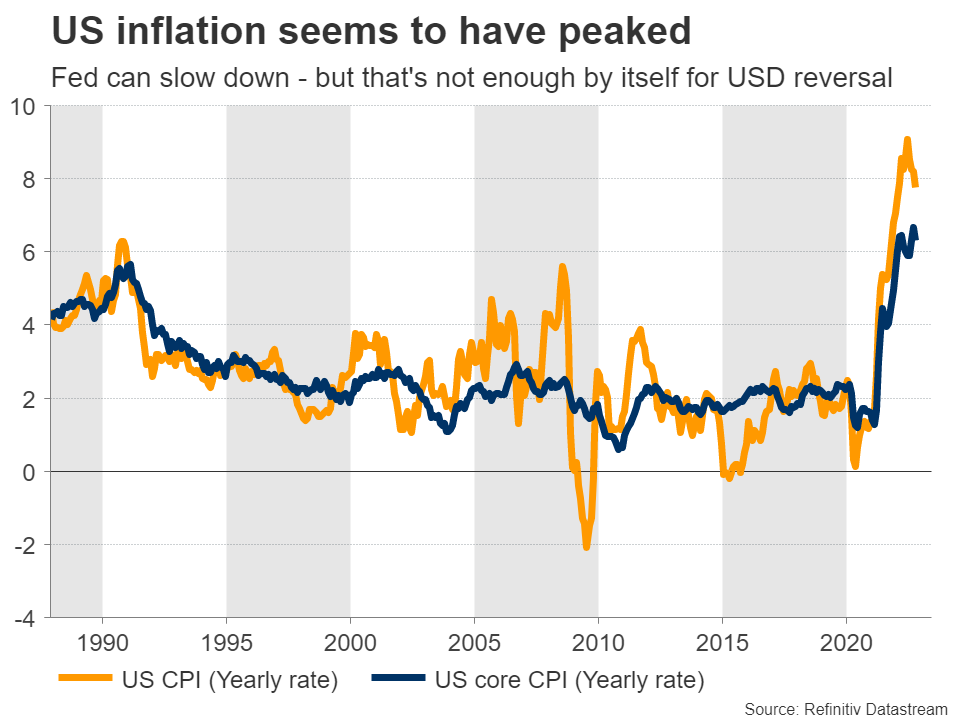

By most indications, US inflation has started to cool and the Fed is about to slow down the pace of rate increases. Market pricing currently suggests rates will peak at 4.9% in March and stay there until the final quarter of 2023. Since one of the main drivers of this rally was the Fed racing ahead of other central banks, the dollar could lose some of its shine as the tightening cycle concludes.

However, a more cautious Fed profile is usually not enough to turn the tide in the dollar. Historically speaking, the economic outlook in the rest of the world - and especially Europe - needs to be bright enough to convince investors that parking funds outside the US is worth the risk. That’s not currently the case.

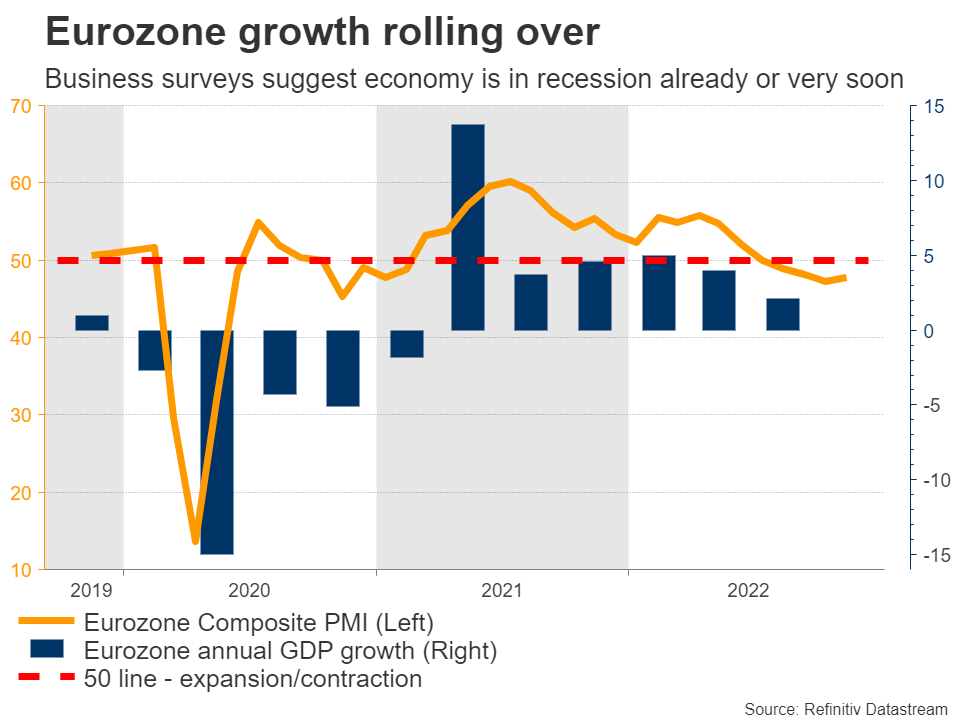

According to business surveys, the Eurozone and United Kingdom are either already in recession or headed directly into one, as the energy shock and the rapid tightening in financial conditions ripple through both economies. This notion is supported by the latest forecasts from the European Commission and Bank of England.

Meanwhile, the outlook for China is arguably worse. Covid outbreaks are intensifying and it could be a while before the economy is fully reopened. On top of the painful deleveraging in the property sector, which might take several years, it’s difficult to be optimistic about growth in the world’s second-largest economy.

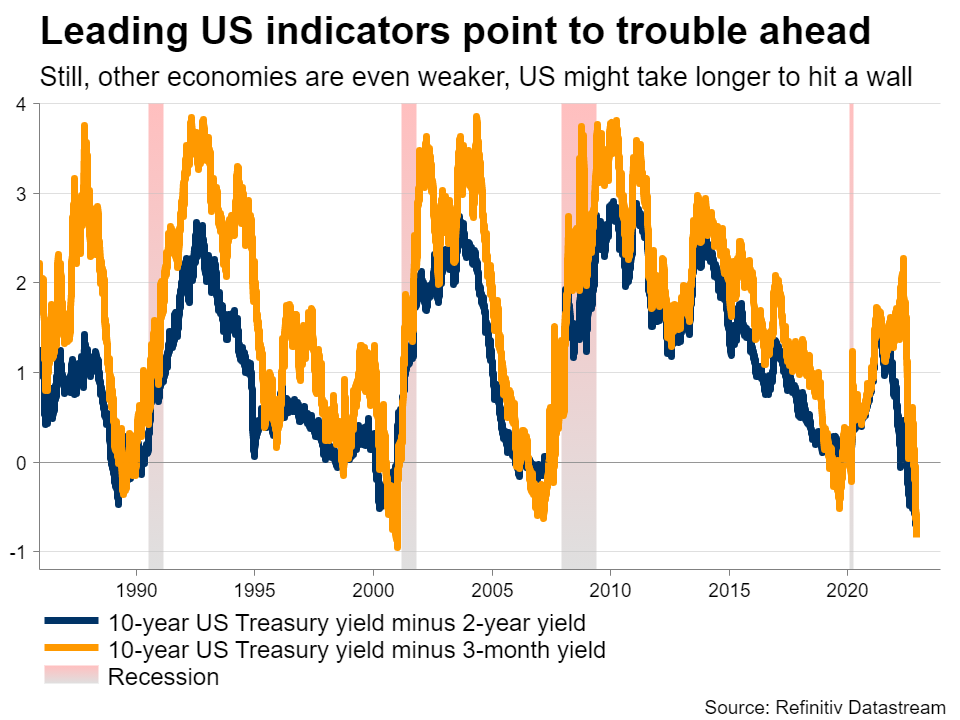

By comparison, America seems more resilient. While most leading indicators suggest it is also headed for recession, it might take longer to get there. Much of this resilience boils down to the nation’s energy independence, which has helped shield it from the worldwide power crisis, as well as longer monetary policy transmission lags.

Since most US mortgages are given at fixed interest rates, it takes several quarters before rising Fed rates can impact economic activity, as people with existing mortgages aren’t affected. In contrast, almost all European mortgages are at variable rates. This means ECB rate increases can affect the economy much faster, hence why Europe appears to be in worse shape.

Therefore, even though the US is also staring down the barrel of a recession, this might be a story for the second half of 2023. At that point, Europe could begin to bottom out - having entered a downturn much earlier - setting the stage for a trend reversal in euro/dollar.

Euro - Trading the weather

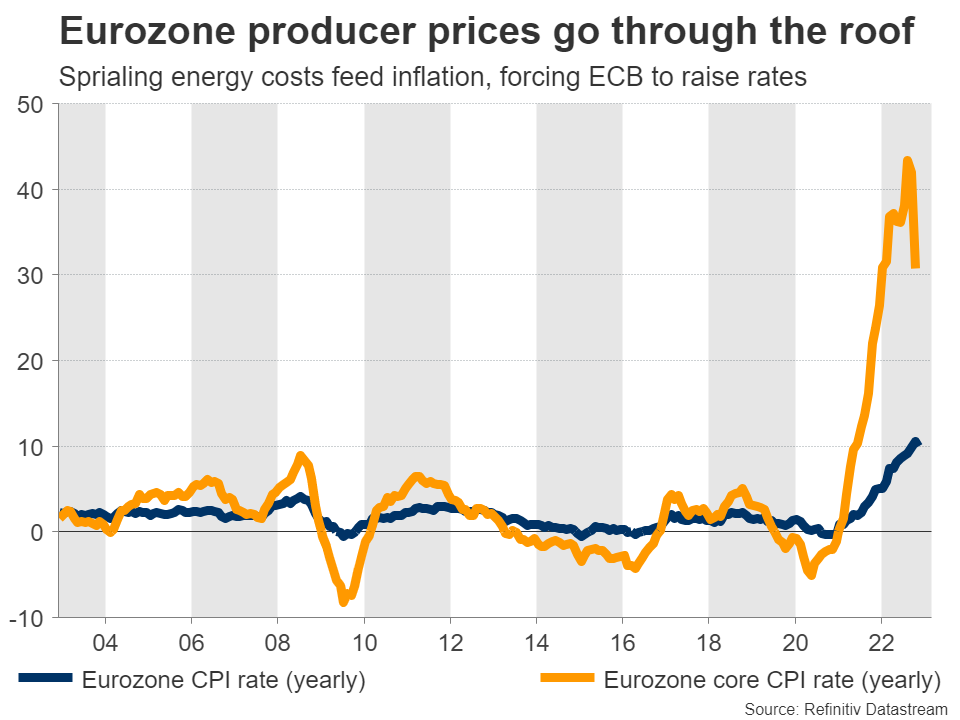

In the euro area, the economic data pulse has been weakening for several months now. Spiraling energy costs served as rocket fuel for inflation, which forced the European Central Bank to roll out some heavy rate increases, further squeezing businesses and consumers.

The euro spent most of the year under pressure because of these concerns, yet it managed to stabilize recently, helped by a sharp decline in oil and gas prices after the European Commission intervened in the energy market. The unusually mild weather so far also helped many nations fill their energy stockpiles, easing some nerves about the severity of any recession.

This suggests the euro’s performance going forward might be linked to weather patterns, as the existing energy stockpiles are not enough for the entire winter. Hence, a bet on the euro is essentially a bet on European weather staying favorable, which is not a very attractive strategy.

Markets currently expect the ECB to raise rates faster than the Fed next year, and the central bank could also begin to reduce its enormous balance sheet - both steps that would normally support the euro. The problem is that these measures can also backfire, by inflicting unnecessary damage on an economy already headed downhill.

Economic performance is ultimately more important than rate differentials in FX markets, which is why a sustainable recovery in the euro is likely a story for the second half of next year. The wildcard is how quickly the war in Ukraine will conclude. Peace talks could be a powerful catalyst for a comeback in the euro, although this doesn’t appear imminent either.

Sterling’s fate tied to global forces

The British pound didn’t fare any better. An economy plagued by the energy crisis, a central bank reluctant to raise interest rates with any urgency, and a budget crisis that chipped away at confidence in British economic governance were a toxic cocktail for sterling, which is set to end the year as the second-worst performer among the major currencies.

Another problem was the pound’s close link to global risk sentiment. Because the UK runs massive twin deficits that require funding from abroad, sterling has turned into a proxy for risk appetite, mirroring any moves in stock markets. The correlation between Cable and the S&P 500 was running at nearly 90% most of the year, which is astonishingly high.

Looking into 2023, this is the biggest threat for the pound. Every major economy is losing steam, yet earnings estimates for next year haven’t been calibrated lower to reflect these risks and equity valuations remain uncomfortably high. This suggests the stock market storm is probably not over yet, which spells downside risks for sterling.

Yen - Time to shine?

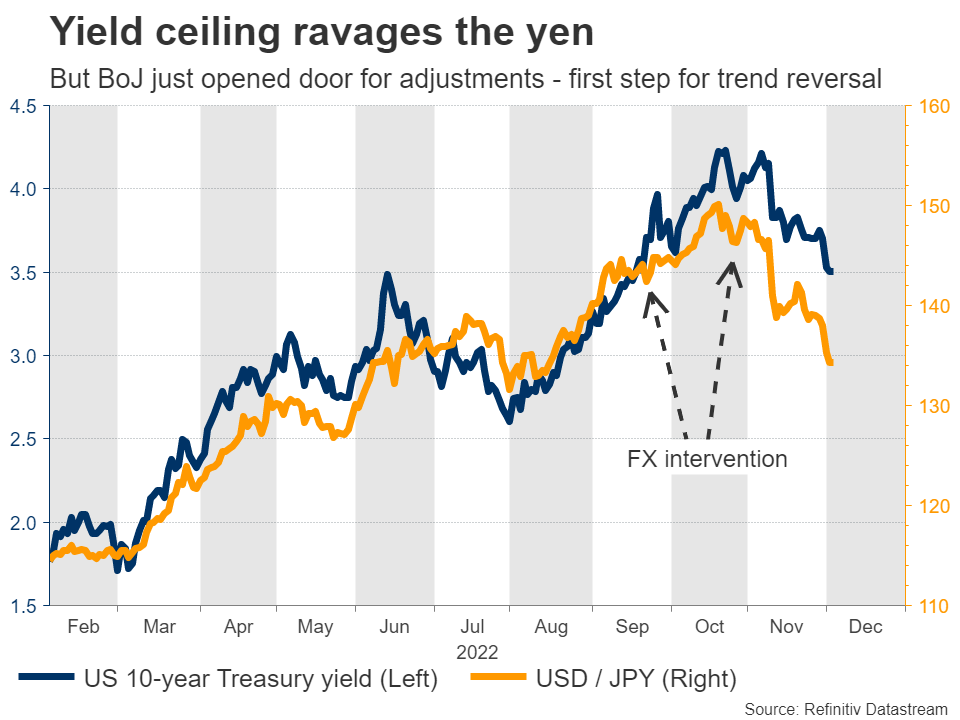

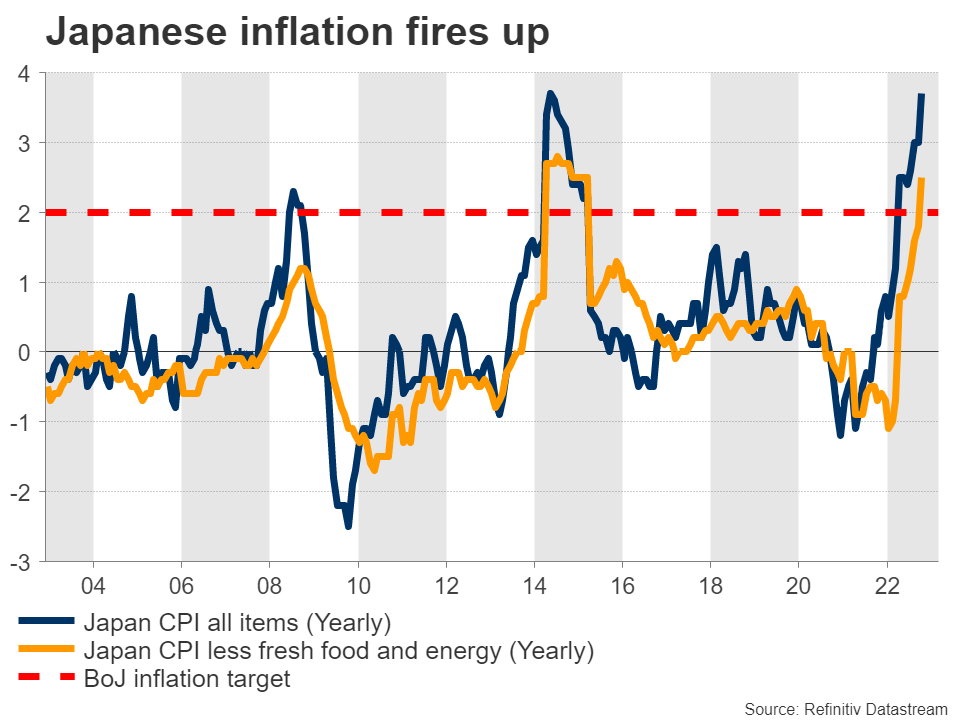

The yen was the biggest FX casualty of the year, crushed under the boot of widening interest rate differentials as the Bank of Japan refused to follow other economies in raising rates. Since inflation was relatively low, the BoJ felt no pressure to tighten policy. As a result, capital left the country, searching for higher returns abroad.

Another thorn in the yen’s side was the shift in trade flows. With energy prices going ballistic and Japan being a net-importer of power, the nation lost its chronic trade surplus. Coupled with tourists being prohibited from visiting the island due to covid controls, demand for the yen vanished.

Yet, this gloomy narrative might be about to change. The Bank of Japan recently opened the door for tightening policy, and the latest acceleration in inflation has added credence to this notion. With oil prices also moving back down and tourists being allowed to visit again, many of the factors that ravaged the yen seem to be fading.

Most importantly, a potential recession in other economies means that foreign central banks will stop raising rates and perhaps look to cut them, in case inflation subsides. Therefore, rate differentials could narrow in the yen’s favor, as foreign central banks stop tightening just as the BoJ begins to.

All told, the stars seem to be aligning for a trend reversal in the yen. An important determinant will be who replaces Kuroda as BoJ Governor when his term ends in April. Someone more open to tightening could be the catalyst for the comeback, especially if that coincides with a deteriorating global backdrop and a retreat in foreign yields.

Aussie, kiwi, loonie: Caught between the Fed and commodity prices

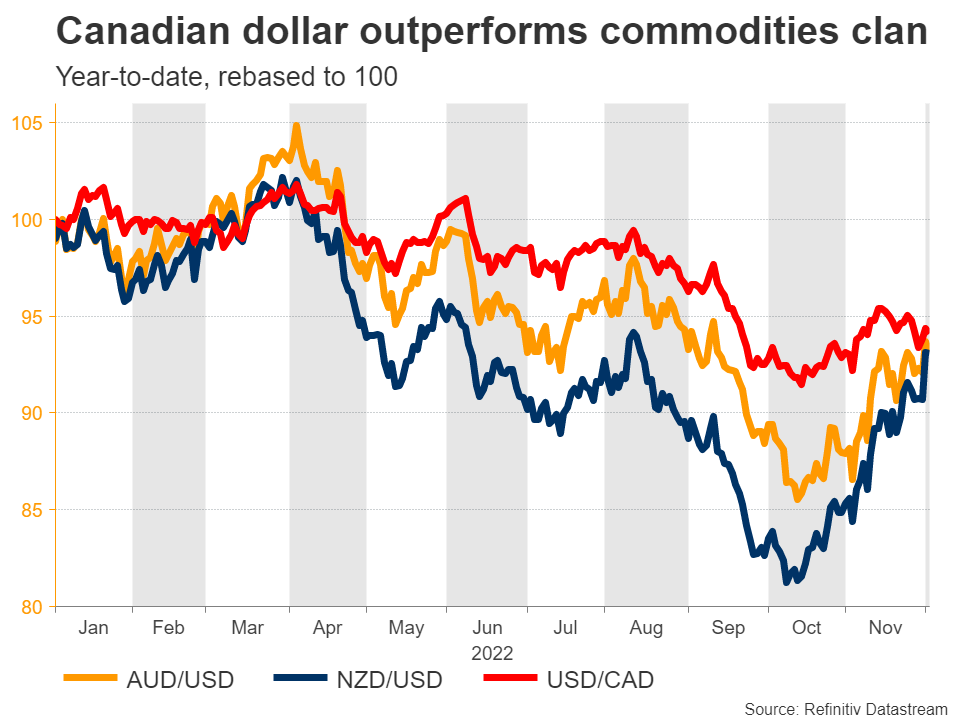

It’s been an odd year for the commodity-linked dollars, as it’s been a constant battle between monetary policy divergence and commodity price shocks, while China risks have also been keeping traders on their toes.

As 2022 draws to a close, the Canadian dollar comes out on top, not just within the commodities clan but it’s also the best performing major currency after the greenback. Without question, the oil rally shored up the loonie. But with the energy crisis subsiding, the currency won’t be able to rely as much on high oil prices for support, turning the spotlight on domestic factors.

The Bank of Canada has been almost as aggressive as the Fed and only has a handful of rate increases left in this tightening cycle, at least according to money markets. Should the BoC pause before the Fed, the loonie might not fare as well in 2023, although Canada’s relatively robust economy might prevent traders from turning too gloomy.

Another central bank that matched the Fed’s pace of rate hikes is the Reserve Bank of New Zealand. But the RBNZ’s early tightening lead in 2021 disadvantaged the kiwi dollar when the Fed caught up in 2022. If it wasn’t for the commodities’ rally spurred by the Russia-Ukraine conflict, the kiwi’s losses could have been even bigger. However, the RBNZ might still win the race, giving the kiwi the edge in 2023 against the US dollar, as inflation remains too high and the labour market too tight.

For the Australian dollar, however, there is more uncertainty both from a monetary policy perspective and what’s happening in China. The Reserve Bank of Australia could end up having a lower terminal rate than many of its peers, although it is prone to making U-turns. But the real question is, how much does RBA policy matter?

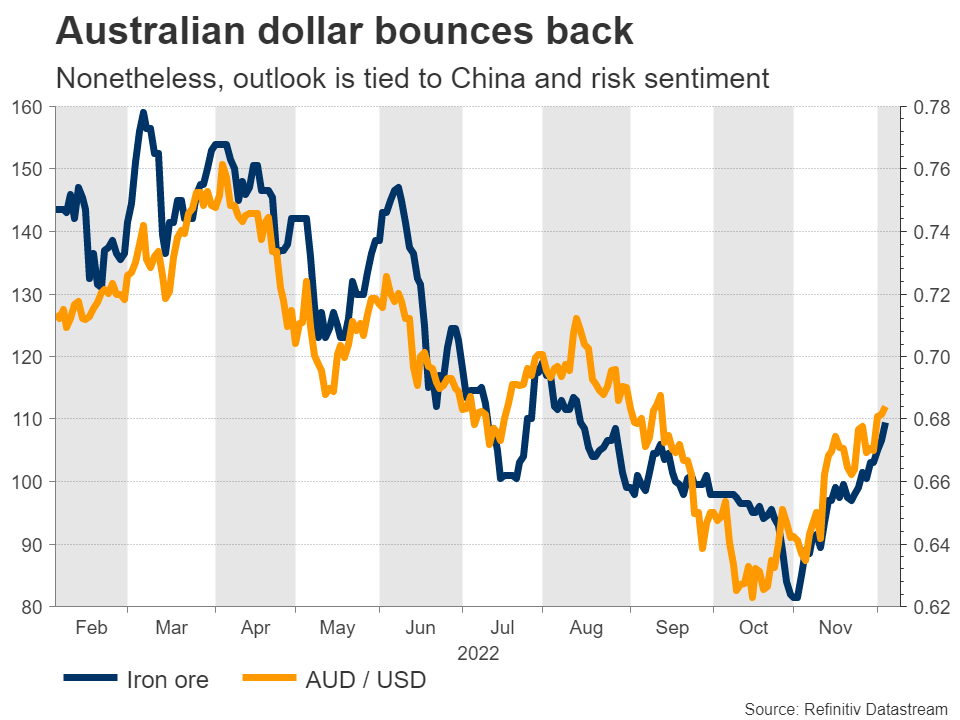

The aussie has been the most oblivious to domestic policy out of the three dollars and put on a stellar performance in March when the RBA remained dovish as other central banks commenced rate increases. Higher commodity prices following the Ukraine war and strong demand from China were a boon for Australia’s current account. But those effects have started to fade.

All hopes for the currency next year rest on China proceeding swiftly with its reopening plans. Stronger growth in its main trading partner would give the Australian economy something to lean on should the RBA struggle to contain inflation and decide to push up rates a lot higher than what it has flagged.

The bearish scenario for the aussie is the Fed hiking rates above 5% and the RBA pausing before the cash rate reaches 4%. But even then, this would only be half the equation and much would still depend on the outlook for the Chinese economy and overall sentiment.