The EU’s refusal to ban the import of Russian gas and oil calmed down the energy market, thus causing a significant decline in oil prices. The currency market also showed a noticeable correction. Thus, the pound sterling managed to surge. Of course, the rise was not as considerable as the previous fall, but still, it was.

Nevertheless, the US dollar continues gaining in value. Yesterday’s climb could be considered a long-awaited rebound that just needed a strong reason. In any case, the news flow is negative for the pound sterling.

The Ukrainian conflict is still in force, thus boosting capital outflow from the European continent. A stand-off between Russia and the West is likely to hit Europe more than its opponent. The overall situation remains the same. This proves once again that yesterday’s increase in the British pound is a local bounce. The primary trend is still intact. Today, the pound sterling is expected to resume falling.

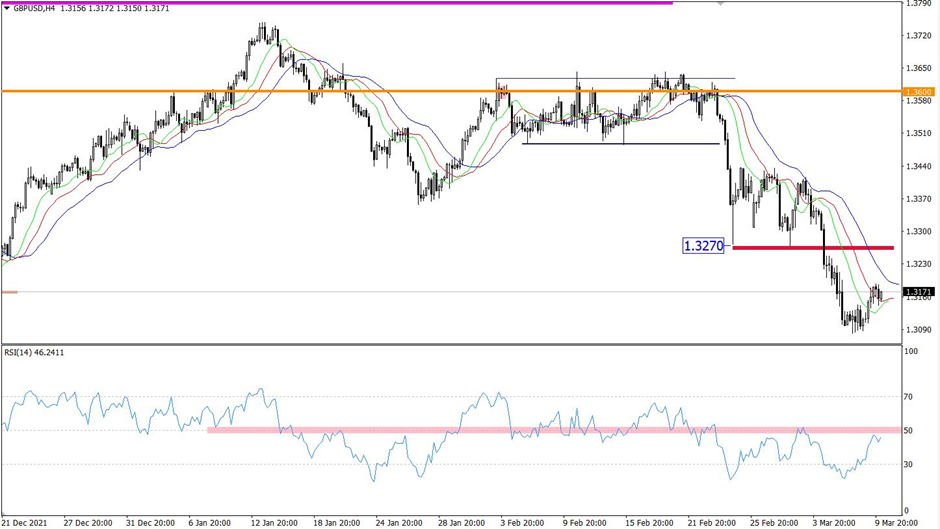

The pound/dollar pair found the support level near the upper limit of the psychological area of 1.2950/1.3000/1.3050. As a result, the pair stagnated and then rebounded. On the four-hour and daily charts, the RSI technical indicator proves the jump by an upward intersection of line 30.

On the same periods, the Alligator indicator is pointing to the downtrend. There are no intersections between moving averages. The daily chart shows that the downtrend, which began in June 2021, has become longer. Now, sellers of the pound sterling can benefit from the situation.

Outlook

The rebound in the pound/dollar pair is just a short-lived phenomenon. Traders’ sentiment remains bearish. That is why if the price settles below 1.3100, it is highly likely to slide to 1.3000.

In terms of the complex indicator analysis, technical indicators signal long opportunities on the short-term and intraday periods amid the recent bounce. In the mid-term period, technical indicators provide short signals due to the downtrend.